Late-August Calm a Breeding Ground for Gold Bullion Bank Shenanigans

Commodities / Gold and Silver 2016 Aug 30, 2016 - 12:19 PM GMTBy: The_Gold_Report

Precious metals specialist discusses the recent correction in the gold market and the moves by bullion banks behind them.

Precious metals specialist discusses the recent correction in the gold market and the moves by bullion banks behind them.

I have been writing these missives since mid-1986 when I was able to hide under the cloth of "client service" rather than "investment research" because the management of brokerage firms will NEVER allow their names to show on any piece of research that isn't BOUGHT and PAID FOR by the issuer being covered. To wit, if I had done two and one-half weeks of study on the balance sheet of Russell Metals (a 1978-era steel fabricator) and delivered a scorchingly accurate analysis of the severity of its balance sheet erosion, the management of my firm would thank me for my good work, buy me seven draughts and a Broiled Pork Hock at the Nag's Head Tavern for lunch and then give me the day off with a few Borden's in my pocket with which to enjoy the peelers over at the Zanzibar. They would then take the body of my research and strip it of anything related to me and find a "noted analyst" with excellent media credibility and, before you knew it, there it was in full regalia, MY report on the firm's letterhead with said "Senior Analyst" carrying the flag, the torch, and the rectal probe needed to re-acquire his head from the lower extremities of his torso.

You see, the investment industry was created totally separate from the banking industry "way back when" because the bankers were caretakers of ALL of the money everywhere and all they had to do was simply "shepherd" the cash and make diligent choices as to who would be lent money with funds that depositors owned. The people that created the "investment industry" were so reviled by the bankers that they would actually ignore each other at social engagements and actually get into fistfights at sporting events.

Canadian bankers were the "elite" and investment dealers were "salesmen" and never the 'twain would meet—until 1987, when the bankers used money and influence to repeal the wondrous British North America Act of 1867 and allow banks to distribute securities to the public. One hundred years after the BNA ACT was delivered allowing the orderly creation of an orderly growth of the caretaking of client SAVINGS, the Canadian Government buckled under U.S. and U.K. pressure and let the banks into the securities game. Voila!

Now these heathens are allowed to elect politicians and appoint judges and create statutes and all you need to understand is that you will always be enslaved to their intentions. A friend of mine recently recounted the story of the wondrous Canadian government and its uncanny ability to unilaterally change "rules" and in this case it was the interpretation of the term "investor" versus "trader." A few years back, the government created the "Tax-Free-Savings Account," which was fully blessed with the right to invest in common stocks. Well, here were are about 10 years later and the government's tax thugs have decided that you can't make "too much" in a TFSA by "trading" because if you do, they disallow all of the "tax-free" trades and throw them right back into income.

Think about it. They tell you it is perfectly alright to invest in common stocks and you are left alone for the first six or eight or ten years and then all of a sudden, the hitman shows up in your mailbox demanding an "interview" and bring all of your trading slips with you because you are going to be required to PROVE that you are an investor as opposed to a trader. I now ask you to think about it ONE MORE TIME. Where is it written that some snot-nosed 32-year-old kid that has been paying taxes for maybe 10 years can tell ME who has paid millions of dollars in taxes over a 40-year career in the investment industry the difference between "trading" and "investing"??? By what Divine Power does a government have the right to THREATEN its tax-paying citizens all because some supra-millennial whiz kid decides that "trading" is a sin and "investing" a charitable act?

That is what Canada has become. Notwithstanding the fact that foreign entities with zero knowledge of the 150-year history of this former British colony are taking their counterfeit currencies and converting those worthless Ponzi-schematic units and are buying huge swathes of lakefront land all throughout the Great Lakes as well as office space and residential property for "investment purposes," that very same government is now targeting Canadian citizens whose grandparents fought with General Brock in 1812 by assigning tax "officers" educated in the Far East to execute the DIRECTIVE.

