Next Financial Crisis Will be Far Worse than 2008/09

Stock-Markets / Financial Crisis 2016 Sep 15, 2016 - 07:29 PM GMTBy: Chris_Vermeulen

We are living in “extraordinary” times, which will end with unpleasant consequences. The world is looking towards the Central Banks to sort out these problems, whereas, the Central Banks are clueless about how to handle this situation.

We are living in “extraordinary” times, which will end with unpleasant consequences. The world is looking towards the Central Banks to sort out these problems, whereas, the Central Banks are clueless about how to handle this situation.

Never in history has the world seen 30% of global government debt at “negative yields”. This is an experiment, which is unlikely to end with a good result.

“Conventional monetary policy has less room to stimulate the economy during an economic downturn,” San Francisco Fed President John Williams wrote in an essay.“This will necessitate a greater reliance on unconventional tools like central bank balance sheets, forward guidance, and potentially even negative policy rates. In this new normal, recessions will tend to be longer and deeper, recoveries slower and the risks of unacceptably low inflation…will be higher,” reports Zero Hedge.

But isn’t the stock market at all-time highs?

Since the third quarter of 2015, the total earnings of the SPX companies have dropped during every subsequent quarter, yet the stock market has reached all-time highs.

Not only this, the current valuations of the SPX are second only to the “lofty” valuations of 1999, which ended with the bursting of the “dotcom bubble”. Nonetheless, the stock markets continue to trade higher in 2016, but for how long?

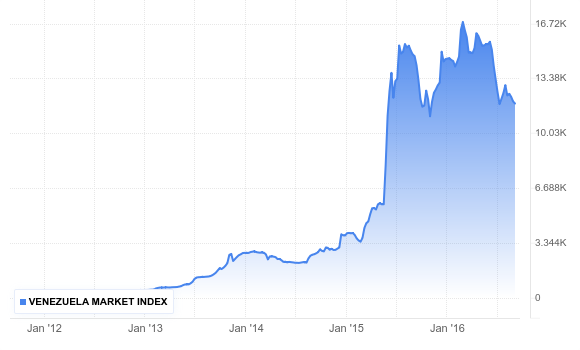

These days there is a big disconnect between the real economy and the stock markets. The best example of this is the Venezuelan stock markets. Though the people there do not have food, there is rampant hyperinflation and there is unrest among its’ citizens, yet, the stock market went up 10 times between 2012 and 2016:

Hence, the investors should be wary of the stock markets rise. The markets will not allow an opportunity to exit in a proper manner, a sample was the fall during the first two months of this year.

Precious Metals’ Powerful Rally Begins!

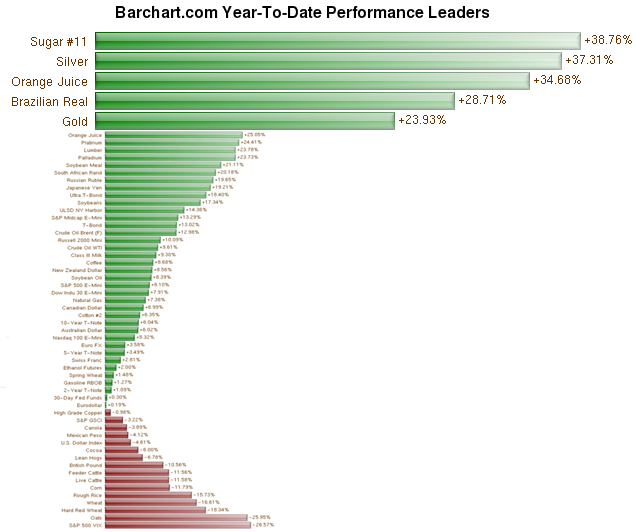

Smart investors are recognizing this opportunity, which has led to a rise in both gold and silver prices and purchases, as shown in the chart below. Both are among the top four performers this year.

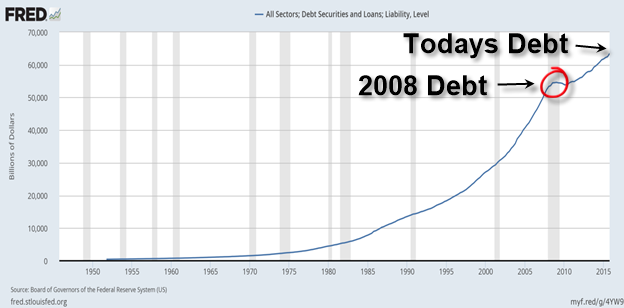

The debt has become unmanageable, it’s on the verge of explosion!

The total debt of the United States has reached gigantic proportions. It has seen an increase by a factor of 14 since 1980 as shown in the chart below. On the other hand, the GDP of the US has only increased by a factor of 6.2.

Such a mind-boggling debt cannot be repaid ever. “Nobody is prepared to accept that we might have to wipe out decades of growth just to eliminate leverage. Banks go, there are defaults, bankruptcies, layoffs,”said Viktor Shvets, the global strategist of the investment bank Macquarie Group, reports Zero Hedge.

Gold and Silver will be the only saviors:

This is what I have been warning our readers, that all this excess will lead to a “Great Reset”, which will be a period of great turmoil and the only ‘asset class’ that will help you survive the onslaught are the precious metals.

“If you think of gold,the only way gold loses is if normal business and private sector cycles come back. If that is the case, gold goes back $100 per ounce. The other outcomes: deflation, stagflation, hyperinflation are all good for gold,” said Shvets.

Attempts to move away from the dollar standard:

There are talks of moving away from the dollar as the global currency of the world. An option being explored is setting up a global currency, which will be a derivative of the five international currencies, the dollar, euro, pound, yen and the yuan.

Nevertheless, this experiment is likely to fail even before it starts, because, not only are these highly flawed currencies, the Central Banks of these countries also own the largest money printing machines in the world.

So what is left?

A return to the gold standard in some way may be possible solution, because it renders the Central Banks jobless. Nevertheless, Shivets points that the gold standard is likely to come after a war and not before that.

Conclusion:

It is possible to forecast the timing of the stock market crash and the next financial crisis, due to our “Cycle Analysis” and “Predictive Analytics ”. I have been warning that the stock market will top out and eventually the large cap stocks will roll over. There is a huge amount of manipulation by the FED. However, as investors, we can be ready for any eventuality by investing wisely in both gold and silver which has worked well for our long term portfolio the past year and soon enough having a net short position on the stock market will be an incredible opportunity for those who embrace the collapse.

Every crisis also brings an opportunity with it, hence, lets’ make the best use of the opportunity before the price of gold and silver blows through the roof. It is better to invest now and see our investments multiply, instead of waiting for the crisis to start, as, by then, more than half of the rally would be behind us.

Get my next article and analysis by visiting www.TheGoldAndOilGuy.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.