The Financial Crisis Is Escalating!

Stock-Markets / Financial Crisis 2016 Sep 16, 2016 - 07:23 PM GMTBy: Chris_Vermeulen

Deutsche Bank and Commerzbank are presently in the process of merger talks. The fact that these meetings are occurring is a signal that Germany’s banking troubles are indeed accelerating.

Deutsche Bank and Commerzbank are presently in the process of merger talks. The fact that these meetings are occurring is a signal that Germany’s banking troubles are indeed accelerating.

Deutsche Bank to Initiate the Next Financial Crisis – Click Here

They are desperately seeking ways to cut costs and improve profitability. These plans include restructuring and job cuts using highly unconventional measures. Last June (2016), Reuters cited anonymous sources as saying that Commerzbank was exploring the option of hoarding billions of euros in vaults as a way of avoiding paying a penalty to the European Central Bank, which is due because of negative interest rates.

Their main problems are derived mostly from both low and negative interest rates. These lenders are used to depending on interest rate margins for income, while offering some services to depositors at either low or no cost. Low interest rates have significantly eroded these banks’ abilities to make money. It has become difficult for German banks to give incentives to their customers to encourage customers to keep money in their financial institutions. These inefficiencies, and the intense competition within the German banking sector, have already led to serious financial difficulties. If one combines these factors with the new challenge of declining interest rates, what possible positive impact can they expect to incur?

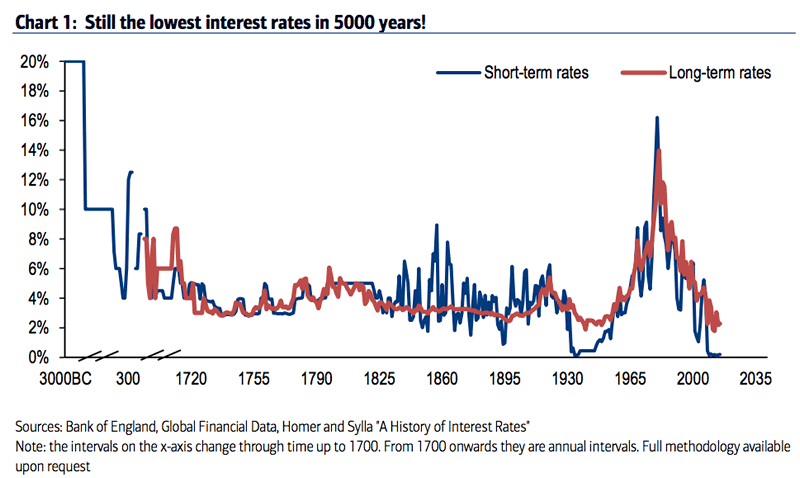

Interestingly, rates are not just low within the context of American history, but they also happen to be at their lowest levels – ever – in over 5,000 years of civilization.

5,000 Years Of Interest Rates – Rates Lower Than 1930’s Depression Era

Deutsche Bank is not merely Germany’s biggest bank, but the political role that it plays in Germany is unique when compared to other countries. Deutsche Bank’s importance to Germany is many times greater than that of an investment bank like Lehman Brothers was to the U.S. in 2008. Deutsche Bank is technically a private bank, however, it is informally tied to the government and formally tied to most major German corporations. The bank’s fate will have an impact on all of Germany.

The Italian banking crisis is not only Italy’s problem!

Italy’s non-performing loan issues have now become common knowledge. Who will be forced into dealing with the repercussions of settling Italy’s impaired debt? That is a political question, and the answer depends, in large measure, on who holds Italian bank debt.

The U.S banks are not shielded from these European Continental banking problems. There is a substantial amount of uncertainty and risk.

The consequences of these failures pyramid the crisis due to the European Unions’ regulations. The European Central Bank (ECB) and the Central Banks of member countries cannot bail out failing banks by recapitalizing them. The bail-in strategy is, in theory, a mechanism for ensuring fair competition and stability within the financial sector across the Eurozone.

The bail-in process can potentially apply to any liabilities of the institution that are not backed by assets or collateral. The first 100,000 euros ($111,000) in deposits are protected in the sense that they cannot be seized, whereas, any money above that amount can be.

Germany insisted that the bail-in process should prevail.

The Bank for International Settlements stated that German banks are the second most exposed to Italy, after France, with a total exposure of $92.7 billion. Demand for gold has increased!

Italy’s ongoing banking crisis is presenting yet another threat to the stability of the ECB.

Commerzbank’s financial statements revealed that their Italian sovereign debt exposure was 10.8 billion euros ($12.1 billion).

Deutsche Bank’s net credit risk exposure to Italy is 13.3 billion euros as of the end of December 2015. Its gross position in Italy is 35.4 billion euros. Deutsche Bank is sitting on $41.9 trillion worth of derivatives.

Consequences of large bank failures are going to be significant.

Gold Is The Only Safe Haven Left In The World

Gold has remained as a form of currency for many centuries. Whenever countries followed a strict gold standard and used it as their currency, those economies were very stable. But, governments have always surpassed their means with their costly spending and have to leave their gold standard so as to fund their inefficiencies. Currently, gold is now beginning its’ multi-year “BULL MARKET”. Gold is the only asset class which will maintain its store of value during the impending crisis which is on the near horizon. The gold mania is about to be unleashed. While global central banks are now implementing negative interest rates, this is the perfect scenario for gold to surge much higher.

Gold does have historical store of value characteristics. It is held by central banks and institutions as a reserve. They do not want to sell it; on the contrary, many of them want to buy still more and accumulate it. Therefore, gold’s characteristic role, with regard to sovereign reserves, is still intact, even amid the fascinating evolution of central banking and institutional finance that we are witness to today.

This week I shared a detailed video for my newsletter subscribers talking about the big picture trends and price targets for gold, silver, mining stocks, oil, natural gas, the S&P 500 index, coffee, and sugar. We have some huge opportunities unfolding on the monthly charts. If you are looking for some easy, big trading opportunities, then follow my analysis and trades at: www.TheGoldAndOilGuy.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.