This is not a racist or ethnocentric missive; it is a missive that is designed to target those Canadians who actually thought that our country could remain the extraordinary society that the United Nations used in Greece as a force of "peacekeepers" and that was because of our effort on WWII. Canadian forces throughout Europe were revered as insanely diligent in their ability to inflict enemy casualties but they were also considered extremely respective of the locals. Today the youngsters that think Canada is a natural breeding ground for freedom and peace and environmental protection are living in a fantasy world that was instigated by the "American Dream" factory spawned in the 1990's by AOL and MSN and later expanded by Google, Facebook and Twitter. It is actually a fantasy CONCEPT that allows young adults to assume that they are safe in the womb of inheritance bestowed upon them by parents and grandparents and the moment where they cash the cheque left to them by Auntie Val, they will see that about 1.2 billion foreigners are competing with them for property originally intended for the children and grandchildren of the Canadian veterans of two world wars.

Now, I am officially to be deemed an "old fart" by the younger crowd that are reading this but I want you all to understand that there is a certain functional reality to the idea that you should live in a community of "like minds." By that, I think that the concept of entering into marriage with those raised in a community of "like minds" is divinely preferable to entering into a marriage where one must sacrifice everything learned in youth about god and religion and family to an entirely new paradigm. If you think for one minute that foreign investors are coming in to Canada to "assimilate" and learn English, remember "God Save The Queen," agree to recite "The Lord's Prayer" and sing "O' Canada" every morning before classes begin, you had better give your collective heads a shake. It is, quite simply, never going to happen. Politically incorrect or not, it is a passionate topic for me and for many Canadians approaching the twilight of careers and lives with retroflection.

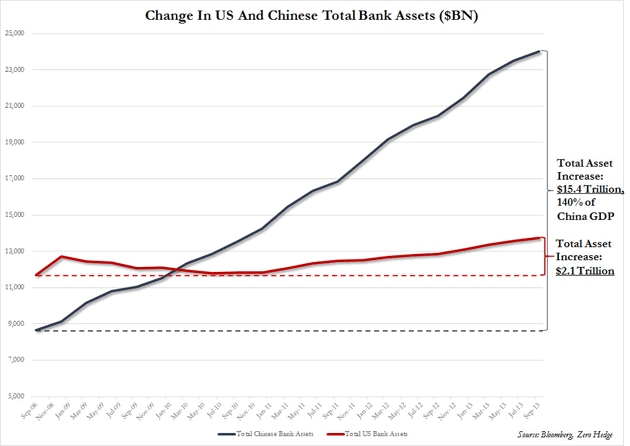

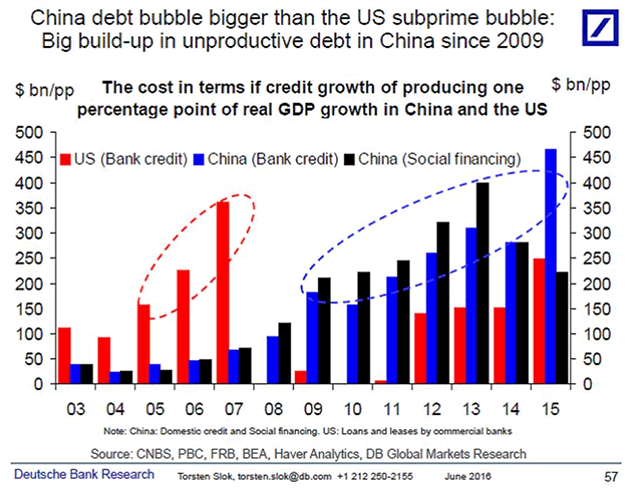

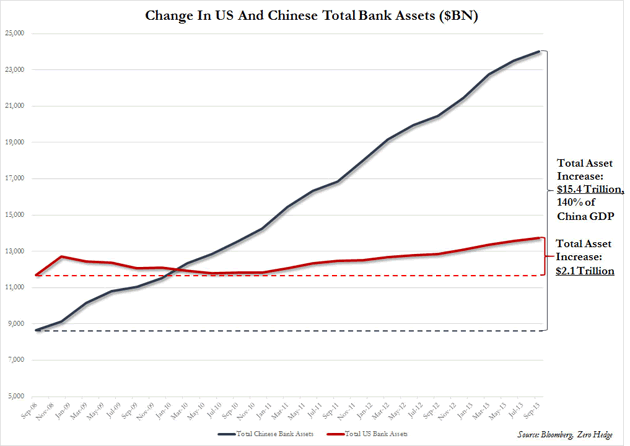

Back to markets and money, you have to do everything in your power to be on the long side of the Canadian dollar until at least 2018. Friends of mine from China tell me that they can send money "offshore" in copious quantities to invest in foreign real estate and that the Chinese government is actually printing the currency out of "thin air" in order to finance the orderly conversion to ANY OTHER currency. Canadian banks are more than happy to take the Renminbi or Yuan and give them loonies because they get the transaction fees and a new account. China is bestowing billions upon billions of dollars onto its citizens from a Ponzi-scheme economy that is on life support from a massive QE-stimulated effort.

