Gold Bullion – The Ultimate Monetary Solution

Commodities / Gold and Silver 2016 Aug 03, 2016 - 01:47 PM GMTBy: GoldCore

Editors Note: We are happy to publish another interesting and thought provoking piece by one of our contributors David Bryan:

Editors Note: We are happy to publish another interesting and thought provoking piece by one of our contributors David Bryan:

Astounding levels of debt in the western world in particular is the greatest financial, economic and monetary challenge facing the world today. To get debt under control is imperative. It could involve a short period when individuals legally opt to become debt free.

A hard currency regime is implemented and private central banking monetary agencies such as the Federal Reserve become totally defunct. Afterwards there is a lengthy period of shock and awe in which every asset deflates against gold until it finds fair market value with a price that is not derived from leveraged finance.

This option to become debt free should not be available to public or private corporations. Corporations continue to have their debt burden and as incorporated assets deflate to fair market value the capital imbalance will motivate a return of wealth resources from the few to the great body of people on the planet.

These steps provide the ultimate monetary solution to the state sponsored ideologies of monetarism, corporatism, socialism, globalism, capitalism and communism, all of which have failed.

Money defines our enterprise, independence, prosperity and economic freedom.

In terms of physics, gold is refined matter with sufficient value to provide tangible monetary capital and is fully accountable money as the entire quantity of gold mined still exists.

Central bank issued money is a monetary ideology and instead of asset wealth to provide monetary capital it relies on faith in a central banks synthetic fiat for monetary transactions.

In a debt creating paradox, the issue of unlimited synthetic money has inflated every asset class beyond affordability and to make financial ends meet, it has forced the great body of people into a life of permanent debt. In a further tragedy against the great body of people on the planet, through the issue of unlimited money the central banks have incorporated most of the world’s wealth creating resources for the exclusive benefit of a privileged few.

The out of control central banks wage vicious monetary wars without having any compassion for the suffering caused to the families in countries they attack. They ruthlessly employ negative interest rates against domestic savers, use money printing, currency devaluations and capital controls that weaken or destroy productive economies.

They inflate bubbles in stock markets, property values, bonds and commodities by flooding the world with synthetic money. This inevitably leads to the deflationary busts in stock markets, property values, bonds and commodities that follow. Using a rinse and repeat operation in what is referred to as the great short the bankers cash in as they engineer the synthetic financial booms in stock markets, property values, bonds and commodities and also cash in as the financial bubbles in the same stock markets, property values, bonds and commodities are burst.

By their own admission it explains how enormous wealth is continually transferred to the privileged few. Oxfam’s research into wealth distribution concludes that 68 people now have greater wealth than half the world’s population (Google). The unsuspecting great body of people on the planet has no idea about the central banking charade that intentionally steals his or her wealth and deprives them of the means to enjoy a reasonable economic opportunity.

The central bank synthetic currency system has one indisputable fact shared in common with every scheme designed to swindle an unsuspecting person and that is to falsely pretend that something without tangible value has monetary worth.

The Rothschild Brothers letter to their New York Associates in 1863 laying the foundation for the Federal Reserve Act: “The few that understand the system will be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

It is not widely known by the great body of people on the planet that the Bank for International Settlements based in Switzerland controls and is controlled by virtually every major central bank in the world. Central banks may have the outward appearance of being national and completely independent. However the fact is that this one unaccountable Swiss banking organization with a history of committing massive fraud is the ultimate counter party to every major central bank currency. (Wikipedia – Bank for International Settlements)

The monetary science that provides for the economic good and benefit of one and all is based on the physics of energy and matter, the dynamic of human enterprise and gold.

Gold held in treasury is refined matter that provides the nations monetary capital and it is wealth that belongs to each of its citizens. When the gold in treasury is responsibly used to back the nation’s currency its citizens rely on using their own wealth resource to fund their enterprise.

With a modest level of wealth generating enterprise the nation’s treasury will normally remain intact, with the wealth of a nation reduced only if it is compromised by the debt creating policies of central banks, or depleted to pay for unproductive wars or spent on lavish political extravaganza. This is monetary science par excellence and has happened many times throughout history, with stable asset prices and a prosperous wealth regenerating economies lasting for hundreds of years until banks, wars or imperial arrogance depleted the treasury.

