A Global Derivatives Expert Shines the Light on Systematic Risk

Stock-Markets / Financial Crisis 2016 Aug 05, 2016 - 04:29 PM GMTBy: David_Galland

Dear Parade-Goer,

Dear Parade-Goer,

As promised in last week’s edition of The Passing Parade, below you’ll find my notes from a wide-ranging and very interesting conversation I had with a friend of mine who recently retired from a position as a very senior risk manager for one of the world’s largest banks.

Unlike most people in his elevated position, my friend—we’ll call him John—is about as down to earth as can be. He lives simply, drives an old truck, and exudes none of the arrogance found in many of his peers.

In fact, if you were to meet him you’d never guess that, until recently, he operated at the very pinnacle of the world of high finance, overseeing tens of billions of dollars of stock, bond, and option transactions on a daily basis.

Given the positions he has held, I strongly suspect he is one of the few people in the world who understands the quadrillion-dollar spider web of derivatives contracts stretching around the globe.

While John and I have been friends for many years now, we typically only talk shop in passing.

“How about those interest rates?”

“Yep, sure are low.”

Now that John is retired, however, I figured the time had come to pick his brain about what’s really going on under the hood in the derivatives markets, especially pertaining to the world’s largest banks.

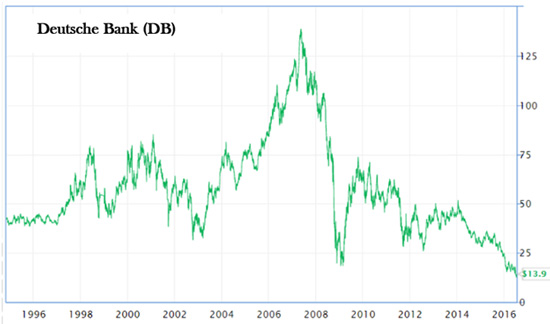

In that regard, as we sat down over breakfast at a local coffee shop, I was particularly interested in Deutsche Bank, which has exposure to upward of $46 trillion in derivatives. With a market cap of $19 billion, it is Germany’s largest bank. Yet, since peaking in May of 2007, its share price has cratered by roughly 90%.

Could Deutsche Bank be the next Lehman Brothers in the making? Which is to say, the next pillar underpinning the world’s shaky financial system to fail?

With that bit of context, and the music tuned up to a soulful rendition of Ain’t No Sunshine by Joe Cocker, chosen, perhaps, because I have been away from my wife for the better part of two weeks while in Argentina, I turn to our conversation.

A Global Derivatives Expert Shines the Light on Systematic Risk

“A bank, especially an investment bank, is a fiendishly complicated institution. It is essentially a huge seething pot of current and future cash flows, the nature and risk of which change as the markets and the economy change.”

In order to better understand the tangled mass of derivatives overhanging the global banking system, we need to begin by defining some basic terms.

- Market value: The amount of money actually at risk. Let’s say you bought a call option contract on 100 ounces of gold. The actual price of that contract in the marketplace (about $7,000 today) is the market value of the contract. As you will soon learn, a derivative is nothing more than a contract.

- Reference: Your gold call option contract on the CME is said to reference 100 ounces of gold. A derivatives contract can reference any manner of assets, from stocks and bonds, to commodities and even other contracts.

- Notional: In the case of your gold option, by multiplying the 100 ounces of gold by the gold’s spot price, say $1,360, we arrive at the notional value of $136,000. That only tells you something about the dollar amount of gold you control with your options contract. It tells you very little about the market value of the contract—i.e., the price at which you could unload your contract in the market.

Keeping those terms in mind, let’s define exactly what derivatives are. As will become clear in a moment, the topic is complex, and so, out of necessity, I will have to oversimplify.

A Derivative Is Simply a Contract

At the core of every derivative is a relatively straightforward contract between two entities. In the case of the gold call option above, that is a contract between you and the exchange.

Similarly, let’s say your bank, Bank A, has a portfolio consisting of $1 billion worth of mortgage loans, and you are a bit concerned about the risks inherent in that portfolio.

