Some Thoughts at the Stock Market Mountain Top

Stock-Markets / Stock Markets 2016 Jul 30, 2016 - 03:30 PM GMT There are several indicators Suggesting this is the terminal move and that it may, in fact, be complete. I thought I’d review those items and put in a few more. Of course, the Triangle is a dead giveaway, but how do we know the pattern is finished?

There are several indicators Suggesting this is the terminal move and that it may, in fact, be complete. I thought I’d review those items and put in a few more. Of course, the Triangle is a dead giveaway, but how do we know the pattern is finished?

If we accept the concept that Wave (5) is an Ending Diagonal, we can see the a-b-c structures in the motive waves. I’ll point out that Wave 3, at 19.34 points, is smaller than Wave 1 at 22.38 points. One rule to remember is that Wave 3 can never be the smallest Wave. Wave 5 at 18.02 points, fills the prescription.

Wave (5) is a mere 15.3% of Wave (1), which can throw one off. However, there is a much larger reason for that truncation. Let’s look at the weekly charts.

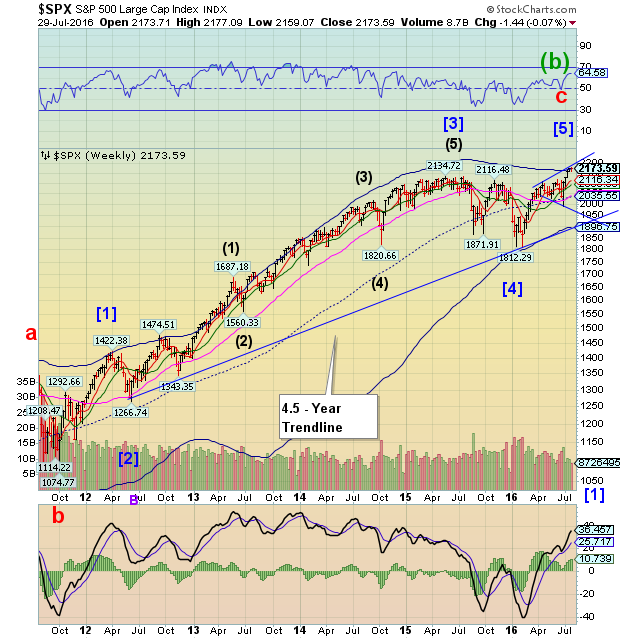

I stretched out the weekly chart to the October 2011 low. A probable reason for the truncation may be that Wave [5] is equal to Wave [1] at 2157.71. That means the SPX may have overshot its target by some 20 points. Is there confirmation elsewhere?

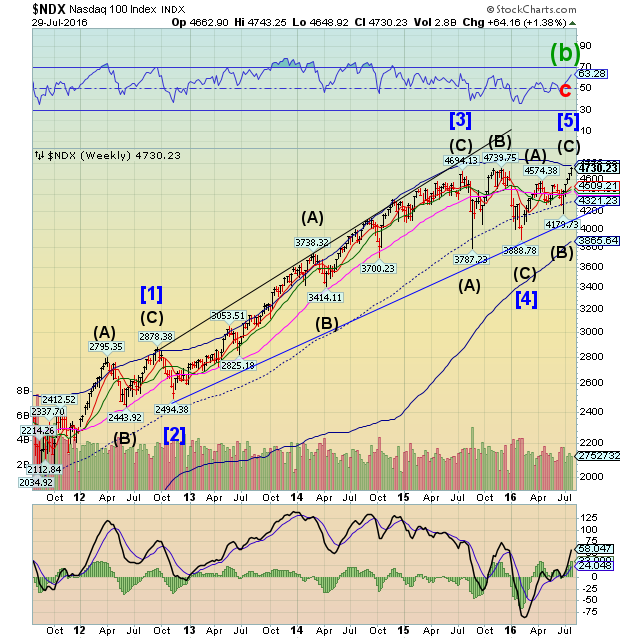

Wave [5] in the NDX is equal to Wave [1] at 4732.24. You can see that it was made today.

Wave [5] in the Industrials equals Wave [1] at 18677.94, so it was a near miss. But it made that high on July 20 and has not rallied since. This tells me that it had ample time to make that target, but the June 20 date has more significance because of the Dow.

You may recall that June 20 came within a day of the time periods for Wave [1] and [5] to be equal. So another piece of the puzzle may be in place. The INDU stocks are called the “generals,” due to the fact that they are most purchased by institutions and pensions. The notion that the generals have abandoned the fight indicates a non-confirmation of today’s high, as is often noted in Dow Theory. Usually the Dow stocks are the last to leave the battle.

I have a busy weekend, so I hope these thoughts are helpful.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.