Gold is the ultimate acceptable unit of value to exchange for goods and service and ensures a system of economic fairness. Gold backed money will hold asset prices stable so that the unproductive in society no longer can speculate using financial derivatives to live off the backs of others. Gold is the only monetary wealth that is physically indestructible and for more than five thousand years it has provided a physical store of value that has protected wealth for generations to come.

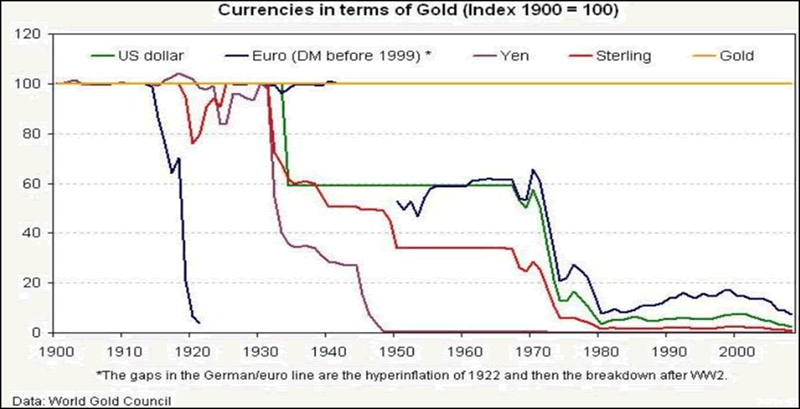

Gold has a natural inbuilt compound interest that over time reflects economic progress and safely protects from the devaluation or the collapse of central banker’s synthetic fiat currencies. Today gold is well in excess of $1,033.50 an ounce and so has increased by more than 5,000% from $20.67 an ounce in 1913 when the private Federal Reserve Bank was given the mandate to issue the nation’s currency.

During this same one hundred year period the Federal Reserve’s dollar has lost over 97% of its original purchasing power and now it is worth less than 3 cents.

Destruction of paper money

Protection from a corrupt central banking finance scheme that has transferred to a few people over 97% of the nation’s wealth that was used to back the original Federal Reserve dollar, is proven wealth preservation, well beyond par excellence.

Gold does not have any national currency and is accepted wealth everywhere in the world.

It is a fact that for several thousands of years every country in the world used either gold or silver for trade and it guaranteed their nation’s monetary worth, it also provided assurance that their economies were completely independent from monetary subordination to a foreign controlled central banking agency.

Before President Nixon in 1971, replaced what was then a partial gold standard for a completely synthetic monetary system, it is estimated that the enterprising middle class of the United States created in the region of 200,000 net new businesses annually.

Instead of continuing to use money that was partially backed by the nations gold reserve and prospering from the compound dynamic of an additional net 200,000 new middle class businesses created each year. The central bankers ability to financial engineer the issue of their own synthetic currency and

provide unlimited finance for corporatism under an agenda of globalism has meant that the number of wealth regenerating private middle class enterprises in America have become net negative. For the great body of people in the United States and elsewhere in the world it has meant that home ownership, job security and real wages have all declined while the fortunes of an unproductive few have grown exponentially.

It seems to have been entirely forgotten that for several thousands of years the use of monetary gold or silver allowed every country in the world to function without any need to tax a person’s income.

Interest on the United States $19 trillion national debt is currently $216 billion per annum and it amounts to a banker’s tax levied on the income of every working family.

It’s not a coincidence that the Income Tax Act was formally passed into law in the same year that the privately owned Federal Reserve Bank was incorporated and the people of the United States were deceived into losing their monetary independence to a central bank.

With monetary control over the ownership and distribution of wealth, as well as the immoral ability to charge interest on synthetic money, it serves to explain why the central banking cartel uses derivatives to financial engineer the daily gold fix. The daily gold fix is designed to prevent the final monetary solution for an out of control synthetic debt based economy and the full re‐introduction of the people’s monetary gold or silver.