So, you wander down the street to Bank B and agree on a contract whereby you will pay Bank B a premium to assume of some of your risk in the unlikely case the loans in your bank’s portfolio suffer, say, a 20% loss.

You’re happy because you’ve reduced your risk by buying protection against an extraordinary loss. On the other side of the contract, Bank B is happy because it’s earning a nice stream of revenue from the premiums Bank A is contractually obligated to pay.

So far, so good.

Then It Starts to Get Complicated

As our story continues, the risk manager at Bank B comes to the conclusion that the bank has too much exposure to mortgage loans. So he heads down the street to Bank C and offers to sell them some of that risk, again for a premium.

Documents are drawn up for Bank C to help cover $100 million of the notional risk referenced by the derivatives contract between Bank A and Bank B. In exchange for agreeing to help cover that risk, Bank C will, again, earn a premium.

And just like that, the original straightforward agreement between two banks has become a complex, intertwined series of contracts—derivatives contracts—involving three banks, each of which now has exposure to hundreds of millions of dollars in counterparty risk.

To give you a sense of just how complex things have gotten at this point, I posed the above scenario to my banker friend and asked him to untangle it. Here is his explanation.

You want Bank A to get protection on the first 20%. In that case, the notional will be much higher than the $200 million it is trying to protect against risk. Let me explain.

What you describe is a put spread. Bank B is liable for any loss from par (100%) to 80%. That is, Bank B is short a 100% put and long an 80% put on a $1 billion portfolio. After that, it is still Bank A’s risk.

If so, the gross notional amount for Bank A is $3 billion, and for Bank B the total is $2 billion. The new trade is $1 billion of 100% puts and $1 billion of 80% puts for each bank. It doesn’t matter that the total amount Bank B could lose is only $200 million. That is the magic of gross notional.

If Bank C took half of Bank B’s risk, then Bank B would add an extra $1 billion notional to their total (500 x 500), as would Bank C. This is in spite of each only having a final exposure to a $100 million loss. Confused yet?

Net total loss exposure at the end is:

Bank A: $800 million

Bank B: $100 million

Bank C: $100 million

All of which add up to $1 billion, which is correct.

Gross notional exposure is:

Bank A: $3 billion ($ billion original asset value + $1 billion long 100% put + $1 billion short 80% put).

Bank B: $3 billion ($1 billion short 100% put + $1 billion long 80% put + $500 million long 100% put + $500 million short 80% put)

Bank C: $1 billion ($500 million short 100% put + $500 million long 80% put)

Total: $7 billion gross notional.

As I hope you can see, the gross notional amounts do not reflect real market risk.

Seeing the complexities involved with just two fairly straightforward contracts—between Bank A and Bank B, and then between Bank B and Bank C—it becomes clear why the vast majority of bankers have a hard time getting their heads around their total derivatives exposure.

Now multiply the number of intertwined multi-billion-dollar contracts by thousands. That’s how you arrive at the situation today, a Gordian knot of intertwined derivatives with a notional value of over a quadrillion dollars.

Enter the Regulators

While many dear readers may harbor a legitimate disdain for the meddlesome minions of the all-powerful nation-states, I have to give credit where credit is due. Post-2008, the banking regulators actually got the message on the systematic risks emanating from free-wheeling investment bankers.

They are now keenly aware of the risks inherent in the tangled web of derivatives contracts on the balance sheets of the world’s largest financial institutions, pension funds, etc.

Among other steps taken since the near-extinction event of 2008, regulators have been pushing the big banks to “net down” their derivatives contracts.

This simply means pushing investment bankers to review their derivatives contracts with the goal of finding those that are redundant or non-productive. When they do, the two parties are urged to essentially tear up the contracts and move on. No harm, no foul.

According to my friend, there has been quite a lot of this going on.

Yet, rather than reducing the overhang of derivatives contracts, all the push for net downs has accomplished is to slightly slow their proliferation. Since the 2008 housing crisis, the pile of derivatives has grown ever higher, and by a lot. Just at a somewhat slower pace.

