Semiconductor Stocks Sector, Updated

Companies / Tech Stocks Aug 30, 2016 - 03:36 PM GMTBy: Gary_Tanashian

We have been using the Semis as a one of several economic signposts, and as an investment/trading destination since the Semi Equipment ‘bookings’ category in the Book-to-Bill ratio began to ramp up several months ago. But those who say that Semiconductors are subject to pricing pressures are correct. It is a segment in which people need to be discrete with their investments. NFTRH 410 updated some details about this market leader.

We have been using the Semis as a one of several economic signposts, and as an investment/trading destination since the Semi Equipment ‘bookings’ category in the Book-to-Bill ratio began to ramp up several months ago. But those who say that Semiconductors are subject to pricing pressures are correct. It is a segment in which people need to be discrete with their investments. NFTRH 410 updated some details about this market leader.

Semiconductor Sector

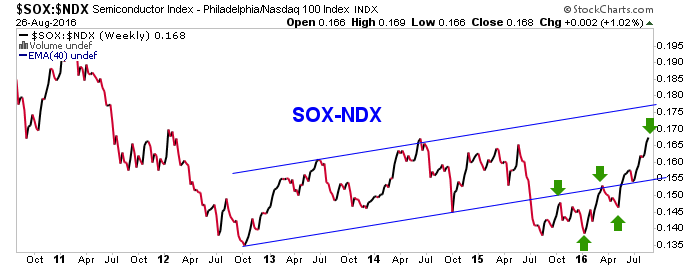

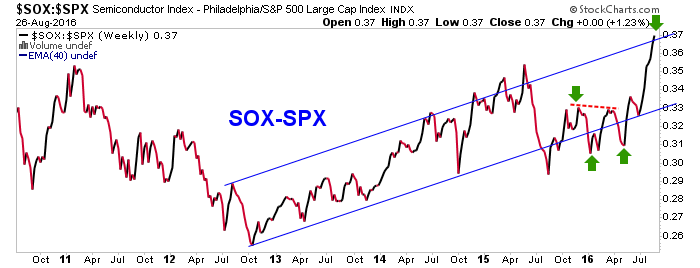

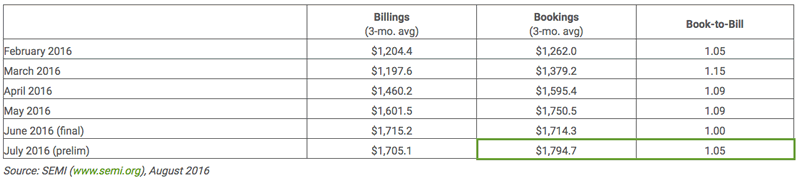

Semi has been a leader for our overall market and economic view, which has been bullish since noting that a trend of three straight months of increased bookings was established in April. The Book-to-Bill for July came in strong once again, with a new high in the key ‘bookings’ category.

From SEMI: “Monthly bookings have exceeded $1.7 billion for the past three months with monthly billings trending in a similar manner,” said Denny McGuirk, president and CEO of SEMI. “Recent earnings announcements have indicated that strong purchasing activity by China and 3D NAND producers will continue in the near-term.”

China? That does not sound like a long-term, stable fundamental underpinning. This Semi ramp up may be relatively selective (aside from Chinese demand, which could cut out at any time, it would pay to focus on 3D NAND).

From Market Realist: “Applied Materials’ (AMAT) strong guidance for fiscal 4Q16 reflects the overall semiconductor industry’s health. AMAT revised its forecast for 2016 WFE (wafer fab equipment) spending from flat to single-digit growth. The slight growth would be driven by a 40% YoY (year-over-year) increase in 3D NAND spending and a 5%–10% YoY increase in foundry spending. However, this growth would be partially offset by a 25% YoY decline in DRAM (dynamic random access memory) spending and a slight decline in logic spending. In 2016, AMAT is witnessing a broader mix of foundry customers from different geographies, especially China.”

Also from SEMI, in a mid-year update: “While many are forecasting low-single digit unit growth for semiconductor devices, average selling price (ASP) trends will drag down the overall revenue outlook for the industry.”

This is important because I agree that the Semiconductor manufacturers are a crap shoot, as many of their products are in essence, commodities, in that they are in a highly competitive industry and readily available. The Equipment and Materials sectors service the whole of the sphere with specialized equipment and materials.