In the last seven years of providing interest free money to a select privileged few, a staggering $57 trillion in newly created central bank synthetic currency has been issued, sufficient to incorporate one quarter of the world’s wealth for the connected few. In terms of the burden this places on the backs of the unsuspecting great body of people on the planet, it translates into $50,000 in real assets and resource wealth that has been put beyond the reach of every family in the world!!

It is an immoral out of control financial system directed without compassion against the great body of people who are forced to financially depend on a central banker’s economic charade. It imposes interest on a synthetic currency levied as private taxation on the most vulnerable in society. It employs counter party finance to remove vast middle class wealth resources from its host nation and in the “big short” uses financial engineering to rig the values of every asset class. It is the permanent loss of individual enterprise to expand a system of crony corporatism and in a cashless society it is the permanent loss of personal freedom to completely traceable finance.

It is beyond foolish to have faith in the objectives of the central banker’s ideology of monetarism that by ‘the brother’s’ stated design is a crooked scheme designed to continually benefit a privileged few insiders at the burden of the great body of unsuspecting people.

When the present one hundred year cycle of synthetic debt issuance has reached its limit, then the trapped central bankers do not have the ability to engineer further debt on the backs of the great body of people or provide money with tangible wealth to reset the system. Without additional debt finance or physical monetary capital the world economy and a great body of people on the planet are destined to die.

In the final monetary solution to get the economy back under control and provide the right ordering of the world – it is scientifically indisputable that only the cyclical laws of physics, which are the dynamic interaction of energy and matter, can provide for the economic good and benefit of one and all. To ensure the stability of asset prices in a well to do society that regenerates its own wealth, the money used for their enterprise must be independently backed by the value of gold held in treasury as monetary capital.

Enterprise is the energy of the individual that creates prosperity and gold is valuable matter to provide monetary capital, this is time proven to be the fundamental physics of economic and monetary science. It is the only dynamic to ensure a nation has continual prosperity, can maintain full meaningful

employment and will create unstoppable progress.

It can be no other way.

The first of three articles in a series that are based on physics, the second Physics of Common Sense and the third Physics and Genetic, Financial & Social Engineering are posted on http://www.thetibetansecret.blogspot.com . David Bryan is author of The Tibetan Secret an inspirational trilogy that examines the astounding findings of Tibetan Sanskrit scholars that are based on physics, the blueprint for the right ordering of the world. Available on Amazon Kindle.

Note: All third party opinions expressed on the GoldCore blog are opinions of their authors, they do not represent the official position of GoldCore.

We were not able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must not rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or price target to any discussed securities or asset.

We do not own any content in the third parties’ articles, news releases, videos or on the links embedded on this blog; any opinions – including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there – are subject to the disclosure provided by those third parties and are not verified, approved or endorsed by the authors and owners of this blog in any way.

Gold Prices (LBMA AM)

03Aug: USD 1,364.40, GBP 1,023.16 & EUR1,218.96 per ounce

29July: USD 1,332.50, GBP 1,012.03 & EUR1,200.18 per ounce

28July: USD 1,341.30, GBP 1,017.64 & EUR1,208.78 per ounce

27July: USD 1,320.8, GBP 1,077.77 & EUR1,200.21 per ounce

26July: USD 1,321.25, GBP 1,006.40 & EUR1,199.56 per ounce

25July: USD 1,315.00, GBP 1,000.32 & EUR1,196.91 per ounce

22July: USD 1,323.20, GBP 1,005.10 & EUR1,199.22 per ounce

Silver Prices (LBMA)

03Aug: USD 20.59, GBP 15.43 & EUR18.39 per ounce

29July: USD 20.4, GBP 15.2 & EUR18.03 per ounce

28July: USD 20.41, GBP 15.51 & EUR18.41 per ounce

27July: USD 19.58, GBP 14.95 & EUR17.81 per ounce

26July: USD 19.68, GBP 15 & EUR17.89 per ounce

25July: USD 19.41, GBP 14.77 & EUR17.66 per ounce

22July: USD 19.7, GBP 15.03 & EUR17.87 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.