Until the Canadian government restricts the conversion of questionable Chinese paper into loonies and toonies, the homes and farms and cottages of Canadians will be absconded with by foreigners with a purpose. That purpose is essentially to establish a beachhead in a free and democratic country unprotected by foreign investment limitations with this "found money" fabricated by a country with a massively indebted financial sector. Therefore, since Canada is now the destination of choice for the Chinese "nouveau-super-riche," it is driving prices through the roof and in due course, the Canadian dollar will respond.

Friday's Jackson Hole Gong Show was just that—a Vaudevillian parade of economists and academics and most importantly BANKERS who were there for one very specific reason: to ensure the integrity and profitability not of the U.S. or global economy but rather to secure the status of the BANKING INDUSTRY as "running the show." The TV lights were staged perfectly and the entrance of Janet Yellen and Stanley Fischer was of Academy Awards vintage with the only thing missing being a red carpet and a bunch of goggly eyed fans. Actually, there were "fans" and it was the financial media that turned it into the Victory Burlesque. In the end, the masters of finance orchestrated a 1.26% advance in the dollar-yen and an 80-point uptick in the USD index that removed the sizeable gains in gold and silver that came with Yellen's comment that the U.S. could avoid recession with $2 trillion of additional QE (buying of a broader range of assets including corporate bonds and shares).

As I have been chortling about for most of the year, we entered into a massive five-to-eight-year bull market in gold and silver and associated stocks on January 19th of this year with gold now up 25.03% and the HUI (NYSE Arca Gold BUGS Index) up 113.84% year-to-date. There will be corrections along the way such as the one we are currently riding out with the GDXJ (Market Vectors Junior Gold Miners ETF) down 14% from the highs of mid-month but as I pointed out on August 15th in the piece entitled "Putting Gold Miners into Proper Perspective," the HUI peaked in September 2011 at 622 from its current 113 and the Junior Gold Miner ETF (GDXJ) peaked north of $150 from its Friday close of $45.15. Conclusion: The miners have a great deal more upside left in them and dips must be bought.

The Friday COT report was a non-event with very modest 6,482 gold contracts sold and 2,525 silver contracts bought by the Commercials but noteworthy that the net short position in gold is up around 346,000 and that is pressing the historical highs seen in past cycles normally associated with tops but thus far unaffected in 2016. I have a great many emails and phone calls asking me why the gold market has been able to shrug off the bearish implications of this large aggregate short position by the bullion bank behemoths, and my answer is that it really hasn't. We have seen massive increases in open interest since the start of the year and that represents enormous new long positions in gold and silver. Since supply has been capped due to central bank positioning to the long side and no new production due to the bear five-year market, one has to wonder why we are still roughly $600/ounce below the 2011 peak. If you imagine no bullion bank (Commercials) interference since the bull began in December 2015, gold would surely be trading several hundred dollars higher and, while it may not have had the juice to see new highs, it would be close. So, the Commercial Cretins HAVE influenced the pricing mechanism and may continue to try to unwind at lower prices but since September is historically the best month of the year for gold market performance, those 346,000 contracts are going to be problematic for someone's P&L going into Q4 if the Seasonals kick in. . .

