The Next Recession is Coming - Expect Around 0% Returns for the Next 7 Years

Stock-Markets / Financial Markets 2016 Jul 29, 2016 - 12:12 PM GMTBy: John_Mauldin

The next recession is coming, and it will be severe.

The next recession is coming, and it will be severe.

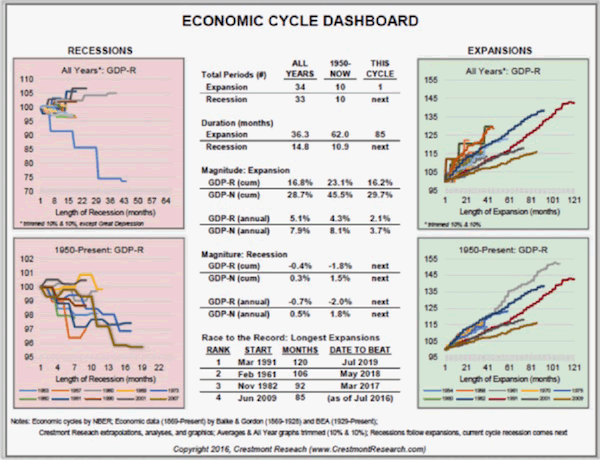

My friend Ed Easterling of Crestmont Research just updated his Economic Cycle Dashboard and sent me a personal email with some of his thoughts.

Here is his chart (click on it to see a larger version).

The current expansion is the fourth longest since 1954… but also the weakest. Since 1950, average annual GDP growth in recovery periods has been 4.3%.

This time, average GDP growth has been only 2.1% for the seven years following the Great Recession. That means the economy has grown a mere 16% during this so-called “recovery.”

If this were an average recovery, total GDP growth would have been 34% by now… instead of 16%. So, it’s no wonder that wage growth, job creation, household income, and all kinds of other stats look so meager.

I think the next recovery will be even weaker than this one (the weakest in the last 60 years) because monetary policy is hindering growth.

Now, combine a weak recovery with NIRP. Asset prices are a reflection of interest rates and economic growth. And both are just slightly above or below zero. So, how can we really expect stocks, commodities, and other assets to gain value?

The upshot is that traditional investment strategies will stop working soon. Ask European pension and i

Welcome to 0% returns for the next 7 years

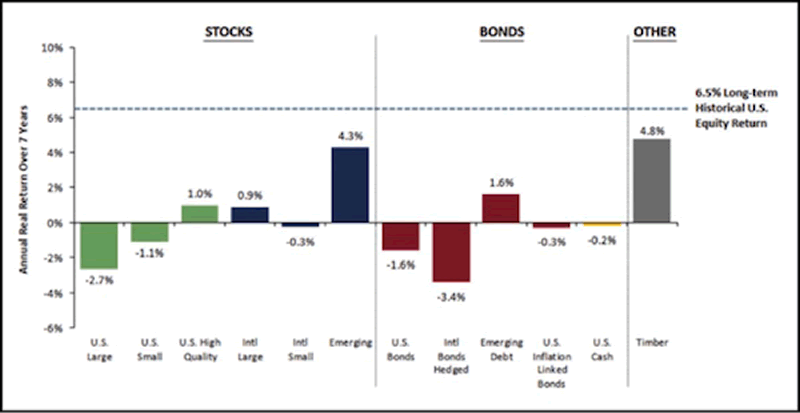

All bets may be off if the latest long-term return forecasts are correct. Here’s a chart from my friends at GMO showing the latest 7-year asset class forecast.

See that dotted line, the one that not a single asset class gets anywhere near? That’s the 6.5% long-term stock return that many supposedly wise investors tell us is reasonable to expect.

GMO doesn’t think it’s reasonable at all, at least not for the next seven years.

If GMO is right—and they usually are—and you’re a devotee of passive or semi-passive asset allocation strategy, you can expect somewhere around 0% returns over the next seven years… if you’re lucky.

See that nearly invisible -0.2% yellow bar for “U.S. Cash?” It’s not your eyes. Welcome to NIRP, American-style.

The Fed’s fantasies notwithstanding, NIRP is not conducive to “normal” returns in any asset class. GMO says the best bets are emerging-market stocks and timber.

Those also happen to be thin markets. Not everyone can hold them at once.

Prepare to be stuck.

Subscribe to John Mauldin’s Free Weekly Newsletter

Follow Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news and analyzes challenges and opportunities on the horizon.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.