What Would Future EU-UK Relations Look Like?

Politics / BrExit Aug 12, 2016 - 02:44 PM GMTBy: Arkadiusz_Sieron

We have analyzed the reasons behind the Brexit vote. Let’s turn to the consequences of the Britain’s withdrawal from the EU, which are probably far more important from the investors’ perspective. As we stated in the previous edition of the Market Overview, the exact impact of the potential Brexit depends on the new economic relationship between the UK and the EU. What are the UK’s options outside the European Union?

We have analyzed the reasons behind the Brexit vote. Let’s turn to the consequences of the Britain’s withdrawal from the EU, which are probably far more important from the investors’ perspective. As we stated in the previous edition of the Market Overview, the exact impact of the potential Brexit depends on the new economic relationship between the UK and the EU. What are the UK’s options outside the European Union?

The first option, often mentioned by the supporters of Brexit, is joining the European Economic Area (EEA). The EEA was established in 1994 to provide countries that are not the EU members with the opportunity to participate in the Single Market. It comprises all EU’s members and Iceland, Liechtenstein, and Norway – this why it is also called “the Norwegian model”. At first glance, this scenario looks perfect. The UK would not be within the EU, but it would have almost full access to the common market (with opt-outs from EU agriculture and fisheries policies). Indeed, economically it would the least painful option, as trade would not be hurt much. However, even this option would entail some costs due to customs controls and other trade barriers such as rules-of-origin requirements. Moreover, joining the EEA does not seem to be politically viable. The UK would still contribute to the EU’s budget (to have access to the Single Market) – and the contribution would be roughly similar to the current one (in 2011, Norway’s contribution was only 17 percent lower than the UK’s contribution) – while it would not receive any spending in return (for example, now the UK is the third largest recipient of the EU research and innovation funding). Additionally, the UK would have to comply with the EU rules governing the single market without having any say in setting them. It would be unbearable for Britons who voted for exit from the EU to “regain” the allegedly lost sovereignty. Last but not least, the UK – as the part of the EEA – would have to allow EU citizens free entry. It is the final nail in the coffin of the Norwegian model, as the Brexit vote was mainly motivated by the negative sentiment toward immigration.

The second most commonly mentioned option would be the Swiss model. Switzerland neither joined the EU, nor the EEA. Instead, it signed a series of bilateral agreements with the EU, which allow it to participate in the single market and tailor its relations with the union. On the surface, the Swiss model is attractive – Switzerland chooses just the EU’ programs it wishes to participate in. However, the reality is not so rosy. Even though Switzerland implements most of the EU’s economic regulations, it cannot influence the EU rules, but merely accept or reject them. What is more, the scope of refusal is limited by the Guillotine clause, which states that if Switzerland does not accept changes in the EU directives, it will trigger the termination of all other agreements. Moreover, the alpine country also pays contributions to the EU budget (at the level amounting to about 40 percent of the UK’s contribution), is allowed free movement of people, but not the free movement of services. The lack of the agreement covering services trade would be a crucial drawback for the UK’s economy, greatly dependent on financial services. Additionally, striking Swiss-like bilateral agreements with the EU would take years to negotiate.

The last, heavily discussed option would be just trading with the EU according to the World Trade Organization (WTO) rules, as the USA or China do. In this scenario, there is no political agreement with the EU, but the economic costs are the highest. The UK’s exports to the EU would be subject to tariffs and non-tariff barriers. The WTO model would also entail reduced access to EU markets for the UK’s services, which would hurt the UK-based financial institutions. And the free labor movement between the UK and the EU would cease, which may be politically attractive for British politicians, but will add some economic costs.

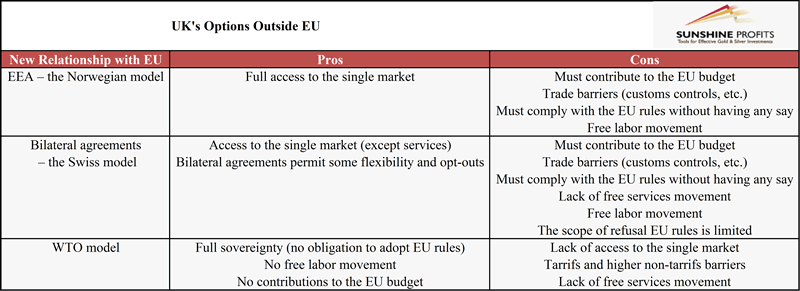

Summing up, Brexit would entail significant economic costs for Britain, no matter how the new economic relationship between the UK and the EU would take shape. Joining the EEA is the cheapest option, but is seen as politically unbearable. The WTO model would be the simplest way from the political point of view, but the economic burden would be the highest. The Swiss scenario ranks somewhere in between (some other less known options, like re-joining the European Free Trade Association, adopting the Turkey or Canada model, are hardly more attractive). The table below presents a comparison between the analyzed options.

Table 1: The pros and cons of different options for the UK outside the EU.

It should be now clear that the UK could not negotiate its own special deal with all the benefits of free trade without the same or higher costs as with EU’s membership. The belief that the UK could cherry-pick the EU rules it likes and quickly strike a new, more beneficial deal with the EU is delusional. Actually, the EU officials may be not in a mood to treat the UK mildly. It is possible that the EU would want to punish the Great Britain just to deter other countries from the idea of separation, especially since the UK’s exports to the EU matter more to the UK than EU’s exports to UK do to the EU (13 percent of UK’s GDP versus 3 percent of EU’s GDP). Indeed, France has already made it clear that it won’t give the UK an easy ride.

It is good news for the gold market. The potential exit process would be long, complex and costly (and perhaps more harmful than expected by Britons), and it would harm the global economy and generate a significant uncertainty and risk-aversion, which should support the price of gold. However, investors should not forget that the behavior of the yellow metal is shaped by the Fed’s actions and expectations of these moves to a large extent, as the recent weeks proved. Therefore, it is possible that the price of gold may decline despite the uncertainty associated with the Brexit, if the U.S. dollar appreciates significantly, or if the expected path of the federal funds rate increases.

If you enjoyed the above analysis and would you like to know more about the structure of the gold market, we invite you to read the March Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.