Gold And Silver – Panic Precious Metals Selling By Elite Overt

Commodities / Gold and Silver 2016 Aug 13, 2016 - 12:56 PM GMTBy: Michael_Noonan

The Military Industrial Complex [MIC], economic war, and massive amounts of newly created debt, year after year after year, have the common purpose of protecting the Federal Reserve fiat Ponzi scheme to preserve the failing “dollar” as the world’s reserve currency. Except for phony accounting, all banks are failing, massively underfunded and totally insolvent. Everything possible is being done to prop up these banks to keep the illusion of financial stability alive, even resorting to stealing from depositors.

The Military Industrial Complex [MIC], economic war, and massive amounts of newly created debt, year after year after year, have the common purpose of protecting the Federal Reserve fiat Ponzi scheme to preserve the failing “dollar” as the world’s reserve currency. Except for phony accounting, all banks are failing, massively underfunded and totally insolvent. Everything possible is being done to prop up these banks to keep the illusion of financial stability alive, even resorting to stealing from depositors.

Why anyone maintains fiat money in a bank is a mystery defying fiscal self-responsibility. All retirement accounts, at least in the United States, will be subject to government confiscation replacing everyone’s investments with worthless government bonds. After all, who more than the federal government can better manage your own funds?!

All local police forces are being militarized. There are even rumors that the UN wants to have all police under their foreign umbrella of control. If that ever happens, it will be proof positive that the end game is in its final stages.

If the elites are so focused on preserving their fiat Ponzi scheme and so intent on wrecking the gold and silver markets, you can be 100% assured that acquiring both or either metal is the smartest move one can make to escape the certainty of the Western world financial calamity that is destined to follow. It did not happen, as expected by so many, in 2013. It did not happen in 2014, 2015, and 2016 is nearing the end of the 3rd Qtr, the latter half of 2016 viewed by many, again, as to when the monetary system will fall apart, or begin to fall apart.

The lesson to be learned is to never underestimate the ability of those in control to remain in control, even to the extent of wrecking the entire financial system, destroying the middle class, and now destroying vestiges of national sovereignty.

Politicians are disconnected from the local populations they purport to serve. The masses of people are disconnected from the reality of recognizing how destructive the elites are. It is more of the latter that enables the former to endure in power. Brazil is a perfect example of how corrupt are the forces to remove a legitimately elected president, mostly because the US wanted to get red of Dilma Rousseff, and replace her with compliant political puppets, just like in the US and EU.

Owning productive land is desirable. Having sufficient supplies of food and water is a necessity. Guns and ammunition are essential. Look at how the federal government is arming as many agencies as possible with automatic weapons and billions of rounds of ammunition. Against whom would those weapons be used? Look in the mirror for the obvious answer.

Keep buying as much gold and silver as possible, and we continue to prefer silver over gold, for now. The unknown “When will things fall apart and PMs rally?” remains unknown. For sure, we are closer with each passing month, but the staying power of the globalists over the masses has been amply proven. Is 2016 [4th Qtr], going to be a time triggering event? It appears not, but anything can happen.

Better a year too soon than a day too late. Stay vigilant in being prepared.

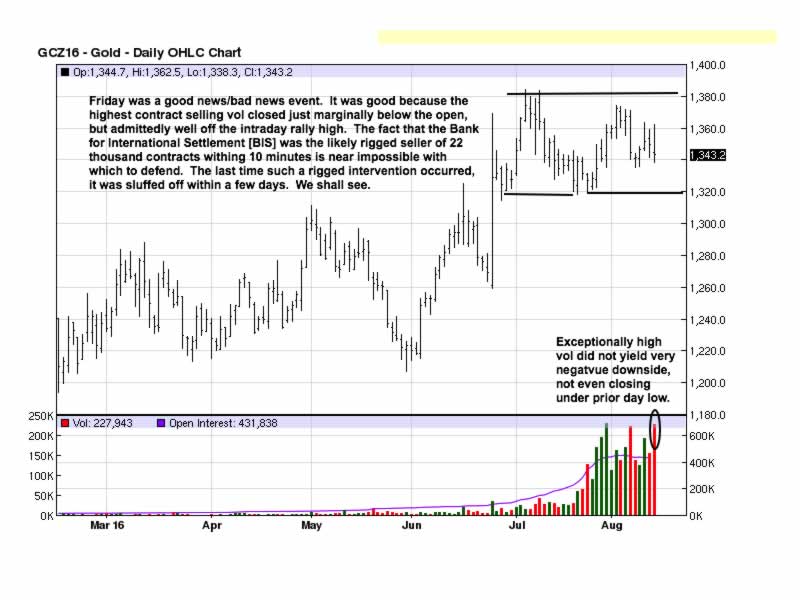

Even with 36,000 contracts being dumped on the market, the downside was visibly limited in effect. [We accuse the BIS, the central bank for all central banks, as being the selling culprit because what other entity has that kind of financial capacity to try to disrupt the gold market, for there can be no other logical purpose in the attempts to manipulate the price of gold?]