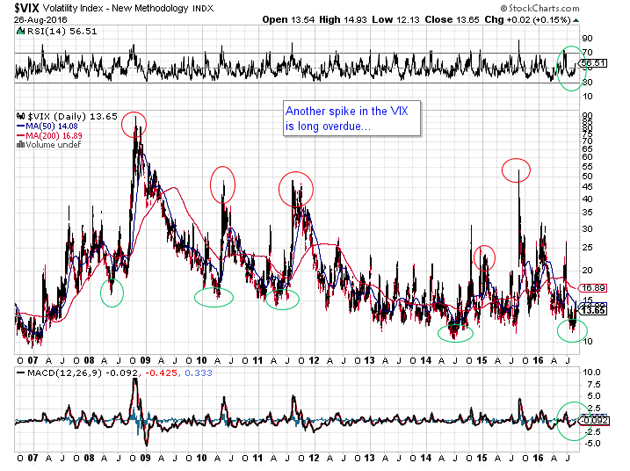

As for U.S. stocks, the VIX (Volatility S&P 500), and silver—all trades that I put on back in July expecting that we would get some serious mid-summer weakness, the following chart really speaks volumes to the power of interventions, be it by the Federal Reserve, the Bank of England, or the Swiss National Bank or by the biggest serial intervener of them all, the Bank of Japan. We have been in one of the longest periods of subdued volatility in years as the algobots now club the VIX futures at every hint of weakness. That, as the chart below shows, cannot and will not continue.

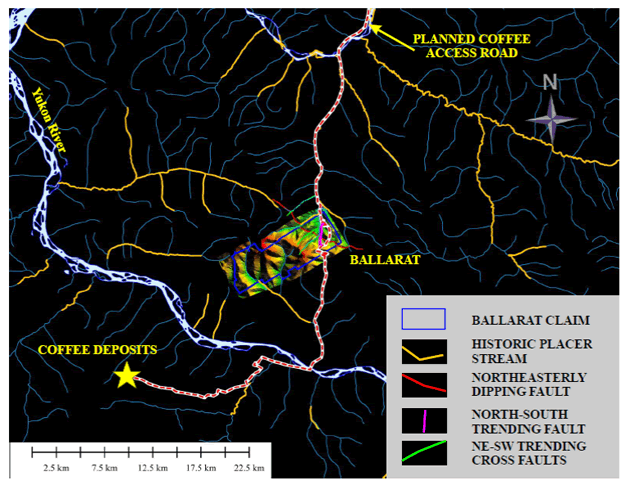

Stakeholder Gold Corp. (SRC:TSX.V) is currently preparing for its Phase Two program on the 100%-owned Ballarat property located 11 kilometers north of the Coffee, recently acquired by Goldcorp for $520 million. All through the 2011–2016 period, I continued to recommend Kaminak Gold and eventually cashed the ticket with Goldcorp Inc.'s (G:TSX; GG:NYSE) offer. With the mighty GG now entrenched in the Yukon, Brent Bergeron, V.P. of Corporate Affairs and Sustainability, has made it abundantly clear in a recent interview concerning its big picture intentions:

"The acquisition of Kaminak is very consistent with our strategy of partnering with junior mining companies to make sure that we're identifying and developing districts with significant exploration potential," said Brent Bergeron, executive vice president of corporate affairs and sustainability at Goldcorp, during a presentation. "It's consistent also, with us looking at a specific project, growing the potential for exploration of that project but also looking at it in terms of an overall camp."

What is interesting is that in the news release dated August 3rd, V.P. of Exploration John Nebocat stated: "The early results at the Eastern zone anomaly are extremely encouraging. The dispersion of the gold-in-soil anomalies suggests that a possible widespread mineralized body may exist here. Also, the currently proposed Coffee access road lies within 500 meters of this area; this could add significant upside potential and provide meaningful logistical advantages should an economic deposit be discovered here." This is all brand new data not before factored in to the SRC story.

I leave all of you with a final reminder of one of the late Richard Russell's many brilliant observations about bull markets and I paraphrase: "One of the most difficult tasks for investors in bull markets is to stay onboard and fully invested. It is like being in a rodeo atop a wild, gyrating bull that tries with every move to throw you off." This is how I feel about the Great Golden Bull of 2016; it is the resumption of a larger bull market that began in July 1999 at $253 and which recently completed its mid-course, long-term correction. I continue to look for a breakout through $1,425–1,450/oz by year-end and serious outperformance by the speculative juniors—the penny explorers. The 357 Magnum portfolio is ahead 36.63% since April 30th and that is AFTER the normally weak summer month that we are now exiting—which bodes very, very well for Q4 for ANY junior explorer that arrives with a new Yukon (or otherwise) discovery. . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation or editing. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Michael Ballanger: I or my family own shares of the following companies mentioned in this article: Stakeholder Gold Corporation. I act as Chairman of the Advisory Committee for Stakeholder Gold Corporation and as such receive compensation for services in the form of cash and/or options/warrants. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.