SPX Challenges the Upper Trendline

Stock-Markets / Stock Markets 2016 Jul 19, 2016 - 06:37 PM GMT SPX appears to have made its high on Friday at 2169.05, 17.2 days from its June 27 low. This morning, the Premarket is challenging the upper trendline of the Orthodox Broadening Top at 2160.00. Once a reversal beneath the trendline is evident, I will comment on what may be expected next.

SPX appears to have made its high on Friday at 2169.05, 17.2 days from its June 27 low. This morning, the Premarket is challenging the upper trendline of the Orthodox Broadening Top at 2160.00. Once a reversal beneath the trendline is evident, I will comment on what may be expected next.

ZeroHedge reports, “After a head-scratching S&P500 rally - which not even Goldman has been able to justify - pushed stocks to new all time highs with seemingly daily record highs regardless of fundamentals or geopolitical troubles, overnight US equity futures dipped modestly, tracking weak European stocks as demand for safe haven assets including U.S. Treasuries and gold rises. Asian stocks outside Japan fall. Crude oil trades near $45 a barrel. “

David Stockman comments, “Another one of the Hedge Fund high rollers, Marc Lasry of Avenue Capital, recently confessed on bubblevision that 2200 on the S&P 500 doesn’t make sense to him, either.

But his reasoning went right to the crux of the bubble implosion lurking just ahead. According to Lasry, the market may be discounting a “stronger-than-expected” economic rebound and thus only appears to be ahead of itself:”

VIX appears to have completed its Ending Diagonal and may be above the Diagonal trendline. We must see a lift-off above the Wave 4 high at 14.00 and preferably a close above the 50-day Moving Average at 15.89.

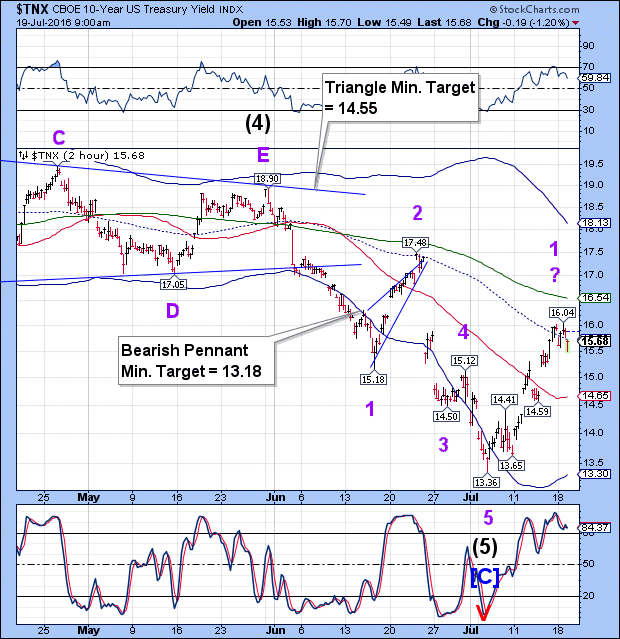

TNX appears to have completed its first impulse off its low. A Wave 2 correction may go to the Intermediate-term support at 14.65, or lower. I am neutral on this move and am patiently waiting it out to make sure the reversal is complete.

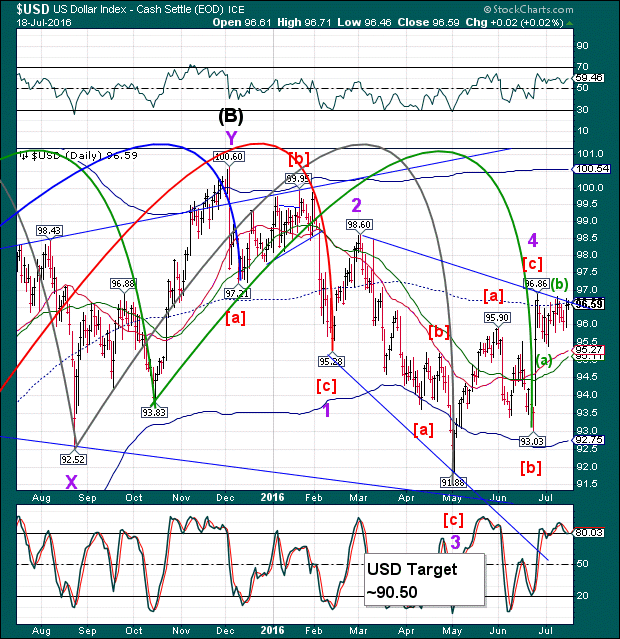

USD/DXY has ventured above its trendline in what appears to be a Wave (b) extension. Wave (b) may break trendlines in a false move, but will quickly come back into line. We must be careful about this move, since the next Master Cycle low is due in the next 30+ days. In other words, this “breakout” may be a suckers’ play.

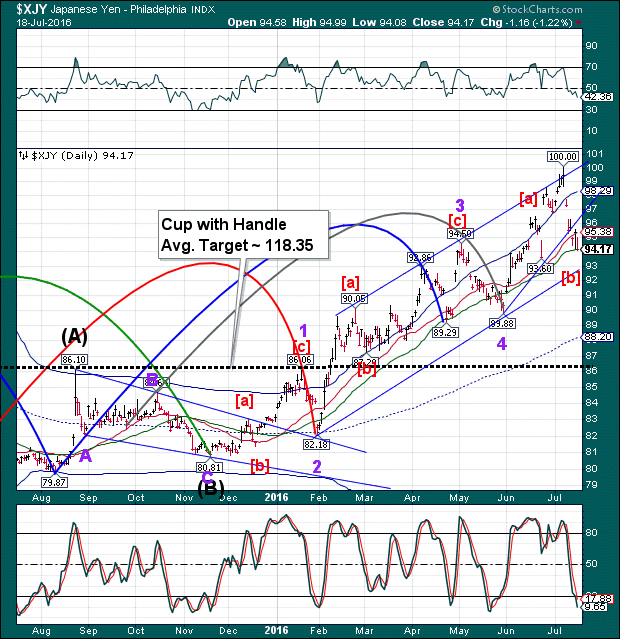

We have a similar situation with the Yen, which closed just above its 50-day Moving Average at 94.14. It appears to have at least one more move to new highs. The cup with Handle target cannot be discounted.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.