Exchange-Traded Derivatives

Another initiative, legislated in the Dodd-Frank bill and being pushed hard by the regulators, is for the banks to standardize their derivatives contracts so they can be traded on exchanges and therefore priced in the marketplace, as opposed to over-the-counter or bilateral deals done behind closed doors.

To encourage the banks to make the shift, regulators reduce the capital requirements the banks have to keep on their books for exchange-traded derivatives.

As will become clear momentarily, the amount of capital the regulators require a bank to post to counterbalance its risk is a critical factor in any discussion about derivatives.

Regardless, thanks to the regulatory push, a large and increasing number of derivatives contracts are now exchange traded, which is to say, on a clearing platform.

While such visibility is good, there is a gray lining because it effectively shifts the risk from the banks onto the exchanges. Should a counterparty to a derivatives contract fail, the clearing members of the exchange would be in line to take on some or all of the liability.

Naturally, the exchanges maintain emergency funds in case of a default. However, once those funds are depleted, it is possible for an exchange to default. The ever greater concentration of derivatives trades on the exchanges has, as a result, given rise to yet another potential systemic point of failure.

This gives the regulators another huge incentive to head off the failure of a large investment bank, à la Lehman Brothers, because such a failure could trigger an unraveling of the mountain of derivatives and take the world’s exchanges down as well.

A moment ago, I mentioned how critical the question of bank capital is. Let’s turn to that now.

Tiers of Capital

In order to better analyze a bank’s risk of failing, regulators divide the bank’s assets into three “tiers” of riskiness.

Tier One: This tier of assets includes cash and exchange-traded securities, including derivatives contracts, where the price is transparent and thus can be immediately priced in the market. As far as the regulators are concerned, the more Tier One capital a bank has, the better.

Tier Two: Based on recent transactions and other understandable inputs, it’s possible to infer a value for Tier Two assets to a reasonable degree. They may not be the sort of assets you can sell in an instant, but as they possess an understandable value, they should be able to be liquidated in the normal course of business.

Tier Three: This is where the problems are. Tier Three assets are not traded on exchanges and have no discernible market price. As a consequence, the bankers and regulators can only guess at a value based on entering some assumptions into a model and hoping they are generally correct. But in truth, they really have no idea.

It is in the category of Tier Three assets that we find the very illiquid derivatives of the sort typically referred to as “crap.” And there are hundreds of billions of dollars of this crap on the books of the banks and otherwise stuffed into the dark corners of the global financial system.

The Constant Quest for Capital

After having divided a bank’s assets into the three tiers just mentioned, regulators assign a risk weighting to the assets and determine, given the resulting risk profile, the amount of capital a bank has to maintain.

The higher the risk level—which is to say, the larger the amount of Tier Two and especially Tier Three assets as a percentage of the bank’s total—the higher the level of capital the regulators will demand.

So let’s talk about Deutsche Bank. In 2008, it had a very low level of capital but has since done three separate capital raises in order to increase its Tier One capital ratio to 10.8% equity against $46 trillion in liabilities.

Which brings us back to the matter of those illiquid assets. Deutsche Bank’s price-to-book-value ratio is just 25%, reflecting investors’ concerns about the bank’s ability to realize the marked value of the Tier Three assets on its balance sheet.

Should the bank realize even relatively small losses on its Tier Three assets, it could quickly eat through its 10.8% capital cushion.

Therefore, in order to right its capital imbalance, perhaps by writing off some portion of its Tier Three capital, Deutsche Bank will need to increase its capital reserves.

So, How Does a Bank Raise Capital?

How can a clearly distressed bank such as Deutsche Bank raise the additional capital?

- For starters, it can issue more shares. However, investors have to be willing to buy those shares, and existing shareholders have to be willing to accept the dilution this creates.

- It can switch to paying in-kind dividends, meaning instead of paying out cash, it issues shareholders more shares.

- Or it can simply stop paying dividends, as Deutsche Bank has already done. So, no joy there.

- It can also reduce the size of its balance sheet, which it and all the other banks have been busy doing. But the larger the amount of illiquid assets on a bank’s balance sheet, the more difficult it is to get rid of them. This is the position Deutsche Bank finds itself in.

