Gold Suffers Weakness on Strong U.S. Jobs Numbers, but UK Stimulus to Offer Respite

Commodities / Gold and Silver 2016 Aug 08, 2016 - 06:11 PM GMTBy: Nicholas_Kitonyi

Gold investors might need to brace up for a potentially disappointing week after strong U.S. employment numbers reduced the allure of the yellow metal. Gold has been on an impressive bullish ride this year and the yellow metal has gained 26% in the year-to-date period to erase the 11% loss that was recorded in full year 2015. In fact, gold has delivered an impressive price gains that outperforms equities and other commodities.

Gold investors might need to brace up for a potentially disappointing week after strong U.S. employment numbers reduced the allure of the yellow metal. Gold has been on an impressive bullish ride this year and the yellow metal has gained 26% in the year-to-date period to erase the 11% loss that was recorded in full year 2015. In fact, gold has delivered an impressive price gains that outperforms equities and other commodities.

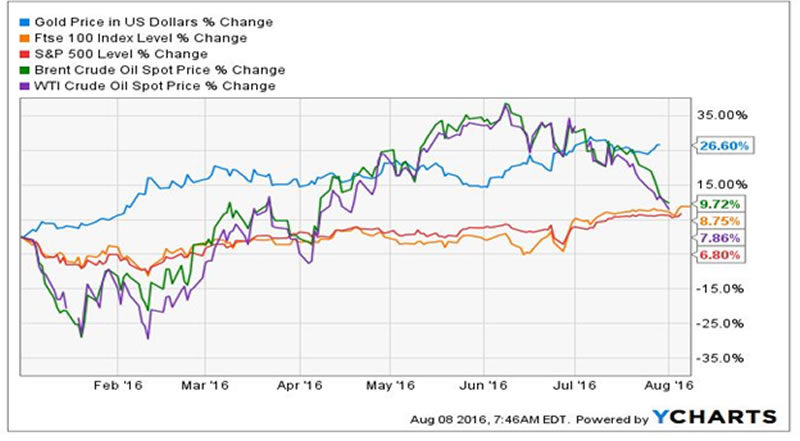

The chart below shows the price gains of gold in U.S. dollar in relation to price gains in equities and other commodities. Gold has gains of 26.06% (blue) while UK's FTSE 100 has scored 8.75% gains (orange) and U.S. S&P 500 has scored 6.80% gains (red) in the year-to-date period. The Brent Crude has managed to score 9.72% gains (green) and the West Texas Intermediate holds 7.86% YTD gains (purple).

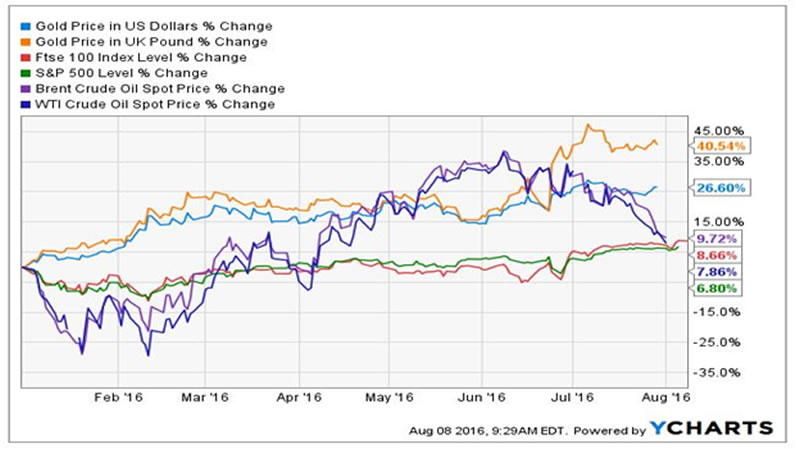

Gold investors in the UK who invested in the yellow metal with the Great Britain Pound will also have booked bigger gains as the chart below shows. Gold price in UK Pound £ has gained 40.54% in the year to date period while equities and the energy industry is still holding on to single digit gains.

Strong U.S. jobs number sends gold crashing

Last Friday, the U.S. Bureau of Labor Statistics reported that U.S. employers created 255,000 jobs in July to be beat the consensus economists' estimate of 180,000 jobs. The U.S. labor market has had the biggest influence on gold prices in the last couple of months because there's a close relationship between the labor market and the plan by the U.S. Federal Reserve to raise interest rates.

Since the beginning of the year, the fed has been hinting that it take cues about the state of the economy from the labor market data. If the labor market shows strong job gains, the fed will surmise that the economy is recovering and fed officials will raise interest rates. However, weakness in the employment data will suggest that the economic growth is still tepid and the fed will hesitate to raise interest rates.

In May, U.S employers added 38,000 jobs instead of the 162,000 jobs that economists had expected. The weak jobs number caused the fed to postpone talks about a rate hike and gold gained as much as 7% after the news broke. However, the June jobs number restored some normalcy into the labor market when it was reported that U.S. employers added 287,000 jobs in June. The strong job gains in June suggested that the incredulously weak jobs gain in May was an anomaly.

Now, the July employment data is out and the labor market has recorded another impressive data. The strong jobs number has reignited the hope of a possible rate hike by the U.S. Federal Reserve and gold trading has been on a downtrend since last Friday because investors started to sell their holdings in droves.

When the news of the strong July jobs report broke, gold for immediate delivery fell 0.3% from its previous close to touch a low $1,331.56 an ounce to mark the lowest price since July 29. Gold eventually ended Friday's session with a 1.9% decline to mark the biggest single session drop since May 9.

U.K. rate stimulus might provide firm support for gold

Interestingly, analysts have started to imply that the strong employment numbers will weaken the prospects of the yellow metal going forward. Peter Hug, global trading director at Kitco Metals noted that “The metals markets are heavily influenced by news bites and psychology. The big jobs number scared the bulls and the requisite reaction was to sell.”

Despite the fact that gold has lost its footing because of the strong employment data, another analyst has observed that "it is still a little too early to conclude that the bullish rally in the bullion has ended – the rally is not likely to end until the fed makes a decisive move to raise interest rates."

One of the factors that might provide a firm support for gold prices to cushion the effects of strong U.S. employment data is the £170B U.K. stimulus package. Last week, Bank of England Governor, Mark Carney revealed a four-pronged stimulus package the designed the snatch the economy of the United Kingdom out of the jaws of a blown out recession. The Bank of England announced its first reduction in interest rates in seven years to an historic low of 0.25%.

The stimulus package that the Bank of England introduced sent gold soaring to touch a one-month high of $1,371.40. Jeffrey Nichols, senior economic adviser at Rosland Capital LLC observed that “The BOE decision was important in so far as it triggered buying of gold, particularly by institutional investors and large speculators.”

By Nicholas Kitonyi

Copyright © 2016 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.