More Stock Market Selling Monday?

Stock-Markets / Stock Markets 2016 Sep 19, 2016 - 10:18 AM GMTBy: Brad_Gudgeon

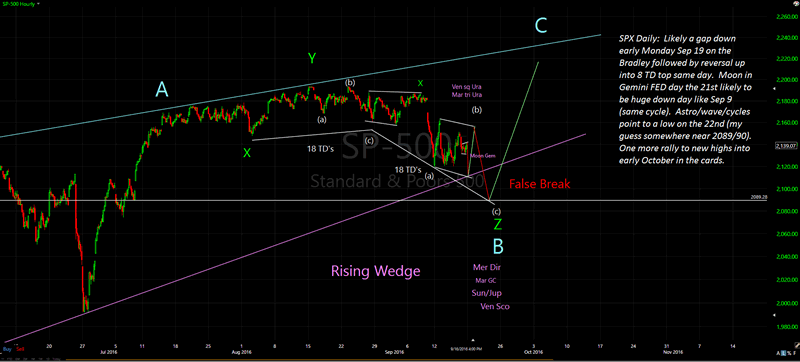

It looks like that we should have more selling early Monday in the stock market according to the extremes of the 4 TD low combined with the current bearish wave action and negative astros. There is a rising wedge that meets near 2110 Monday. I'm not sure we tag that or not, but in any case there should be a strong rally Monday out of this sell-off according to the cycles.

FOMC day, September 21 is running the same potential cycle as September 9th which portends another large down day ahead of us with a low on the 22nd. These types of patterns where the rising wedge gets broken are known as “False Breaks” and they are always the last of the sequence before new highs and then the subsequent larger sell-off I'm expecting into November.

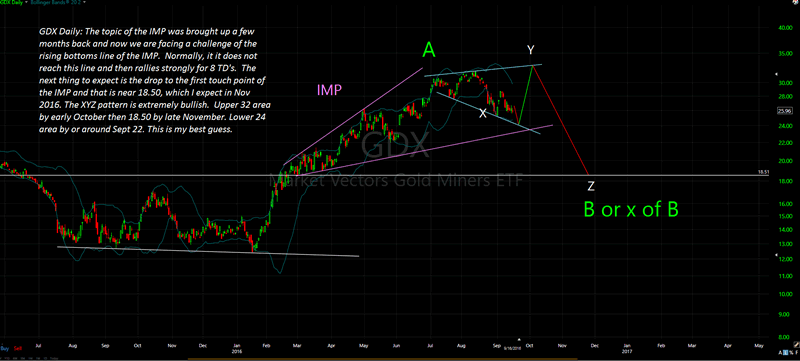

To me GDX looks more attractive at the expected low than the SPX does. Charts below

We added auto-trading with Global Auto Trading this week. We also added two new trade alerts: Volatility with UVXY and SVXY, and Options Trading that trades SPY, GDX and UVXY/SVXY puts and calls. We are also adding webinar training for those new to trading.

Also coming soon are FREE webinars explaining the benefits of joining our group followed by a week's worth of tire kickin' to try out the service. Check out our September 2016 trades so far +22% so far this month. Get ready, big moves a comin' soon! Sign up for our free e-mail updates at blustarmarkettimer.info

Another thing I wish to mention: please don't trade this or any other forecast verbatim without getting proper updates from the author. Tracking the stock market is much like tracking the weather: you need to have regular updates. Things can and do change.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.