It’s Official: The Global Real Estate Bubble is Finally Bursting!

Housing-Market / UK Housing Aug 30, 2016 - 05:28 PM GMTBy: Harry_Dent

It’s official.

It’s official.

The global real estate bubble is bursting.

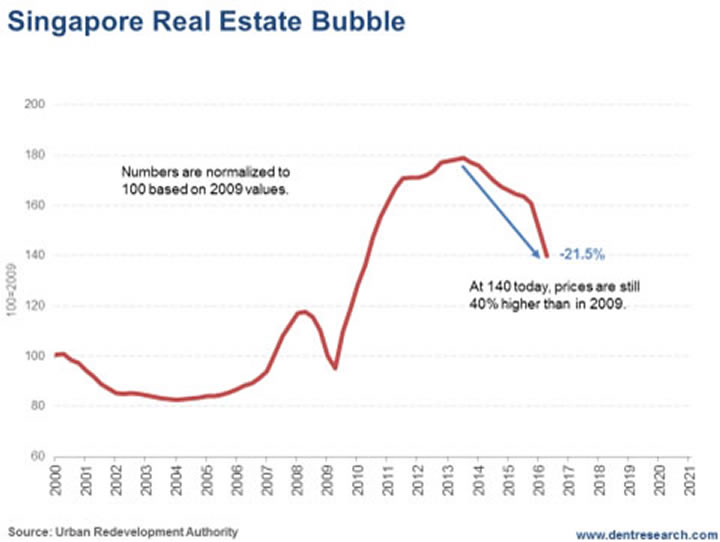

After imposing a hefty 26% tax on foreign buyers, and a 12% to 16% surcharge for buyers who flipped their house between one and two years, Singapore real estate has declined 21.5%.

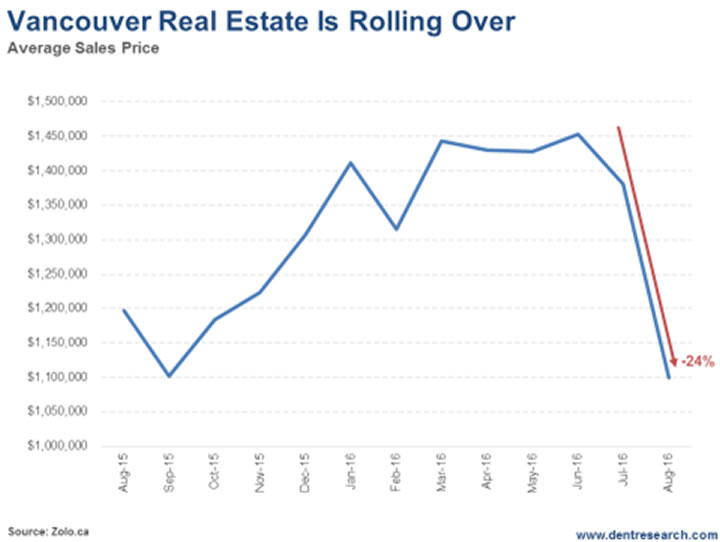

Vancouver has taken similar measures, and – surprise, surprise – its real estate is down 24% in just five months!

That’s what I mean when I say that when bubbles burst, they do so dramatically and rapidly.

But this is likely just the beginning…

I put Singapore into razor-sharp focus in February of last year when I noted it had some of the most expensive real estate in the world. It has the highest standard of living of any country in Asia – even higher than in the U.S.!

The problem is that the country is 100% urban and has limited land – making it incredibly susceptible to the kind of bubble that’s formed there.

And boy, has one ever.

Prior to this recent crash, real estate prices there had risen 68% since early 2009 following the global financial crisis…

And 110% since the 1999 low after the financial crisis across Southeast Asia.

Now, they’re down 21.5%:

Clearly, it was a bubble waiting to burst!

Eventually, there was public backlash against foreign buyers who were bidding up prices. After a certain point, the everyday, $60,000-a-year household couldn’t afford to live in its own city!

And now that the government has slapped a bunch of fines on those buyers, those foreigners aren’t buying like they used to – and Singapore’s prices are crashing down to earth!

Just like I said they would a year and a half ago.

I also covered Vancouver about a year ago prior to heading there for our third annual Irrational Economic Summit. (We’re hosting our fourth in less than two months in West Palm Beach, FL. (Click here for details.)

As I said at the time, Vancouver is my favorite city in North America… and is also one of the single bubbliest cities on the planet.

Like Singapore, its residents were getting fed up with foreign buyers – mostly Chinese in their case – jacking up prices across the city.

From the beginning of 2002 to when I reported last year, home prices had gone up 290%!

A bubble, plain and simple.

I warned they would likely start punishing foreign investors as well – and they did. The city slapped a 15% tax on them. And given that Vancouver was a prime location for Chinese investors laundering their money out of China, the city got hit hard – again, down 24% in just five months.

What did I say? Bubbles. Always. Burst. There are no exceptions in history.

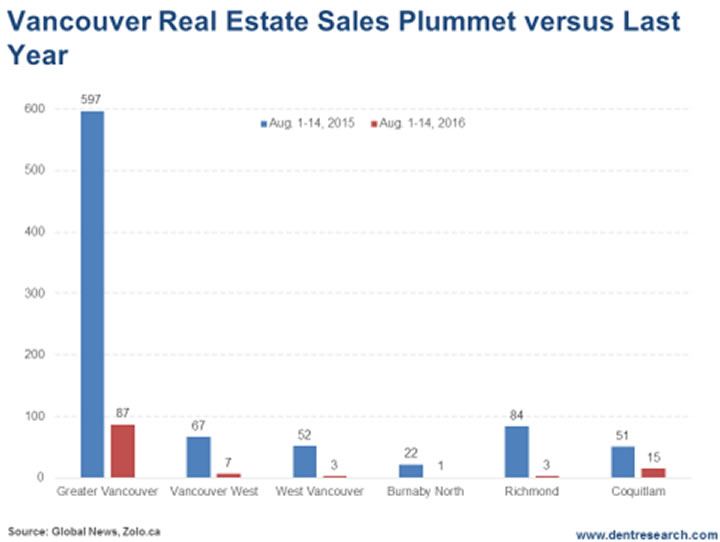

In greater Vancouver, sales have fallen from 597 in the first half of August last year to a mere fraction of that – 87 over the same timeframe. That’s an 85% crash, for crying out loud!

It gets worse. The most high-end part of the city, West Vancouver, dropped from 67 to seven – 90%.

And Vancouver West, the area across the bay with mostly upscale suburbs, which the Chinese love the most, is down from 52 to three, or a whopping 94%. The Richmond area got hit the hardest, falling from 84 to three, or 96%.

For now, buyers in Vancouver are staying put until they see how this shakes out.

But is this a crash in the making or what?

The question now is… who’s next?

My bet’s on London. I could see the highest-end falling off more rapidly after Brexit. Then San Francisco. And finally – the coup d’etat – Shanghai and China.

Let me make myself clear. This is the beginning of the greatest and most global real estate bust in all of modern history.

So I’ll ask again…

How much do you love your real estate?

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.