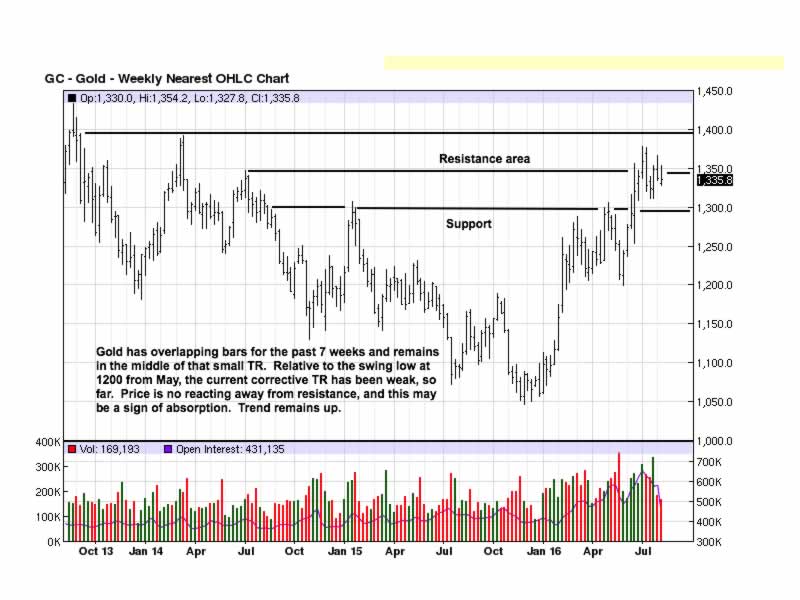

A retest of the 1300 area remains a possibility. To the question of “When?” and will the end of 2016 be the timing trigger, the charts do not appear to support that expectation.

This does not mean a massive move cannot tale place between now and year-end.

All one can do is be prepared for the inevitable without being dissuaded from the blatant elite manipulation with lessening effect on the market. Previously, the massive amount of contracts dumped onto the market occurred when price was in a down trend. Right now, the weekly trend is up, and it takes greater effort to change a trend. A one day dumping of 36,000 contracts may have impacted the daily chart, but it has not altered the up trend in the weekly.

Even though the daily chart is more sensitive than the weekly, the impact of the sale of 36,000 contracts has not altered the trend even on this time frame. The trend is labored, but it continues to work higher.

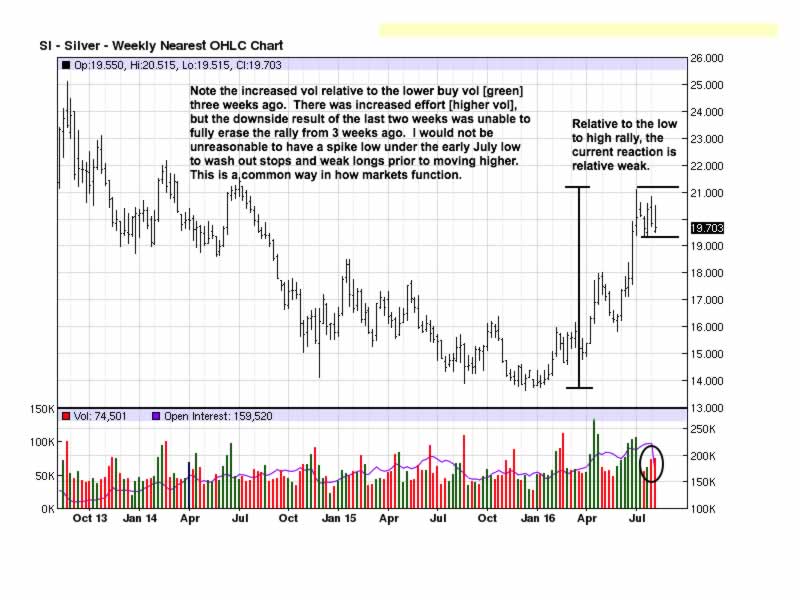

The vertical heavy line depicts the rally from the November 2015 to the last swing high in order to put the last six-week corrective activity into context. The correction has been relatively weak. It may not be over, and if the elites have any say it will continue, if not down, then at least sideways. Patience is the obvious watchword.

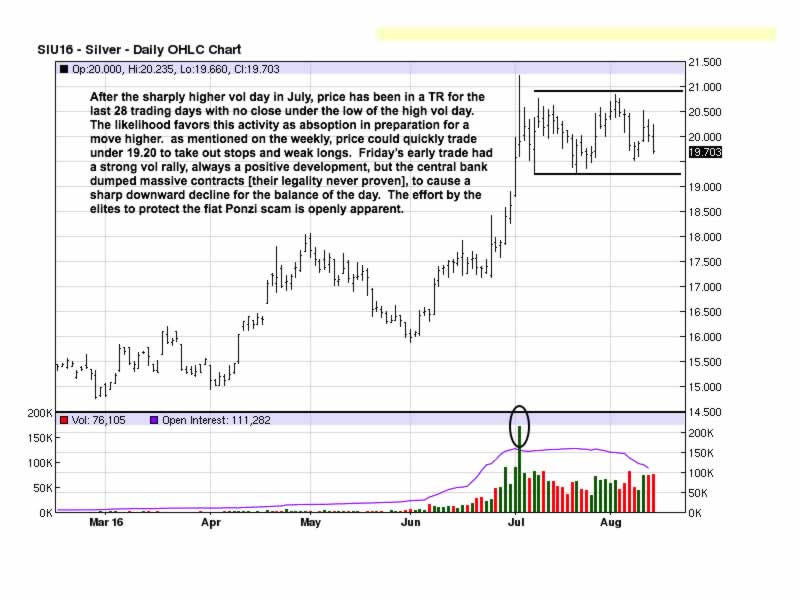

The bane of all traders, irrespective of their intent, as in short-term or longer term, is a sideways moving market. Odds favor an eventual breakout to the upside, but a push for a retest just under the 19.20 area, first, is a possibility, and it would not do anything to alter the current structure of the chart.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.