Stock Market Breakdown Analysis

Stock-Markets / Stock Markets 2016 Aug 02, 2016 - 04:52 PM GMT A “measured” fractal may form a low at 2140.00-2145.00, then develop a bounce. However, the mid-Cycle support at 2122.54 and the 50-day Moving Average at 2112.88 may attract a lower decline toward that range.

A “measured” fractal may form a low at 2140.00-2145.00, then develop a bounce. However, the mid-Cycle support at 2122.54 and the 50-day Moving Average at 2112.88 may attract a lower decline toward that range.

Either way, SPX is setting up for its first bounce back to retest either sort-term resistance at 2162.08 or the trendline at 2165.00.

Many pros go short at that first pullback.

ZeroHedge reports, “According to our friends at TrimTabs, contrary to speculation that "money remains on the sidelines", far from the "most hated rally ever", the month of July saw a near-record $43.0 billion in new cash added to bond, commodity, and equity exchange-traded funds in July, the biggest monthly inflow since December 2014, when these funds hauled in $50.7 billion.”

The VIX appears to be ready to “have a go” at the 50-day Moving Average at 15.38. It appears that it may complete a second impulsive wave higher. Chances are that it may not break out above that level on the first try, but be aware that a close above the 50-day is a confirmed buy (confirmed sell for NYSE).

We have no further progress to report on the Hi-Lo index.

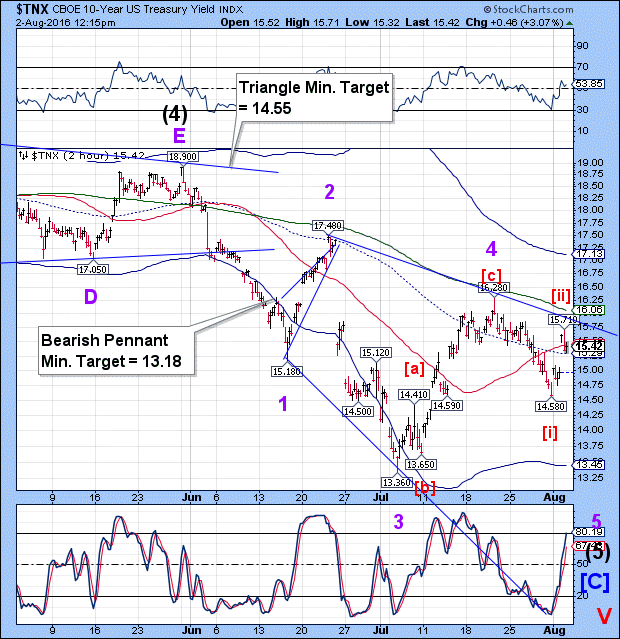

It appears that TNX may not make it above the trendline, although it may have one probe higher to go before a reversal into Wave [iii].

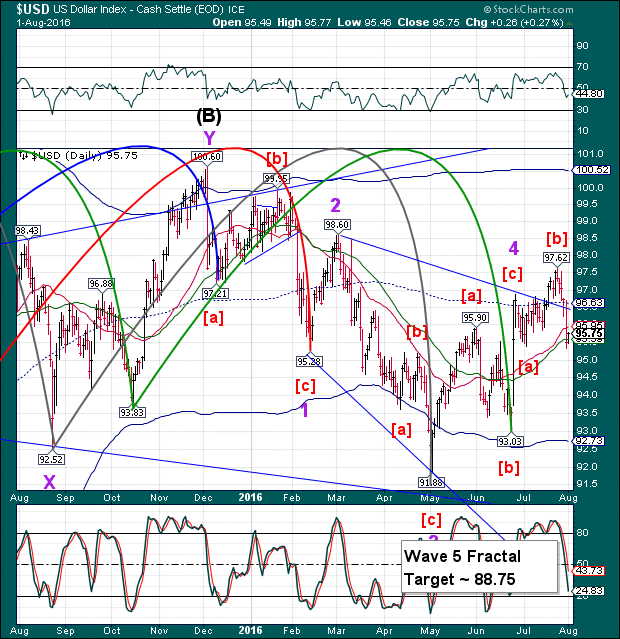

USD declined to 95.05 thus far today. As mentioned earlier, it may decline to near 94.50 before it is ready for a bounce.

ZeroHedge reports, “The BoJ launched its mini-ETF-bazooka but disappointed overall, and last night Abe unveiled a disappointing 26th fiscal stimulus plan since 1990 - practically admitting that Abenomics had failed. The worrying thing is that this double whammy of under-delivering appears to have shaken the world's faith in everything Japanese as bonds, stocks, and the JPY carry trade are unwinding in a hurry. While 10Y JGB yields rise back near 0bps, USDJPY just broke back to a 100 handle, near one-month lows...

Big round trip from last month's hope...”

WTIC continues its decline toward its Head & Shoulders target. It may go as far as its Wave 4 low of 35.24, made in April. The current decline may be over by Friday. A week-long bounce may ensue.

ZeroHedge comments, “ Well that escalated quickly. Having toyed with the $39-handle yesterday, this morning's plunge has erased those stops…

... and WTI is set to test the early April lows on the way back to 2016 lows...”

Should its make a new low in the vicinity of $25.24, it appears that another Head & Shoulders formation may result, with that targeted low near $20.00.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.