Physical Gold Delivery Failure By German Banks

Commodities / Gold and Silver 2016 Sep 02, 2016 - 04:33 PM GMTBy: GoldCore

The physical gold delivery failure to clients of Deutsche Bank who own Xetra-Gold, the gold exchange traded commodity, was confirmed yesterday by Deutsche Bourse who said that the inability to deliver gold was not limited to Deutsche Bank and that other German banks were having “problems” delivering gold.

The physical gold delivery failure to clients of Deutsche Bank who own Xetra-Gold, the gold exchange traded commodity, was confirmed yesterday by Deutsche Bourse who said that the inability to deliver gold was not limited to Deutsche Bank and that other German banks were having “problems” delivering gold.

This is yet another example of a bank not making good on promises to redeem their gold investment products, as seen with ABN Amro in 2013 and indeed Julius Baer in recent months as we pointed out yesterday (see here). It is the latest example of the unappreciated risk of owning gold exchange traded commodities (ETCs), exchange traded funds (ETFs) and indeed most institutional gold investment offerings.

Xetra-Gold filed an official response yesterday regarding the physical gold delivery failure, one which can be read in German on the following page and was reported and commented on by Zero Hedge overnight:

What is notable is that instead of immediately refuting the story – as it should have done if there is no breach of prospectus covenants – and declaring that any and all physical gold demands have and will be satisfied, Xetra took a very circular approach to responding, one which in effect confirmed our concerns, that the issue was not so much with Xetra, but with the sponsor bank, in this case Deutsche Bank.

Furthermore, the author of the original godmode article, Oliver Baron, penned his own reaction, in an article titled “Deutsche Boerse takes a stand.” He writes that “yesterday’s article “Xetra-Gold: Nothing but a scrap of paper?” has struck nerves: Not only that GodmodeTrader was cited among others, at “Zero Hedge” a financial website influential on Wall Street, but also at Deutsche Bank and at Deutsche Boerse, where the article has caused quite an internal stir, as Godmode traders was informed.”

He further writes that Deutsche Boerse Commodities has released a fairly spongy formulated observation on the physical delivery of Xetra-Gold. The key phrases are:

“The Deutsche Boerse Commodities GmbH points out that holders of Xetra-Gold shares can at any time exercise the right to delivery of securitized gold. Deliveries are made via a branch of a bank indicated by the investor. The requirement is that the branch offers this service because the delivery can take place only through the depository bank of the investor.”

As we reported yesterday, what made this particular “failure to deliver” notable is that the original client had asked for delivery via a Deutsche Bank branch, the same bank as the ETC’s sponsor, which is why, as we noted before, this appears to have been a problem involving not Xetra-Gold, as much as Deutsche Bank itself.

Baron agrees. As he writes, “in other words, it depends, according to Deutsche Boerse Commodities, on the particular bank branch whether the physical delivery can be carried out.”

And, as we learned last night, it does appear that if the delivery is requested at a Deutsche Bank branch, the answer is no.

But this is where it gets even worse. As Baron adds, in a telephone conversation with the author, the Deutsche Boerse Commodities exchange was unwilling to supply further information to Godmode traders whether physical delivery is generally feasible at most bank branches or not. And worst of all, “the exchange was unable to name any bank which is in a position to deliver physical gold without problems.“

Baron’s conclusion: “the “right” for actual delivery at Xetra-Gold is theoretical: physical delivery is only possible if the respective bank branch also cooperates. Suspicious gold investors should consider Xetra-Gold as another form of paper gold and not as a physical gold investment.”

Our take is slightly different: while we already know that physical delivery at Deutsche Bank appears to have been compromised, according to the Deutsche Boerse response, the ability of any and every other bank in Germany to deliver gold is now likewise questionable. Which begs the question: where is all the physical gold?

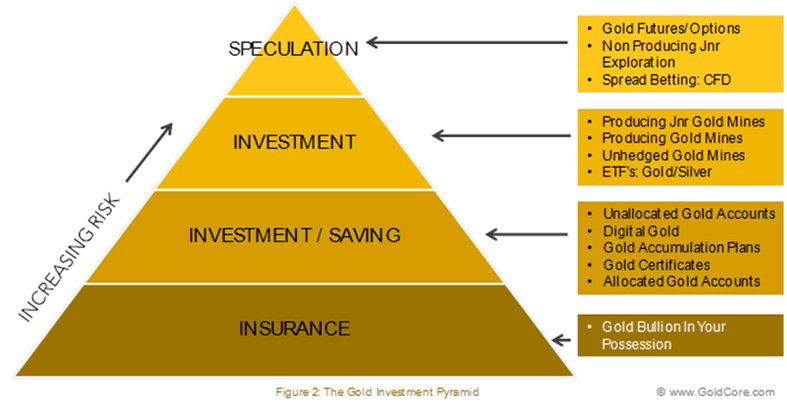

The risks inherent in investing in gold exchange traded funds (ETFs) and exchange traded commodities (ETCs) is something that we have warned of since these new gold proxy investment instruments came on the scene in 2003.

See Beware of Exchange Trade Funds (ETFs) Bearing Gold and watch the Bloomberg video from 2012 below:

Physical Gold Favored Over Derivatives at GoldCore: See Bloomberg Video Here

Paper, digital and financial proxies for gold are not real gold. Hence the importance of owning coins and bars either in one’s possession or in allocated and segregated storage in the safest vaults in the world.

Gold Prices (LBMA AM)

02Sep: USD 1,311.50, GBP 987.95 & EUR 1,172.74 per ounce

01Sep: USD 1,305.70, GBP 1,985.80 & EUR 1,172.13 per ounce

31Aug: USD 1,314.45, GBP 1,000.30 & EUR 1,179.19 per ounce

30Aug: USD 1,318.85, GBP 1,008.39 & EUR 1,180.90 per ounce

26Aug: USD 1,324.90, GBP 1,002.95 & EUR 1,173.33 per ounce

25Aug: USD 1,324.50, GBP 1,001.06 & EUR 1,172.98 per ounce

24Aug: USD 1,337.30, GBP 1,010.73 & EUR 1,185.38 per ounce

Silver Prices (LBMA)

02Sep: USD 18.75, GBP 14.15 & EUR 16.76 per ounce

01Sep: USD 18.65, GBP 14.08 & EUR 16.73 per ounce

31Aug: USD 18.74, GBP 14.27 & EUR 16.82 per ounce

30Aug: USD 18.78, GBP 14.35 & EUR 16.82 per ounce

26Aug: USD 18.67, GBP 14.15 & EUR 16.54 per ounce

25Aug: USD 18.50, GBP 14.02 & EUR 16.39 per ounce

24Aug: USD 18.84, GBP 14.23 & EUR 16.70 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.