Economic Confidence Index Plunges while Stock Market Makes Record Highs

Stock-Markets / Stock Markets 2016 Aug 02, 2016 - 07:31 AM GMTBy: Chris_Vermeulen

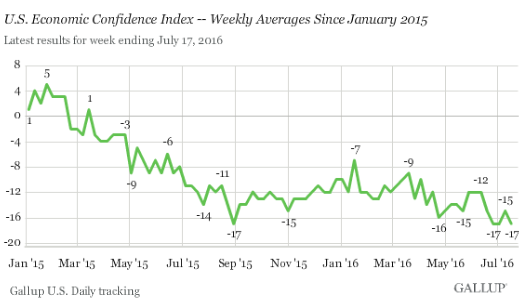

The Gallup Poll has released an Economic Confidence Index which reflects the sentiment of Americans, as it pertains to the economy.

The Gallup Poll has released an Economic Confidence Index which reflects the sentiment of Americans, as it pertains to the economy.

As the stock market makes new record highs and the housing “bubble” market soars, one would expect that the “average” American would be smiling from ear to ear. However, the chart below appears to present nothing but gloom and doom. The Gallup Polls results are dumbfounding the American public as to why this divergence has occurred. I feel we have touched upon a few points as to why this is occurring.

First off, half of all Americans do not even own one stock. Secondly, there are many U.S. companies making large profits overseas. That may be positive for the company but that does not necessarily translate into a better financial position for mainstream Americans.

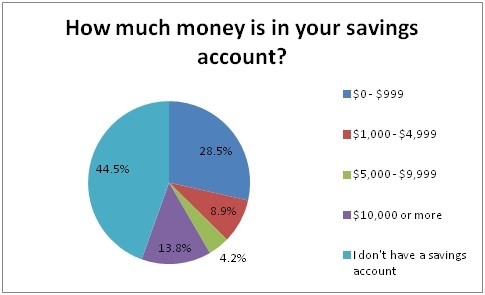

A survey was recently released showing that 62 percent of Americans do not even have $1000.00 in their savings accounts. Most Americans are only one small emergency expense away from being on the streets. What this means is that many will simply rely on credit cards, friends and/or family for their funding should a financial emergency arise. Is this meant to be our economic recovery?

How much do Americans save?

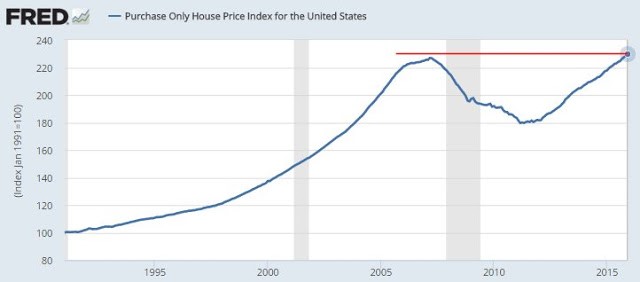

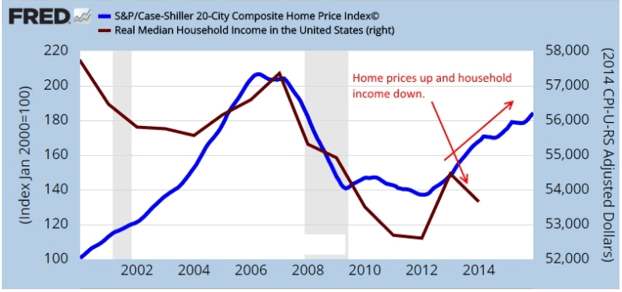

Housing values, which are being “artificially” inflated, only prevent Americans from purchasing their ‘dream homes’, as is reflected in low homeownership rates.

The housing market is once again too expensive for most American families to afford. During the last housing “bubble”, many Americans were able to partake in the mania and enjoy equity gains although they were fleeting.

This time around, most of the gains are going to investors and large institutional buyers that have crowded out mainstream America. This is a first in history to occur, at least on this large of a scale. The homeownership rate is the lowest in a generation as many young Americans are saddled with unsurmountable student loans and consequently forced to return to living at home.

Inflated home prices coupled with decreasing incomes, provide a recipe for disaster! Total wealth, in the U.S., is at a record high level, once again. Consequently, most of the gains are in the hands of a very few.

Americans are angry with the “establishment” and are frustrated with their economic ‘uncertainty’

Americans no longer trust mainstream media. This is being reflected in the political climate: i.e., non-establishment candidates, Brexit, etc. and even new asset classes like digital currencies like bitcoin.

The stock market is fully “decoupled” as to how good Americans are doing, overall.

The SPX is up a stunning 220% since the lows that were reached in 2009 and US economic confidence index shows more people simply do not trust the economic numbers and media.

Concluding Thoughts:

In short, I continue to warn about a down turn in both the economy and stock market. The markets continue to mature and the leading indicators point to a sharp correction in the financial systems I the coming months.

Safe haven investments have rocketed higher like bonds, gold, silver, mining stocks as smart money positioned its self in preparation for a crisis. As I have mentioned many times already, is just going to take one bad event or piece of data to cause the tipping point for the market. The question is when and what will it be?

Just like the 2008 bear market in stocks and financial down turn, this will be no different in terms of what will happen, just like every previous bear market/financial down turn before that. Stock prices will fall, people will lose their jobs, companies go bankrupt, housing defaults increase, personal spending comes to a grinding halt.

When it comes to our investment and trading capital, you can either ride the financial rollercoaster and do nothing, move to cash with some safe haven investments like bonds/precious metals, or bet against the US economy and watch your net worth reach new highs during a time when everyone you know is losing money, jobs and confidence.

Follow my weekly articles, swing trades, and long-term ETF investing positions.

Chris Vermeulen – www.TheGoldAndOilGuy.com

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.