- Of course, it can look to raise cash by cutting expenses and diverting revenue to its capital reserves, versus using that money to expand its business.

This is clearly one of the few avenues left to Deutsche Bank, which explains why the bank just announced another big layoff of 9,000 employees and the closing of 200 branches.

But that sort of cost savings can only go so far as it shuts down lines of business and therefore much-needed revenue streams.

And when all else fails, the bank can go to the German government and beg them to write a big, fat check out of the taxpayers’ account.

What it cannot do is issue more debt, because that debt is not an asset but a liability, the cause of the bank’s problem in the first place.

So, in the case of Deutsche Bank it comes back to issuing more shares or getting a bailout. Or, more likely, both.

However, as few investors will want to buy shares when they are almost sure to be diluted by the bank issuing ever more shares, Deutsche Bank is pretty much left hoping for a bailout.

For the record, since 2008, Deutsche Bank has done three large capital raises, one for €10.2 billion in 2010, one for €5 billion in 2013, and another for €8 billion in 2014.

Clearly signaling the latest raise was inadequate, Deutsche Bank’s CFO recently went on record stating in no uncertain terms that the EU must once again step up to the plate and provide a €150 billion bailout for the European Banks. Including, of course, Deutsche Bank.

If it weren’t for the German government’s implicit guarantee that they won’t let Deutsche Bank fail, the bank probably would already have started boarding up the doors.

Why Not Just Unwind the Derivatives Contracts?

Simply, it can’t. That’s because of the illiquid nature of the bank’s Tier Three capital. And don’t forget, it’s illiquid for a reason—no one can really get a handle on what its actual value is.

To illustrate that point, imagine a contorted $1 billion derivatives contract with a 30-year term whose value is referenced to a bunch of other contorted, overlapping, long-term derivatives contracts?

Sure, you can punch numbers into a model and declare the contract is worth, say, $10 million. But who’s going to believe you? Or, more to the point, who’s going to write a check to take the contract off your hands?

Increasingly, the answer is, no one.

What Happens If the German Government Doesn’t Bail Deutsche Bank Out?

We are now getting to a key takeaway on the topic of derivatives.

And that key point is this: As long as the major parties to a derivatives contract play their respective roles, it’s unlikely the holder of the instruments, no matter how leveraged, will actually fail.

That’s because of the difference between the notional value of the derivatives and the market value. At the bottom of the massive pile, there are assets with a discernable market value. The notional value of the rest of the pile is largely smoke and mirrors.

Again, as long as everyone can fulfill their side of the derivatives contracts, the system can continue to chug along. However, when a key player does fail—as happened with Lehman Brothers—everything begins to go south in a hurry.

That’s because when a counterparty to a derivatives contract is no longer able to meet its obligations, the entire thread of contracts referenced to the market value of the underlying asset begins to unravel.

Which is why my friend John strongly believes that the one clear lesson the regulators and governments gleaned from the 2008 housing crash is that they can never, ever again allow a large financial institution to fail.

That is a critical point every investor needs to understand. It’s so important, in fact, I’m going to restate it even more forcibly.

In the next wave of trouble for the large financial institutions—and there will be another wave of trouble—there is zero chance any of the important banks will be allowed to fail, no matter how dismal their balance sheets are.

No matter what it takes, and nationalization is certainly an option, failure will never be allowed.

So, yes, Deutsche Bank is in trouble and if left to its own devices, it would likely go belly up.

But as it is a certainty that the German government will not let it fail, there will be no trigger to set off a cascading and catastrophic failure in the derivatives market.

Are All the Big Banks Concerned About the Derivatives Mess?

Absolutely. Which is why Barclays and UBS and other large banks have shoved their non-core and legacy businesses—the ones revolving around complex derivatives—into separate businesses that they are rushing to wind down.

This is not an easy option for Deutsche Bank. Unlike the other banks, the vast majority of its revenues come from investment banking operations. It doesn’t have a big commercial banking presence or a leading wealth management group to fall back on to help it remain profitable.

