Gold Has Biggest One Day Rally Since Brexit As Elites Rush Into Gold

Commodities / Gold and Silver 2016 Sep 09, 2016 - 06:13 AM GMTBy: Jeff_Berwick

The multi-day Brexit gold surge back in June was the biggest upward move since 2008 with gold rallying 4.5% the day after the vote. Yesterday, gold had its biggest one-day rally since, rising 1.6%.

The multi-day Brexit gold surge back in June was the biggest upward move since 2008 with gold rallying 4.5% the day after the vote. Yesterday, gold had its biggest one-day rally since, rising 1.6%.

This came on the back of Goldman Sachs revising its September rate hike odds down to 40% from its previous 55% prediction just a few days earlier, and the release of deteriorating manufacturing numbers.

This diminishing likelihood of a Federal Reserve rate hike has caused the dollar to fall to more than a one-week low against the Japanese yen and the euro.

As we’ve posted here, numerous big-name billionaires, or in the case of Jacob Rothschild, a trillionaire, have been moving significant portions of their holdings into the yellow metal over the summer.

Lord Rothschild has increased his gold position while simultaneously decreasing his US dollar holdings by around 6%.

His timing is interesting given that the biggest shake-up in the world currency market in decades is set to happen on October 1st, the day before the end of the Jubilee Year, with the Chinese yuan being added into the IMF’s SDR basket.

Rothschild recently said, in his semi-annual address to shareholders of RIT Capital Partners , “It is impossible to predict the unintended consequences of very low interest rates.”

He acts as though the consequences of low interest rates are unintentional, but artificially suppressed rates are deliberately being used to expand the money supply, keep bankrupt governments operating and are, in effect, siphoning wealth away from citizens through the hidden tax of price inflation.

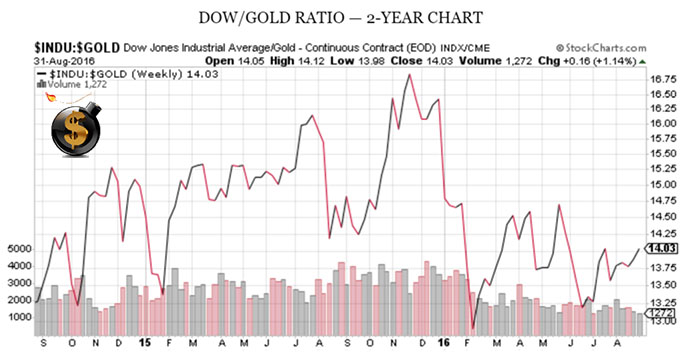

The notional value of the Dow Jones has increased, but if you look at the Dow/Gold ratio, you’ll notice a much starker image. The Dow, in gold terms, is down significantly since the start of the year.

The case for gold was made even stronger in Jackson Hole last week after Janet Yellen hinted that the Federal Reserve may follow in the footsteps of the Bank of Japan and the European Central Bank by purchasing assets including equities directly in the marketplace. She suggested that future policy makers explore purchasing “a broader range of assets”.

At the same conference, Christopher Sims of Princeton University said, “It may take a massive QE program, large enough even to shock taxpayers into a different, inflationary view of the future,” to prevent an all-out collapse.

And around the same time Atlanta Fed President Dennis Lockhardt said, “We’re entering a brave new world of central banking.”

So, we now have billionaires, trillionaires, academia and the Federal Reserve all stating that we are in uncharted waters and that anything can possibly happen.

If you don’t want to be “shocked into a different, inflationary view of the future” and want to hear more about what is going on with precious metals, watch our most recent interview with Colin Kettell of Palisade Radio, who is very knowledgeable about the space.

You can watch the full interview here:

In a world where most tax slaves don’t own gold, and retirement accounts are low hanging fruit for greedy governments to seize, many people are likely to get hurt. In fact, it’s been said that those who lose the least in the upcoming crash will do the best. Physical gold and related securities are the best insurance. Even gold-backed or self directed IRAs are much safer than some of their alternatives.

As we mentioned in the video above, we have had amazing success over the past year, with some of our speculative picks up over 1,000% and our overall portfolio up 200%. If you want to join thousands of others who receive up-to-date information about these sorts of investments and who have prospered tremendously, you can get more information on the TDV newsletter here.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.