Hyperinflation Versus Deflationary Collapse

Economics / Economic Collapse Sep 08, 2016 - 06:06 AM GMTBy: Darryl_R_Schoon

If the thunder don’t get you, then the lightning will… The Grateful Dead, The Wheel(lyrics)

If the thunder don’t get you, then the lightning will… The Grateful Dead, The Wheel(lyrics)

In the world of phenomena, everything has a beginning and an end; and today, the bankers’ endgame is moving closer to its inevitable resolution and demise. The question is no longer if, it is when and how.

The relationship between paper money and gold is causal in central banking’s collapse. When paper money was backed by gold, it (1) gave the bankers’ paper money its value and (2) constrained the ability of governments to print limitless amounts of money, as governments needed money backed by gold to balance trade deficits, i.e. value for value.

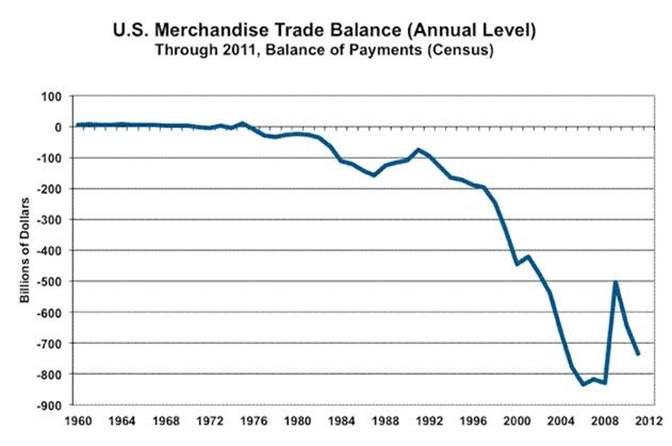

The importance of this constraint, i.e. “golden-fetters”, became clear when escalating military spending caused the rapid loss of US gold reserves; and in 1971, the US withdrew the gold-backing of the US dollar and the US balance of trade permanently went negative.

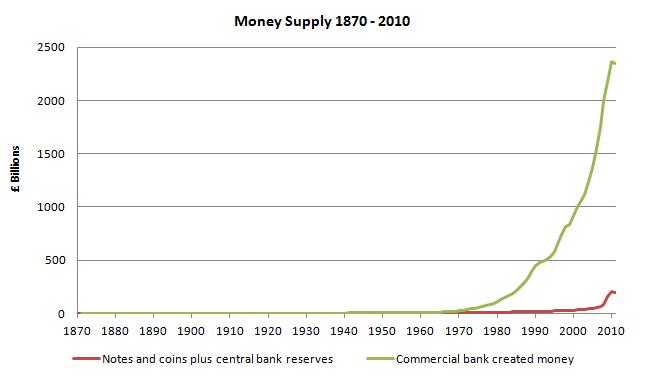

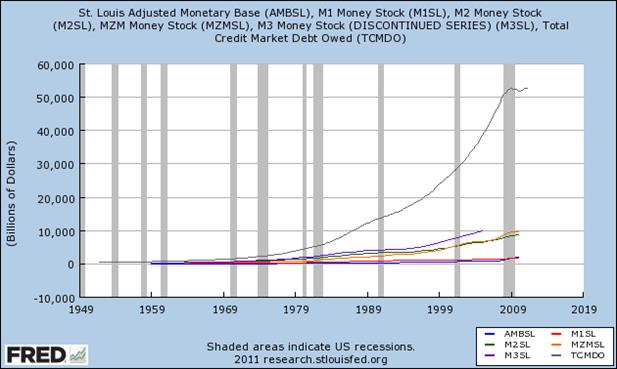

With gold no longer limiting how much money governments could print, after 1971 the global money supply exploded.

http://positivemoney.org/how-money-works/how-did-we-end-up-here/

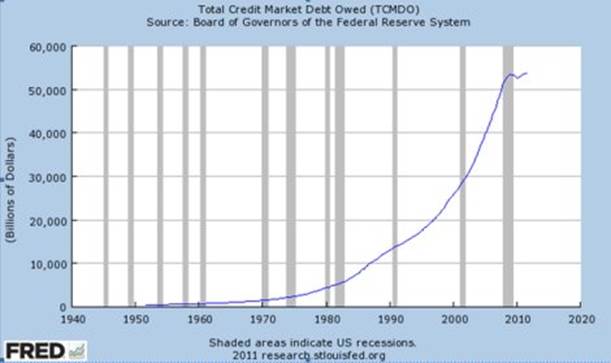

In capitalist economies, because money enters the money supply as loans, the explosive rise in the money supply led to an equally explosive rise in debt.

