Stock Market Freefall Episode Coming Soon...

Stock-Markets / Stock Markets 2016 Sep 13, 2016 - 05:15 PM GMT SPX has nearly retraced yesterday’s rally in an impulsive fashion. 2100.00 has already been tested in the futures. It is not likely to provide much support in this decline. The new target appears to be the December closing price at 2044.00.

SPX has nearly retraced yesterday’s rally in an impulsive fashion. 2100.00 has already been tested in the futures. It is not likely to provide much support in this decline. The new target appears to be the December closing price at 2044.00.

I had been discussing with a friend on Wall Street the moment when the dealer banks who have loans outstanding to the hedge funds start calling them in. He explained that the loans are private deals, so we won’t know the exact moment that this happens, but the hedge funds are so levered that my guess is that it could happen at any time.

The fact is, no one has any idea what is happening. ZeroHedge writes, “Blame Rosengren/Brainard schizophrenia; blame China money markets turmoil; blame Japan's rumored reverse twist; blame reality sneaking in... Whatever you blame, bonds and stocks are both getting monkey-hammered...”

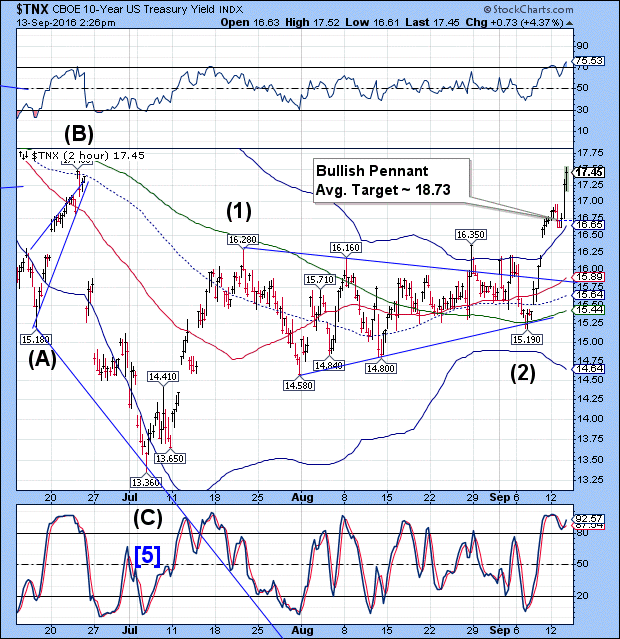

TNX broke out against its June high on the news of a poor 30-year auction. The Bullish Pennant suggests more upside in this move.

ZeroHedge explains, “After yesterday's ugly 3 and 10Y auctions, of which the latter is still trading at a record "fails" charge in repo, there were few hopes for today's 30Y auction, especially in light of the dramatic blow out in yields profiled moments ago. Well, it's a good thing expectations were low because the just concluded reopening of $12 billion in 29Y 11 Month paper was the latest bond debacle, with the paper tailing the When Issued by 1 bps, printing at 2.475% compared to the 2.465% When Issued.”

VIX is well on its way to regaining lost ground while the ETFs are breaking out to new highs. VIX now sports a Pennant formation , suggesting a challenge of its Brexit high at 26.72.

The NYSE Hi-Lo Index has been on a sell since Friday’s close beneath its mid-cycle support/resistance. Although it hasn’t moved hardly at all since then, it appears destined to decline to the Cycle Bottom support at -401.53 in the very near term.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.