SPX Challenges the Trendline

Stock-Markets / Stock Markets 2016 Aug 04, 2016 - 02:44 PM GMT Good Morning!

Good Morning!

SPX spent the overnight session challenging the upper trendline of its Orthodox Broadening Top at 2165.00. It currently appears to have fallen back beneath it.

ZeroHedge wrote at 6:55 am., “In a mostly quiet session, European and Asian stocks rose, pushed higher by financial stocks and the USDJPY which initially dipped on some hawkish comments by BOJ deputy governor Iwata, only to rebound later in the session, lifting the Nikkei 1.1%, while the Stoxx 600 rose 0.4% led higher by the banking sector. S&P futures are unchanged after yesterday's last hour ramp. The key event is the BOE decision due in half an hour, which saw the pound dip initially only for cable to regain all losses in recent trading, despite a 100% price in expectation that Mark Carny will deliver the first interest rate cut in seven years.”

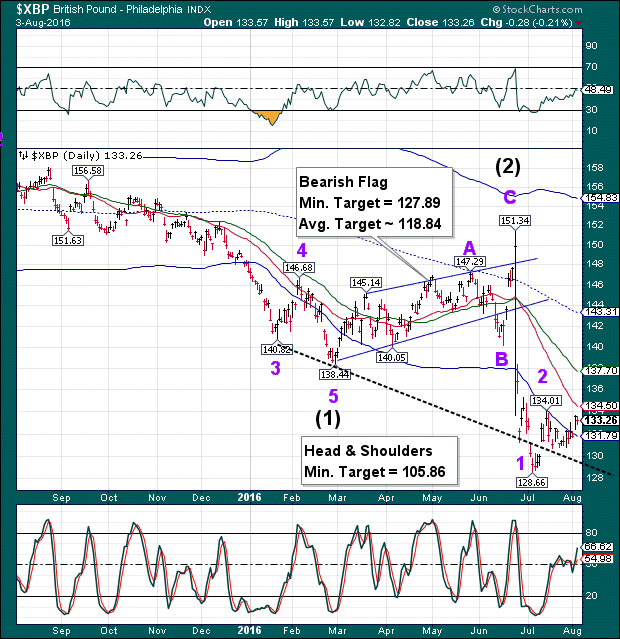

10 minutes later, it wrote, “s expected, the Bank of England unanimously cut rates for the first time since the financial crisis by 25 bps to a record low 0.25%. However in a somewhat surprising move, the BOE also expand its QE by £60 billion to £435 billion in a 6-3 vote, of which up to £10 billion will be in the form of corporate bond purchases, as we previewed last night. Overall a very dovish decision, with Mark Carney providing more monetary stimulus than many had expected, sending sterling plunging and the FTSE100 surging.”

This sent the Pound Sterling back down to challenge its Cycle Bottom at 131.79. A little further below is a Head & Shoulders neckline that may send the Pound down even deeper.

ZeroHedge again observes, “All the speculation that central banks are putting the brakes on unconventional monetary policy and shifting to fiscal stimulus demands, were tossed aside this morning when the BOE launched what was been dubbed a "kitchen sink" response, one in which it not only cut rates for the first time since the financial crisis, by 25 bps to a record low 0.25%, but also boosted QE while announcing it would resume corporate bond purchases.“

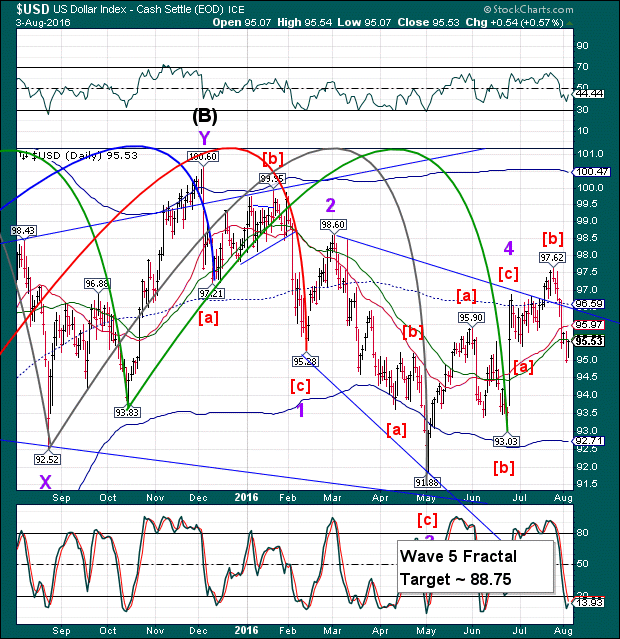

USD rallied toward its Intermediate-term resistance at 95.97 on the announcement. The retracement may now be complete, or nearly so.

This has had a deleterious effect on the USD/JPY. Should it decline beneath 100, we may see liquidity dry p in the markets.

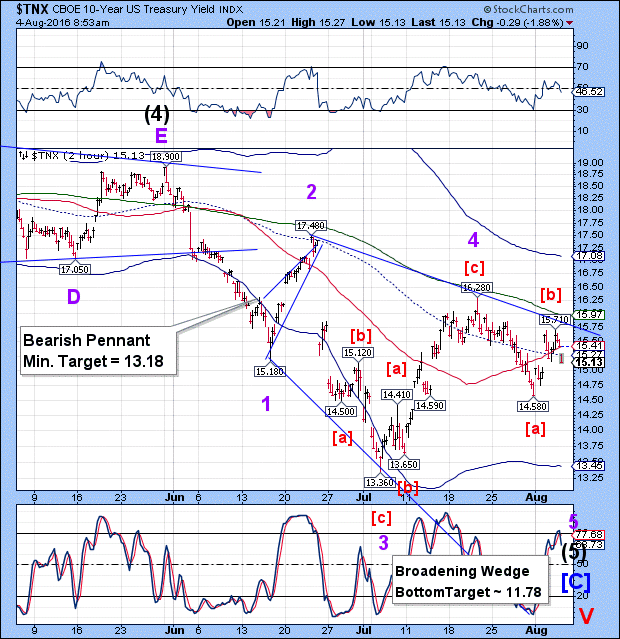

TNX has now resumed its descent beneath mid-Cycle support at 15.32. It next potential measured target (12.88) appears to be beneath the Cycle Bottom support at 13.45.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.