Today, this is the central bankers’ final—and fatal—conundrum: Aggregate levels of debt are now so high, credit can no longer induce sufficient economy expansion to pay off or even service capitalism’s constantly compounding debts.

Central bankers’ efforts to revive economic growth, e.g. quantitative easing, low, zero and negative interest rates, are like pouring more and more gasoline into an already flooded engine hoping the additional gas will cause the stalled engine to go faster.

Today, central bankers are trapped by conditions they created. It was their excessive expansion of the money supply after 1971 that lead to the speculative bubbles whose serial collapse resulted in the reawakening of deflationary forces not seen since the Great Depression;.

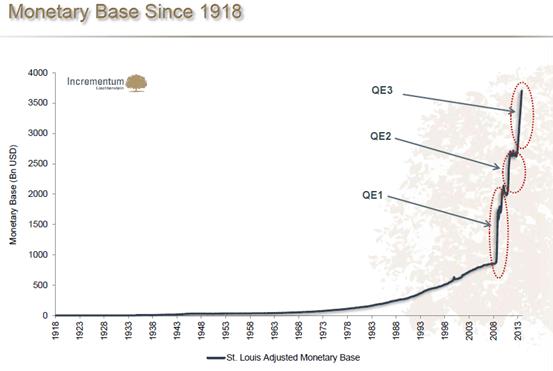

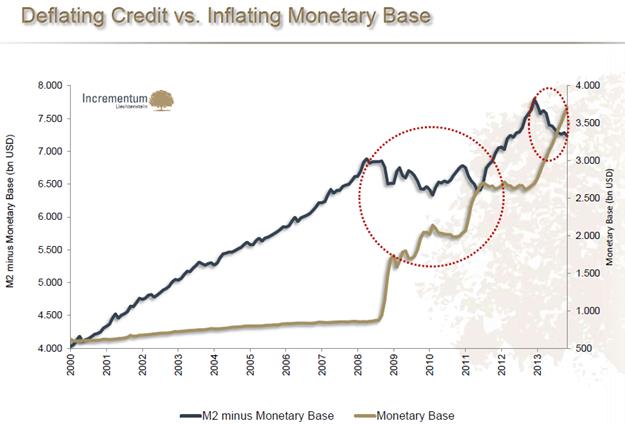

To prevent another Great Depression, central bankers desperately tried to revive economic demand and growth by increasing the monetary base to increase the amounts of loans banks could make.

But instead of loaning the money, banks redeposited the excess reserves (AMBSL) with central banks; and the hoped-for increase in circulating money (M1, M2, M3, etc.) and credit and debt (TCMDO)—and growth in economic activity—never occurred.

..the increase in the monetary bases was not translated into growth in the money supply because banks have been reluctant to extend loans, choosing instead of accumulate reserves.

p. 265, Quantitative Easing As A Highway to Hyperinflation, Imad A. Moosa,2014

In the end, self-interest is a two-edged sword with no handle

TOMORROW: A HYPERINFLATIONARY TSUNAMI OR A RIPTIDE OF DEFLATION..OR BOTH

During the Great Depression, money appeared to ‘disappear’ because in capitalist economies, banknotes are derivatives of credit and debt masquerading as money; and in a severe deflationary collapse, debts default, credit is withdrawn and what appears to be money vanishes.

Today, central bankers are attempting to offset the growing global deflationary riptide by ‘inflation targeting’, i.e. using cheap credit and inflating the monetary base to artificially induce inflationary demand. So far, deflation is winning; but should inflation gain the upper hand, hyperinflation, not inflation, will result as the monetary base is now too large to limit any inflationary surge.

A deflationary collapse or hyperinflation may be an even-money bet

Capitalism’s survival is not

Fait Paper Money: The History and Evolution of Our Currency by Ralph T. Foster (2010) tells the story of fait paper money. In its one-thousand year history, no regime of paper money has every lasted. The fate of today’s fiat paper currencies, e.g. the US dollar, the euro, the yen, the yuan, the pound, etc. will be no different.

In my latest youtube video, It’s Not About Gold; But It’s All About Gold, Ralph T. Foster and I discuss Eric Maria Remarque’s book, The Black Obelisk, and the Weimer hyperinflation. Foster’s observation that the Weimer hyperinflation was intentional has particular relevance today, see https://www.youtube.com/user/SchoonWorks/discussion,.

Germany intentionally hyperinflated its currency to pay its onerous war debts, i.e. reparations, after World War I with hyperinflated, i.e. worthless, paper money. Today’s desperately over-indebted nations might well do the same.

While the cost of hyperinflation is extremely high

In extreme cases, it appears reasonable

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.