Even worse, Deutsche Bank’s investment banking operation has long specialized in fixed income. That is where the worst of the worst derivatives problems are to be found.

So Deutsche Bank is stuck. It has no option but to raise capital. Which, per above, means get a bailout.

All things being equal, Deutsche Bank would be rushing towards bankruptcy. However, that would almost certainly trigger a waterfall collapse in the global financial system, much in the same way that Lehman Brothers’ failure almost did.

That will not be allowed.

How Will Governments Make Sure None of the Large Institutions Fail?

My friend didn’t have an answer, other than “They’ll figure something out.”

But history suggests a number of options, starting with another round of quantitative easing with hundreds of billions directed to the banking sector.

Or, it could involve reestablishing the sort of intra-governmental lines of credit deployed in the 2008 crisis. For example, the US could create a special line of credit, backed by nothing, for Germany to tap, and Germany could then use that supposedly secure line of credit to prop up Deutsche Bank.

It could involve creating a new form of government-backed bond that Deutsche Bank would be able to “buy” using its Tier Three trash as cash.

How they manage to keep these banks afloat almost doesn’t matter. The key point here is that Western governments are never going to allow a bank the size of Deutsche Bank to fail. Period.

Tradeable opportunity? Maybe. Those of you who are speculative-minded might wait to take a position until Deutsche Bank is teetering on the edge of the abyss, but before the government announces its bailout, then back up the proverbial truck. That might work out.

Elsewhere in Europe

As our breakfast began to wind down, our conversation turned to the situation with the Italian banks. At which point my friend, who is typically reserved in his demeanor, surprised me by leaning forward and making a chopping motion with his hand to emphasize his words.

“The Italian banks are toast! FUBAR! Done!”

To underscore the point, he related the story of two troubled Italian banks—Veneto Banca and Banca Popolare di Vicenza. Desperate for capital, one, then the other, filed for IPOs in the hopes that investors would shell out cash for shares.

In both cases, the IPOs were so poorly received that a fund set up by the government to back-stop the Italian banking sector ended up buying all the shares in both of the failed IPOs, over €2.5 billion worth. In doing so, the back-stop fund depleted the bulk of its assets.

In other words, the Italian government essentially nationalized the two troubled banks and in so doing shifted their liabilities onto the backs of taxpayers. And these were relatively small banks. The cost of bailing out the larger Italian banks now in trouble is estimated at over €150 billion.

Portugal’s banks are in the same situation.

And, my friend informed me, so are the French banks, even though no one is paying attention to them at this point.

What Happens If Europe’s Banks Begin to Fail?

My friend felt that the EU could handle the €150 billion hit from Italy’s banks. But just barely. While there is no good mechanism to recapitalize them, that hasn’t stopped the ECB before, so they’ll conjure some up way to do so.

The French banks, on the other hand, will require a more energetic response. It will certainly include some or all of the options mentioned above. But first and foremost, we can expect to see a big new round of quantitative easing.

That’s pretty much the only way to come up with the hundreds of billions necessary to keep the banks afloat and the mountain of derivatives from imploding.

And make no mistake, since 2008 these banks have raised a lot of money, probably on the order of half a trillion dollars.

This is one big rat hole.

Would My Friend Step Away from the Stock Market Based on What He Knows?

No. For one, he (and I) both see clear signs of an uptick in the global economy.

And we share the belief that under no circumstance will governments allow the large banks to fail.

Since this edition is already running long, I won’t digress into a commentary on the corrupt nature of the financial system, or the fiat funny money underpinning it.

Rather, I am just stating the fact that as long as the fiat system remains intact—and it is at no immediate risk of being replaced—governments’ implicit guarantee to stand behind the big banks provides a back-stop to global markets.

Finally, my friend also agreed with me that trouble in Europe will cause a pickup in investment flows into US equities and even Treasury bonds, despite historic low yields. Notwithstanding their own financial challenges, US markets are still considered the safest in the world.

