Stock Market - The Sh-- Hits the Fan

Stock-Markets / Stock Markets 2016 Sep 09, 2016 - 02:13 PM GMT Good Morning!

Good Morning!

SPX Premarket is down, breaking through the 2-hour mid-Cycle support and challenging the 50-day Moving Average. Should the SPX open beneath the 50-day, it may open the floodgates of selling.

ZeroHedge reports, “Yesterday we asked if the stealthy Japanese intention to steepen the JGB yield curve will crash global markets. While a crash, if any, has yet to emerge, overnight we have observed another bond selloffs, particularly at the long end of the curve, which has spilled over into stocks around the world on what Bloomberg dubbed were "signs central banks are starting to question the benefits of further monetary easing." Oil pared a weekly gain, leading commodities lower.”

Dana Lyons writes, “Options data from the International Securities Exchange does not corroborate the frothy readings seen in most other sentiment measures.

We’ve mentioned several times in several different outlets that perhaps our biggest concern regarding the equity market presently is overheated sentiment. From professional active money managers to volatility traders to traders in bearish ETF’s and mutual funds, sentiment readings are registering either severe complacency or downright bullishness. This nearly unanimous optimism is what has us concerned.”

VIX appears to be challenging the 50-day Moving Average at 13.01 this morning.

Usually the VIX and SPX cross the 50-day in close proximity. It may be interesting if VIX and SPX both cross their respective 50-day Averages at the open. That would be a confirmed sell signal on both counts. We will be watching the NYSE Hi-Lo Index after the open.

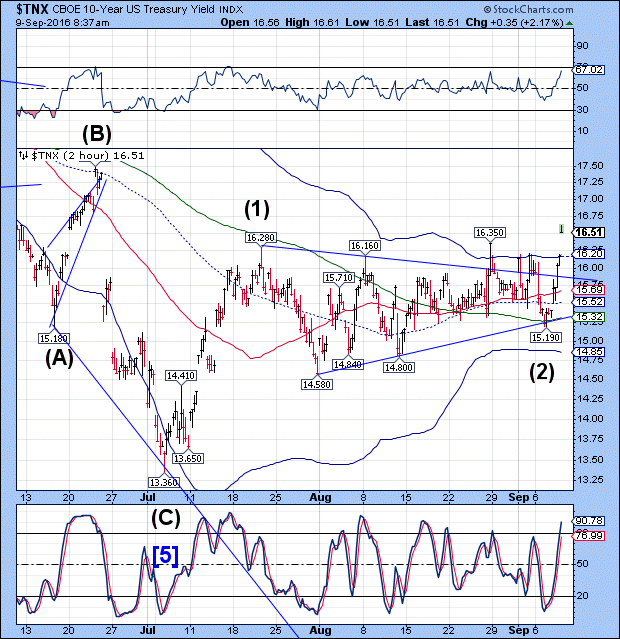

TNX broke out, confirming the change in trend for longer-term Treasuries. This confirms what we saw yesterday in USB, which made a new low at 66.75 this morning.

Can you say, “No place to hide?”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.