Crude Oil Prices: Investors Getting Comfortable with New Levels?

Commodities / Crude Oil Sep 15, 2016 - 07:22 PM GMTBy: Nicholas_Kitonyi

When the price of oil breached above the $50 level, everyone thought alas, we could be hitting $70 before the end of the year. It was a steady rally that appeared to have turned the tide completely. However, things did not turn out as earlier predicted. Within no time, oil prices dropped again below $50 and have since failed to reach those levels. If anything, there are fresh fears that the price of crude oil could drop below $40 if the production levels remain unchecked.

When the price of oil breached above the $50 level, everyone thought alas, we could be hitting $70 before the end of the year. It was a steady rally that appeared to have turned the tide completely. However, things did not turn out as earlier predicted. Within no time, oil prices dropped again below $50 and have since failed to reach those levels. If anything, there are fresh fears that the price of crude oil could drop below $40 if the production levels remain unchecked.

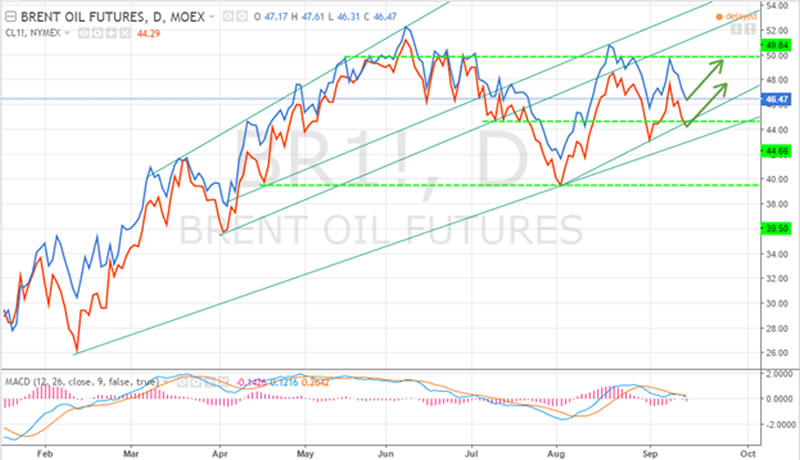

Based on current trends, the price of Crude oil and that of Brent crude have oscillated within the $40-$50 range for the last five months. This is the longest period the price of oil has showed some level of stability since the grand slump began in 2014. But analysts still believe that in the long-term, the prices will remain choppy as more investors move to trade on short-term time frames.

As illustrated in the chart above, the prices of crude oil and Brent continue to fluctuate in the range of $44-$49, and based on the current price levels, it appears as though a rebound could be on the cards. The price of Crude oil has not surpassed the $50 level since June whereas Brent last hit that mark in mid-August. According to Edward Goodman a senior commodities analyst at NetoTrade, Brent could breach the $50 mark again this month, but Crude oil will continue to trade below that level, potentially till the end of the year.

In general terms, investors appear to be quite happy to play with the Crude and Brent oil prices within this range in the short term. It looks as if initial predictions of for the price of crude oil reaching $60 this year are now unrealistic while dreams of the valued commodity finally returning to historical highs are now all but shuttered for the time being.

So what exactly has pinned investor expectations on oil prices to such low levels?

To begin, oil prices are USD denominated, which means that if the US Dollar Index rises, then the price of oil alongside other commodities like Gold and Silver are under pressure. High USD Index indicates a strengthening US dollar, which means that less units of the USD will be required to purchase a particular commodity than the quantity required before.

As per the chart above, the US Dollar Index has been very choppy since the start of the year, but based on the current trend, it appears to be oscillating within a certain range of 94-96 points. This shows some bit of stability, which again suggests that the USD is steadying against most currencies.

In addition, there has been oversupply of oil in the market with Saudi Arabia and other Oil rich nations refusing to check production. In the US, shale drilling allows producers to easily start and stop production of oil depending on market conditions and again, this has put pressure on oil prices leading to the current levels. If the process of starting and stopping production was highly expensive to shale drilling companies, then they would think twice before oversupplying the market with the commodity.

The other thing that seems to be affecting oil prices is the anticipation of another US interest rate hike. High interest rates make income generating assets more attractive to investors than commodities. Crude oil being one of the most popular commodities in the market is highly affected by the current situation. This has reduced investor expectations on the price of oil going higher than the $50 level and in the process increased short-term trading activity as compared to long-term trading. The price remains significantly choppy thereby making it hard to predict long-term movements.

Conclusion

In summary, the price of oil appears to be pegged within the range of $40 to $50 and investors also seem to have accepted those levels as the ideal targets for this year. Nonetheless, there are those who fear that the price of crude oil could drop below the $40 level especially if the US Federal Reserve Committee announces another rate hike before the end of the year.

The bottom line is that the price of oil faces more than just the one common obstacle of oversupply. The US Dollar Index appears to suggest that crude oil prices could remain pegged at the current level for the foreseeable future whereas a rate hike could stir things up a bit.

By Nicholas Kitonyi

Copyright © 2016 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.