3 Signs IBM Is in Big Trouble—and How the Company Masks It

Companies / Tech Stocks Aug 04, 2016 - 07:00 PM GMTBy: John_Mauldin

BY TONY SAGAMI : I got a lot of positive feedback on my recent column, “Anatomy of a Successful Short Sale.” It’s no surprise, though. Spotting failing companies is as useful and lucrative as uncovering hidden gems.

BY TONY SAGAMI : I got a lot of positive feedback on my recent column, “Anatomy of a Successful Short Sale.” It’s no surprise, though. Spotting failing companies is as useful and lucrative as uncovering hidden gems.

Now let’s put theory into practice and take a look at a stock that my subscribers are currently shorting.

That stock is IBM.

IBM recently reported its quarterly results. The see-no-evil analysts on Wall Street jumped for joy at what I think were terrible results.

What was so terrible? Here are the reasons why I expect this stock to fall.

Acquisitions to hide falling revenues

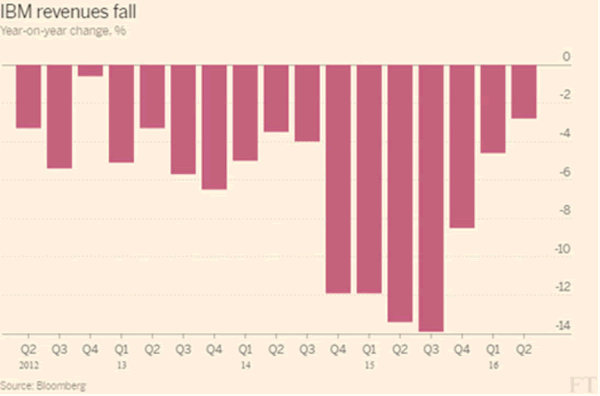

How about this: IBM has reported falling revenues for 17 consecutive quarters.

IBM pulled in sales of $20.2 billion last quarter. But that’s 2.7% less than a year ago and 25% lower than in 2011.

The weakness is widespread:

- Global Business Services had revenues of $4.3 billion, down 2%.

- Technology Services & Cloud Platforms (includes infrastructure services, technical support services, and integration software) had sales of $8.9 billion, down 0.5%.

- Systems (includes systems hardware and operating systems software) had sales of $2 billion, down 23.2%.

- Global Financing (includes financing and used equipment sales) had sales of $424 million, down 11.3%.

- With all that red ink, acquisitions are the only way you can make yourself look good. IBM has bought 11 companies worth $5 billion so far this year.

In fact, it has spent more on acquisitions in the last 12 months than ever before.

The acquisitions have boosted the Q2 revenues of $20.2 billion by $400 million. So, the results would have been even uglier without them—a 5% decline instead of the current 2.7% growth.

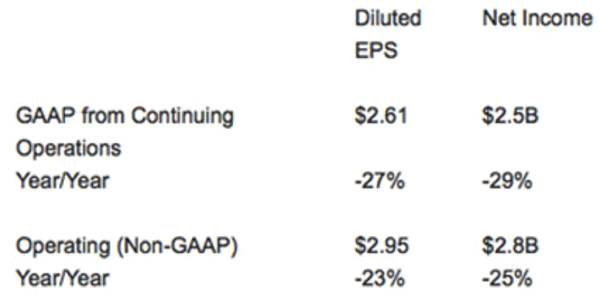

Pro forma calculations and massaged profits

IBM reports its earnings on a pro forma basis instead of a GAAP basis (I wrote about this tactic in detail in this column). This way it can use “accounting magic” to prop up its pro forma profits.

IBM reported better-than-expected “pro forma” profits of $2.95, which was above the average forecast of $2.88. On a GAAP basis, those profits shrink to $2.61 a share.

Still, even those phony pro forma calculations are 25% lower than a year ago.

A cash hoard of borrowed money

IBM is proud of its cash hoard, which increased from $7.6 billion in Q2 of 2015 to $10.6 billion today. That cash, however, didn’t come from operating profits. It’s borrowed.

IBM had $33 billion of debt a year ago. The company took on $11.5 billion more and now owes a staggering $44.5 billion.

That $10.6 billion cash isn’t going to last long. IBM is burning through it. The company had $3.4 billion of operating cash flow in Q2 but spent $5.9 billion on:

- $1.0 billion on capital expenditures

- $2.8 billion on acquisitions

- $1.3 billion on dividends

- $800 million on share repurchases

That’s $2.5 million of negative operating cash flow. Only IBM’s debt makes it possible. It’s a big warning sign of a company in trouble.

By the way, competitor Infosys warned that Brexit could hurt its business. IBM, however, adopted the see-no-evil defense: “Brexit didn’t help, but from everything we’ve seen we haven’t changed our view,” said CFO Martin Schroeter.

I think that IBM’s day of reckoning is near…

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.