Gold, Stock Market Down: Now What?

Stock-Markets / Financial Markets 2016 Sep 12, 2016 - 09:44 AM GMTBy: Brad_Gudgeon

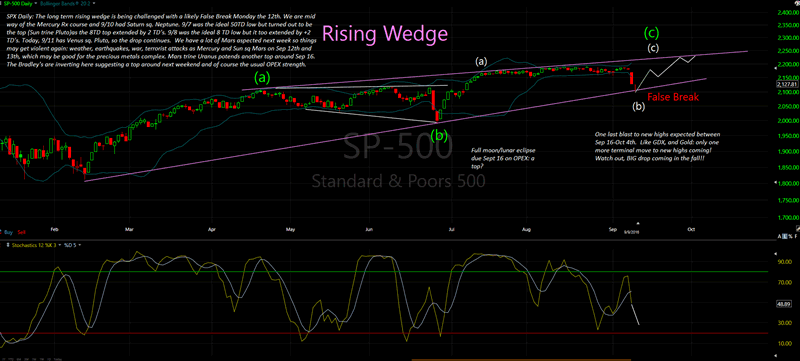

Last I wrote, I was expecting a stock market top early in the week with the late week dropping. We had gone short on Thursday, but late screwy wave action had me pull out to neutral (to my chagrin). I had been looking for a 10 week low within this general time frame and I believe we are there. A move down to challenge the SPX 1994-2100 area would not surprise me on Monday. This should be a great buying area for one more move to new highs by early October at the latest before we see the expected autumn swoon.

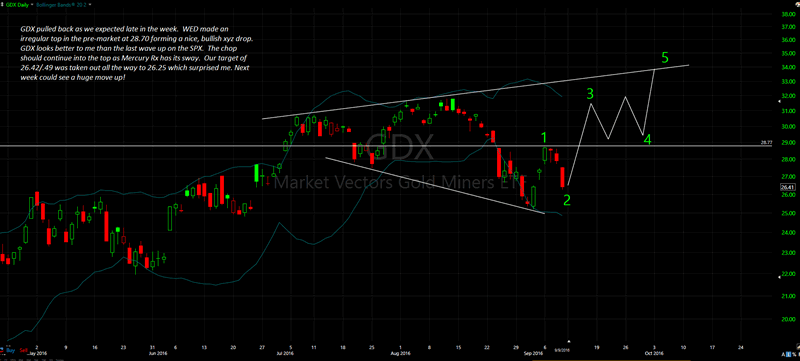

On GDX, I was looking for the 28.43 to 29 area by Wednesday and we hit 28.70 early Wednesday in the pre-market. A look at the dollar's action combined with Mercury Rx had us getting short GDX via DUST and GDX puts for some nice profits as I expected a possible move to as low as 26.42/.49 Friday (we tagged 26.25). GDX looks like a great buying opportunity to me for next week into OPEX as the astro/cycle/waves look good for a nice rally. Mars is rearing its ugly head again early in the week, but tops off with a trine to Uranus later in the week.

GDX Daily Chart

SPX Daily Chart

We are adding auto-trading with Global Auto Trading next week. We also added two new alerts: Volatility with UVXY and SVXY, and Options Trading that trades SPY, GDX and UVXY/SVXY puts and calls. We are also adding webinar training for those new to trading.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.