Another Billionaire Warns of Catastrophic Depths Not Seen in 5,000 Years – and Emphasizes Gold

Stock-Markets / Financial Crisis 2016 Sep 16, 2016 - 09:21 AM GMTBy: Jeff_Berwick

In past issues, we’ve documented increasingly concerned billionaires warning of dangerous economic times. Many have favored gold as an alternative allocation in a world where $13 trillion-worth of debt is negative yielding, interest rates are artificially suppressed and we’re on the brink of major wars.

In past issues, we’ve documented increasingly concerned billionaires warning of dangerous economic times. Many have favored gold as an alternative allocation in a world where $13 trillion-worth of debt is negative yielding, interest rates are artificially suppressed and we’re on the brink of major wars.

The newest addition to this gold-loving billionaire’s club, is none other than hedge-fund manager Paul Singer. At CNBC’s Delivering Alpha Investors Conference this week, the founder of the $27-billion Elliott Management Fund, the 17th largest hedge fund in the world, mentioned that at current prices gold is “undervalued” and “underrepresented in many portfolios as the only … store of value that has stood the test of time.”

Singer, along with numerous other hedge-fund managers, has been increasingly outspoken in his criticism of the Federal Reserve and other central banks for creating dangers in the market unlike any in what he terms the “5,000 year-ish” history of finance. Singer noted that “it’s a very dangerous time in the global economy and global financial markets.”

This quote is frighteningly similar to the response given by Donald Trump on Fox Business not long ago when he was asked if he had money in the market. He answered, “I did, but I got out,” and then went on to say that he expected “very scary scenarios” for investors.

Singer also stated that he thinks owning medium- to long-term first world debt is a “really bad idea”… and then proceeded to tell listeners to sell their 30-year bonds.

Earlier in the conference, prior to Singer, Ray Dalio who is the manager of the largest hedge fund in the world, Bridgewater Capital, was also vocal about the diminishing returns provided by government debt held by central banks. “There’s only so much you can squeeze out of the debt cycle,” he said. He went on to say that central banks are at a point now where their ability to stimulate is limited.

Seated next to Dalio was Former Treasury secretary Timothy Geithner who voiced concern about limited “tools in the keynesian arsenal,” that probably wouldn’t be enough to offset the next recession.

Geithner obviously believes that a recession is on the way. Dalio and Singer are trying to convey the same message. A massive crunch is looming.

We agree with them, although we believe Geithner was sugarcoating what’s to come.

After all, we are on the precipice of a crash of biblical proportions according to the former chief economist of the Bank for International Settlements, William White.

We have mentioned his quote numerous time here at TDV but feel it’s important to reiterate because of its magnitude: “The only question is whether we are able to look reality in the eye and face what is coming in an orderly fashion, or whether it will be disorderly. Debt jubilees have been going on for 5,000 years, as far back as the Sumerians.”

As the Fed considers its second rate hike in 10 years, Singer condemned policy-makers for acting with “amazing arrogance” when he and others had warned of a mortgage crisis prior to 2008.

What he and those who agreed with his stance don’t know, or at least won’t state publicly, is that these shoddy central bank policies are detrimental by design. In other words, their sole purpose is to destabilize the world economy.

This deliberate market sabotage is necessary for the transference of power from the more developed nations to less developed ones. Ultimately, the idea is to eliminate smaller regional and national central banks. Once things get bad enough, these smaller banks will be blamed for provoking a given crisis. And, secondarily, the end goal is to blow up the entire system in order to bring in the one world government and central bank.

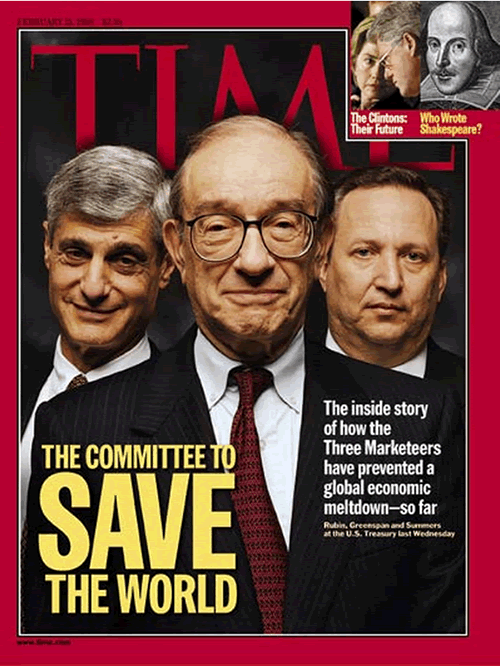

The elites have used the same tactics time and time again throughout history. First, they create the problem, then there is a reaction, and then finally they come swooping in to “valiantly save” the day. It’s happened numerous times before.

And it will soon happen again.

Of course, the globalists have demonstrated that every intervention only makes situations worse.

We reported on the blatant thievery going on at Wells Fargo in our last article and noted how the elites were probably laughing hysterically at what they’re able to get away with. They were even able to convince many younger American voters that “democratic socialism” would be their savior, as seen by the significant, youthful support for Bernie Slanders. Debt and currency crises have already started to materialize, as we’ve seen in the socialist utopia that is Venezuela. If this is any indication of what’s to come, the future is looking awfully gloomy.

As Singer and others including Dalio have mentioned before, the most tried and true measure of wealth and value is gold.

At TDV we provide unique Austrian-economics based analysis from the anarcho-capitalist pespective of the state of the world’s economy, as well as suggestions on how to protect your assets in these tempestuous and unprecedented times.

Jacob Rothschild, a member of the family partly responsible for the creation of all this chaos, even said himself that we are in “uncharted waters” and that it’s “impossible to predict the unintended consequences of very low interest rates.”

We have a pretty good idea of what the consequences will be and we’re taking action to protect ourselves and even profit from them. Rothschild seems to know the consequences, as well, as he has been buying up gold and selling the stock market and the US dollar.

You can survive and profit from the orchestrated collapse too. Subscribe to TDV’s newsletter here to receive constantly updated information on how to protect your family and friends.

In the end, it is getting truly bizarre just how many billionaires, central bankers and others of note are all warning of the coming collapse. We’d almost begun to worry that they were going to pull a switch-a-roo on us, but if you asked the great majority of investors and financial analysts, they’ll tell you that they see nothing but smooth sailing ahead.

So, while many are warning, many are hearing, but not listening. The bible said something about that, I believe.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.