SPX is Shaking and Rolling

Stock-Markets / Stock Markets 2016 Jul 29, 2016 - 11:48 AM GMT I don’t believe that I have seen anything quite like this before. I am certain that Citadel and the central banks are doing their utmost to keep equity values at their elevated levels. It appears to be the only thing left to do to validate their existence.

I don’t believe that I have seen anything quite like this before. I am certain that Citadel and the central banks are doing their utmost to keep equity values at their elevated levels. It appears to be the only thing left to do to validate their existence.

Nonetheless, there appear to be cracks in the structure leading to a possible breakdown. All of this reminds me of the Tacoma Narrows bridge, otherwise known as “Galloping Gertie.”

Deutsche Bank is complaining about the FOMC cycle and their inability to pull the trigger.

ZeroHedge reports, “In his latest Global Equity Strategy update piece, Credit Suisse strategist Andrew Garthwaite takes a random walk across Wall Street's trading desks, and confirms what many know: namely, that nobody actually knows anything.

Garthwaite writes that "his team has come across almost no one who seems to have outperformed or made decent returns this year." He cites data from Morningstar according to which in the year to July 1st, just 29 out of 242 funds in the Investment Association UK All Companies sector beat the performance of the FTSE All Share. Moreover, the Dow Jones Credit Suisse Long/Short equity index, which tracks hedge fund performance, fell by 5% year-to-date.”

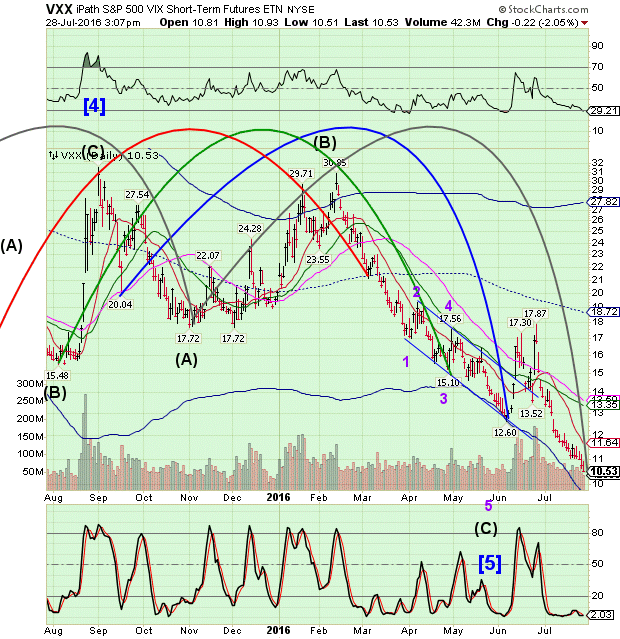

VIX has been flat through all of this back-and-forth in the market. That is likely because the central banks cannot control the behavior in the options market.

However, on the retail side, the VIX ETFs are getting hammered. This does not look like some trigger-happy investors piling on the short side. It appears to be a concerted effort to keep investors away from hedging their portfolios. In addition, today is day 269 in the current Master Cycle for the VIX ETFs. In my opinion, normal human behavior works in 258 day cycles. The decline should have ended a week ago. Could a turn be imminent?

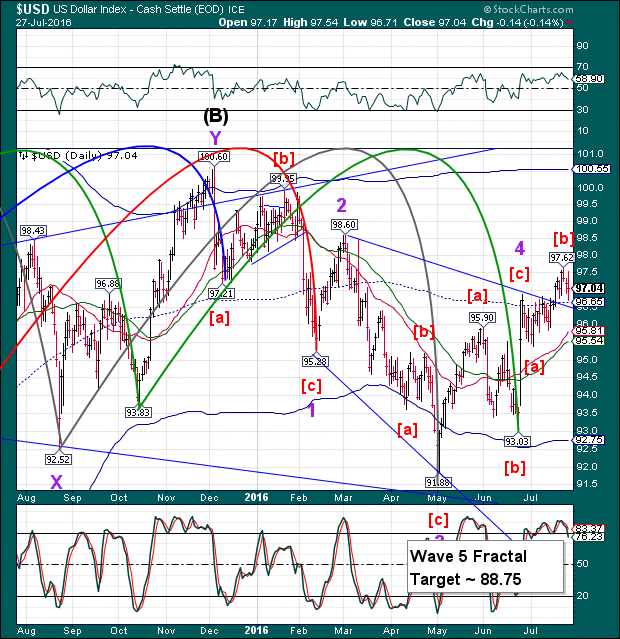

Meanwhile, the USD is attempting to rally above its mid-Cycle resistance at 96.65. this is giving the computers the liquidity to buy up the equities market, at least until the close.

However, the markets are waiting for the BOJ announcement that may solidify the short-term direction of the markets.

Will Kuroda underwhelm?

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.