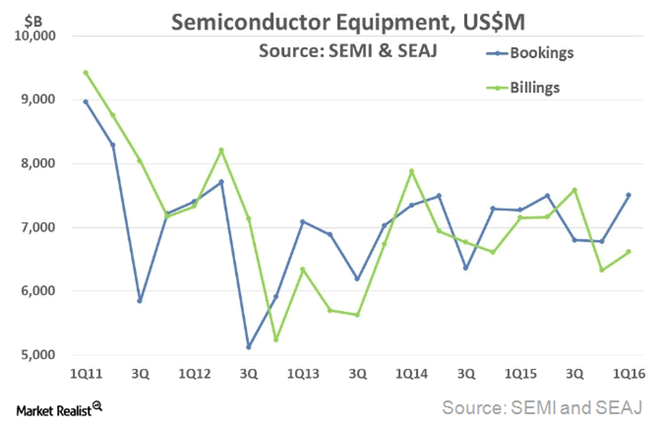

“One bright spot are semiconductor equipment bookings that are showing a 6 percent year-over-year increase (see figure below). The strength in bookings is boding well for a stronger second half of the year and is supported by 2016 capex plans by Intel, Samsung and TSMC as detailed by IC Insights’ recently released bulletin.

Other segments are showing positive momentum. First quarter silicon volume shipments, as well as equipment bookings and billings were higher than the fourth quarter of last year. Quarterly increases continued into the second quarter for equipment bookings and billings, silicon wafer volumes, and leadframes. The World Semiconductor Trade Statistics showed that device shipments increased 5 percent, resulting in a 1 percent increase in chip revenues in the second quarter when compared to the first quarter. Based on past data trends gains are expected to continue into the third quarter as the third quarter, on average, is the strongest quarter for semiconductors.

The lingering question is, “will the gains in the second quarter and anticipated gains in the third be enough to offset the typically slow fourth quarter?” The answer is, “it depends.” From a device perspective it does not appear it will, as evidenced by the current mid-year outlooks depicted above [graph omitted]. However, from an equipment and materials point of view the future is more promising. SEMI is expecting the semiconductor equipment market to increase a nominal 1 percent this year, while the materials market will increase just under 2 percent, which would put the equipment and materials markets at $36.9 billion and $44.1 billion, respectively.”

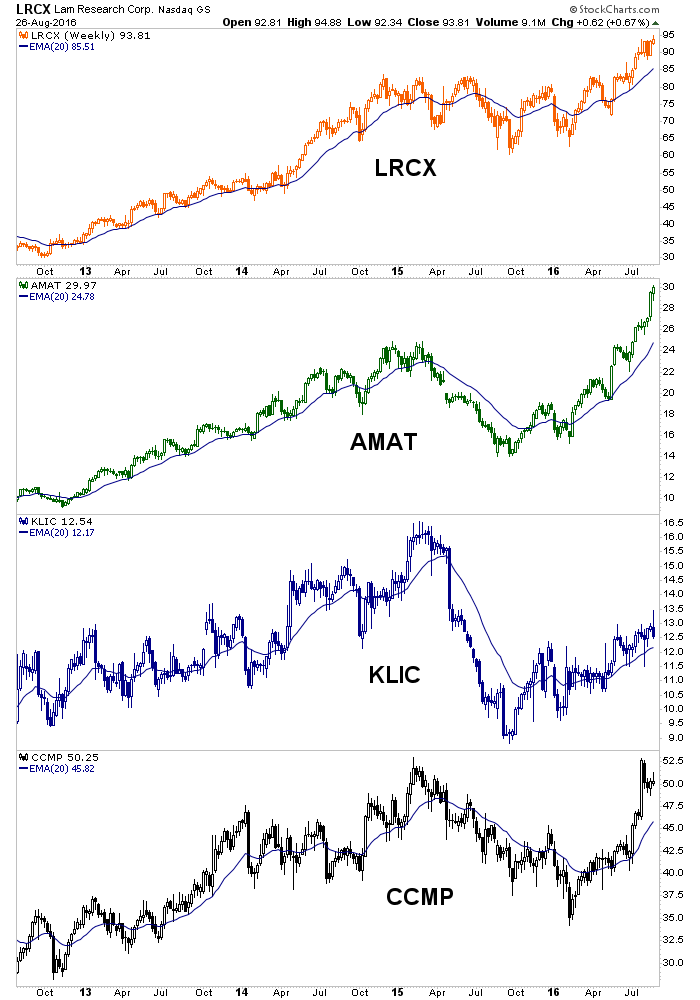

How does this affect our view? As a leading economic indicator I’d say that the Equipment and Materials ramp up remains a positive, although we should tamp down any enthusiasm that a grand new economic era may be upon us and continue to cross reference other indicators like PALL-Gold, Commodities vs. Gold, etc. for cyclical indications. As a view on direct investment or trading in the Semi sector, I’d say we’d need to be very discrete. Quality, leading equipment companies like AMAT and LRCX and Materials companies like CCMP are the focus.

This chart shows the bullish state of 2 Equipment companies, the constructive state of another, and one still bullish Materials company. We’ll look at others going forward if/as the situation remains constructive.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.