Given there is $20 trillion now parked in European stocks and bonds, with much of that money generating negative interest rates, the investment inflows will do much to support the US markets.

(Though biased, because I sincerely believe in the value it offers to investors looking for bargains in US stocks, I want to mention our new premium service, Compelling Investments Quantified.

It is sharply focused on finding undervalued stocks and uses a proprietary quantitative analytical “black box” to ensure each pick has pretty much zero market risk. For more on our limited-time, low-cost Charter Subscribers offer, which comes with an unprecedented six-month money-back guarantee, click here.)

The Charter Subscription period ends August 31 and won’t be repeated, so don’t miss it. Click here to learn more now.

The Big Short?

Having recently seen The Big Short, I asked my friend if there is an equivalent of the mortgage-backed-securities bubble at this point in time.

That bubble brought down the housing market and almost the entire financial system in 2007/2008. Anything like it in the works today?

He thought about it for a moment, but not very long, before answering in the negative. For starters, the regulators do have the banks on a very short leash. Not the case back then.

And they’ve learned their lesson that too-big-to-fail literally means too big to fail.

We also talked about the US Treasury market and the fact that yields are at the lowest level in history. He agreed they could go lower still as the money in Europe starts to flow to the United States.

The old quip, Don’t Fight the Fed, was mentioned.

Which seems to be a good place to end this missive.

Never lose sight of the fact that we live in a world with a politicized monetary system that allows “money” to be created out of thin air and where government entities are both willing and able to interfere in markets at will.

Therefore, to adopt a firm opinion based on what “should” happen based on the properly working mechanics of a free-market system is to operate under a false paradigm.

Simply, otherwise correct and logical conclusions—for instance that the banks should fail and the mountain of derivatives implode—are founded on a faulty premise.

While remaining vigilant is called for, don’t let fear of a crash keep you from making an investment profit in equities. But we have to be very selective in the equities we own and, as insurance against the unthinkable, include gold in our portfolios.

Here Come the Clowns

As today’s missive, I will only share one item for this week’s entry into the follies and foibles of the human ant.

For reasons that will immediately become understandable, given my fondness for Argentina as a cozy bolt-hole from the madness of the large Western nation-states, the headline grabbed my attention.

And then concern turned to a good laugh. Truly, stupidity knows no bounds. Here’s the story from BubbleAr.

ISIS APPARENTLY DECLARED HOLY WAR AGAINST ARGENTINA Because we didn't have enough on our plate already. Right? We all knew someday having all those naked women on Dancing with the Stars was going to come back to haunt us. And on Friday evening, a menacing-looking Twitter account appeared out of nowhere. And I say "menacing" because it contained Arabic characters and that fact alone is already terrifying to a lot of islamophobic people. The person behind the account, a man named Hassan Abu Jaaf (!!!!), started making threats against Argentina in Arabic and using hashtags like #OpenFireInArgentina, tweeting at President Mauricio Macri and uploading photos of what one could only assume where his potential targets in the city (these included the kosher McDonald's in the Abasto mall and the Casa Rosada). Everyone freaked out. The time had come to pay for our godless awesomeness. AND THEN IT TURNS OUT IT WAS JUST A COUPLE OF STUPID TROLLS TWEETING FROM A HOUSE IN VILLA URQUIZA You know what you should never, ever do as a practical joke? Pretend to be a terrorist and tweet that you're planning to assassinate the President. Especially on a Friday night, when the police and government officials are going to be particularly mad at you for ruining their weekend plans. You would think this is pretty obvious but two 21-year-olds in Villa Urquiza decided to try it anyway because who doesn't love a practical joke involving a terrorist attack? Society. That's who doesn't. And if getting caught in just a few hours wasn't embarrassing enough, the mother of one of them decided to talk to the press and, visibly furious, called them "a couple of idiots who had nothing better to do." Spoken like a true angry mom. |

And with that, I will sign off for the week. I apologize for the length of this week’s Parade but hope it helped you to better understand the nature of derivatives.

If you have story ideas, or just general comments, don’t hesitate to send them my way at David@GarretGalland.com.

Enjoy the parade!

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.