Stocks and Bonds - The Central Bankers' Experiment: The Great Bust

Stock-Markets / Financial Markets 2016 Sep 17, 2016 - 11:16 AM GMTBy: Doug_Wakefield

The public enthusiasm, which had been so long rising, could not resist a vision so splendid. At least three hundred thousand applications were made of the fifty thousand new shares, and Law's house in the Rue de Quincampoix was beset from morning to night by the eager applicants."

The public enthusiasm, which had been so long rising, could not resist a vision so splendid. At least three hundred thousand applications were made of the fifty thousand new shares, and Law's house in the Rue de Quincampoix was beset from morning to night by the eager applicants."

The quote above is from McKay's classic, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, found in the first chapter, "Money Mania – The Mississippi Scheme". The Mississippi Scheme reached its final "all time high" in January 1720, and Mackay wrote about this madness in 1841.

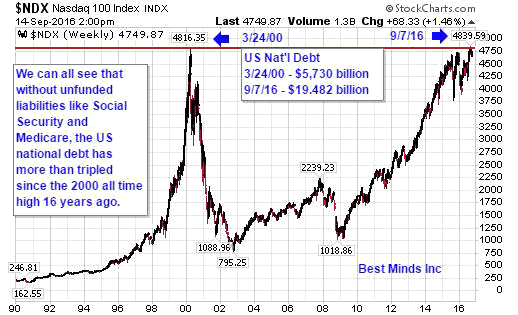

I would have thought the collapse of the dot.com bubble in 2000 or the credit bubble that fostered the Great Recession of 2008 would have driven both investors and advisors to learn how flooding a system with cheap credit has always lead to strong booms and devastating busts. Yet it is not merely the public that has shown little interest in understanding history, but the central planners of world markets and the global economy, the world's most powerful central banks, otherwise, why fuel the largest debt bubble on record?

Just one day after the S&P 500 produced its most recent all time high on August 15th, this statement was made in the semiannual report of the Chairman of RIT Capital Partners, Jacob Rothschild of the Rothschild banking dynasty of the last 2 centuries.

"The six months under review have seen central bankers continuing what is surely the greatest experiment in monetary policy in the history of the world. We are therefore in uncharted waters and it is impossible to predict the unintended consequences of very low interest rates, with some 30 percent of global government debt at negative yields, combined with quantitative easing on a massive scale."

Massive global debt; 30 percent of global government debt at negative yields; "Quick and Easy" electronic money printing on a global scale. What could go wrong?

Let's review again a few items taking place right now.

First, the monster has grown totally out of control by the central bankers presenting the public with the lie that given enough ultra-cheap debt things could get back to normal.

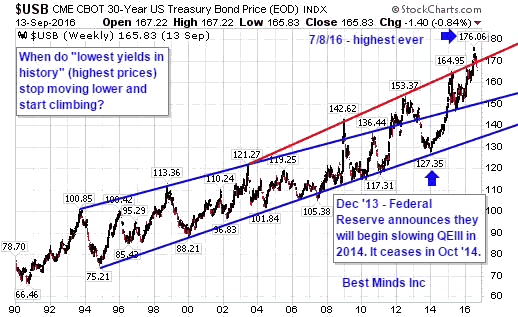

Take a look at these two pictures of US Treasuries.

The first is a long chart of price movement of the 30 year Treasury. As we can see, this chart spans more than a quarter of a century, and reveals that in July we watched the highest price (lowest yields) ever in American history.

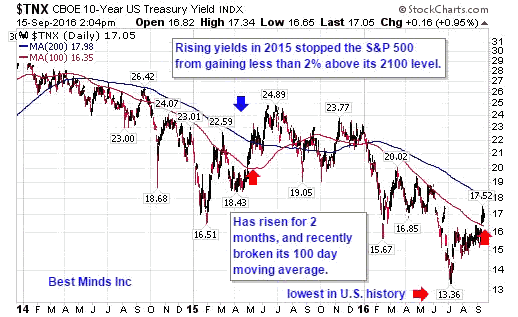

The second is a shorter term chart yield movement of the 10 year US Treasury.

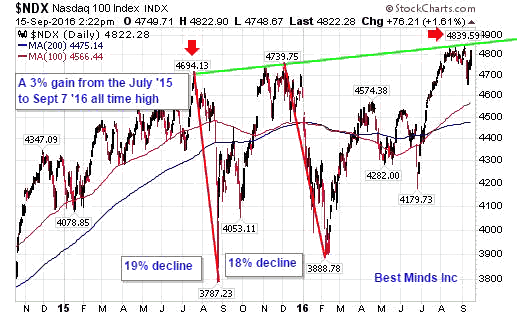

The next monster bubble is the NASDAQ 100. Take a look. Don't those chasing the new high in this market realize where we are in history, and what took place last time we reached these nosebleed heights?

Of course, herein lies the problem as we wait for the next press releases to trigger the high frequency computers on February 21st. Is the crowd mood so bullish or complacent now that EVERY central banking press release is seen as nothing but more heroin for stock bulls, while ignoring the much larger sovereign debt markets of the world, totally dismissing the diminishing returns once the financial media has presented us with one more "all time high" headline?

I wonder if the end of equity options on Friday would be a motivating factor in seeking to squeeze out every dime at these levels?

Limits are Being Reached

Let me pose another question thinking investors and advisors are asking right now, "What if bond yields rise (prices drop) at the same time stocks drop?"

In the Sept 6th Wall Street Journal article, Time To Worry: Stocks and Bonds Moving Together, we learn that expectations have become so high on everything going up because of central banking policy, global markets are prime for sudden shocks. Being on the right side of these shocks has now become important.

Li Yang, Committee Member of the Chinese Academy of Social Sciences and of the National Institution of Finance and Development made comments recently in an economics conference in China that "The real estate bubbles, especially in the second and third-tier cities, have long been there. The decision made by the central government is to reduce the inventories of the housing market, a move understood as destocking in view of the real economy and as bursting bubbles in the financial perspective. It is an adjustment that we have to put up with."

Does that sound bullish for China housing? Does that sound like a concern after becoming the first nation in history to quadruple their debt load in 8 years, and who must now deal with the reality of building entire uninhabited cities?

Bank of Japan Governor Haruhiko Kurado's comments found in a Sept 9th Zero Hedge article reveal that even he understands there are consequences for leaving pension managers, corporate leaders, and the Japanese people with negative yielding bonds:

"Some business firms have revised down their profit forecasts due in part to the increase in the net present value of retirement benefit obligations. We should take account of the possibility that such developments can affect people's confidence by causing concerns over the sustainability of the financial function in a broad sense, thereby negatively affecting economic activity."

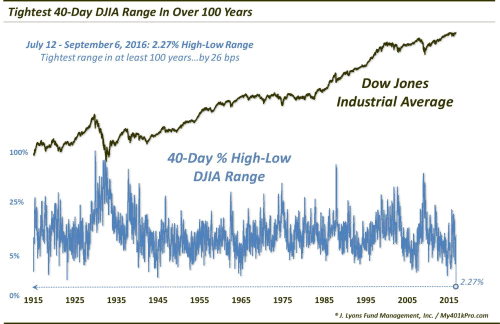

Probably one of the most incredible things I have seen in the last few weeks as this global house of debt continues to shake, is that one of the world's largest producers of passive index funds pulled in its highest amounts of new money ever in August, and yet as shown above, yields on 10 year US Treasuries were already rising from their historic lows in July and currently, August holds the record for the highest price level of the S&P 500 and Dow Jones Industrial.

One thing is certain at this stage. Volatility is not going to be put back in complacency mode like the 100 year record Dana Lyons' produced on September 6th.

As the car drives up the mountain road faster and faster, risk levels climb as well. Whether it is the collapse in 1720s from the Mississippi scheme or the 85% collapse in the banking index (BKX) during the Great Recession, the start of this unwind is only going to benefit those who have continued to use their own minds, study history, and take action before the next big wave of selling ignites, which will probably be in the futures markets during the middle of the night, something we all watched after the Brexit vote on June 23rd.

And yes, markets are more powerful than central bankers, who frankly, I believe grasp this more and more as time goes on.

Do You Have an Action Plan For the Next Big Shift?

There are sound reasons and arguments for what can be done other than hoping central bankers keep market bubbles from doing what they have done for 400 years, but time is running out on merely thinking about taking action.

Bulls become bears, and bears become bulls. Trends always end; always begin.

What mind games must all investors, advisors, and money managers deal with in this global financial/political game we now live in? How does one combine dates and events, financial history, and technical and fundamental analysis in order to gain confidence in this game where we are lead to believe contrarians will never win, and central bankers have overcome gravity?

To gain access to the most up to date research, click here to start a six month subscription to The Investor's Mind and ongoing trading reports.

On a Personal Note

Check out posts at my personal blog, Living2024.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.