Capitalism Has Entered a New Era—and Historic Stock Market Investing Returns Are Gone Forever

Stock-Markets / Stock Markets 2016 Jul 15, 2016 - 04:40 PM GMTBy: John_Mauldin

We live in interesting times. We continue to see repercussions from Brexit. The other major players—in Europe, China, and Japan—seem to be in a downward spiral. Not to mention, the bubble-like issues we see in Canada and other parts of the world.

We live in interesting times. We continue to see repercussions from Brexit. The other major players—in Europe, China, and Japan—seem to be in a downward spiral. Not to mention, the bubble-like issues we see in Canada and other parts of the world.

The world is quickly getting far more complex… something that central banks’ (and everybody else’s!) models can’t capture. We are tiptoeing into a period of enormous uncertainty.

Bill Gross addresses these topics in two of his recent letters (I featured them in my free weekly newsletter, Outside the Box). His first deals with the expectations that most investors have about future returns over the long term—as opposed to what reality suggests. Of course, your mileage may vary. It depends on how you choose to create your portfolio. The average investor, however, is at best looking at about a compound 4-5% over the next 10 to 15 years.

And that’s if everything works and we see the top end of the expected returns. Given current bond yields and stock valuations, that outcome may be unlikely.

Bill’s take is not significantly different from what I’ve been writing, but he makes a number of very good points and has data sets that are really worth paying attention to. Plus, Gross is just a fun writer.

His second letter starts with the simple game of Monopoly that we are all familiar with. Bill then begins to develop an analogy to the real economy.

Nowadays, central banks keep increasing the amount of money you get every time you pass Go. If that happens in Monopoly, your investing strategy changes significantly— the price of assets goes up because the supply of money increases at an ever faster rate. Which means that the velocity of money rises until at some point you have a problem. Quoting:

[H]owever with yields at near zero and negative on $10 trillion of global government credit, the contribution of velocity to GDP growth is coming to an end and may even be creating negative growth as I’ve argued for the last several years. Our credit-based financial system is sputtering, and risk assets are reflecting that reality even if most players (including central banks) have little clue as to how the game is played.

Bill is shouting a warning about the viability of the current economic system.

He didn’t quote Yeats, but I will: “The centre cannot hold.”

Bon Appetit!

(Originally published on the Janus Capital website, June 2, 2016)

The economist Joseph Schumpeter once remarked that the “top-dollar rooms in capitalism’s grand hotel are always occupied, but not by the same occupants”. There are no franchises, he intoned — you are king for a figurative day, and then — well — you move to another room in the castle; hopefully not the dungeon, which is often the case. While Schumpeter’s observation has obvious implications for one and all, including yours truly, I think it also applies to markets, various asset classes, and what investors recognize as “carry”. That shall be my topic of the day, as I observe the Pacific Ocean from Janus’ fourteenth floor — not exactly the penthouse but there is space available on the higher floors, and I have always loved a good view. Anyway, my basic thrust in this Outlook will be to observe that all forms of “carry” in financial markets are compressed, resulting in artificially high asset prices and a distortion of future risk relative to potential return that an investor must confront.

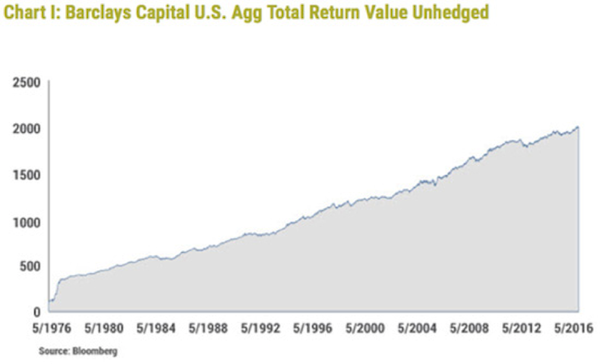

Experienced managers that have treaded markets for several decades or more recognize that their “era” has been a magnificent one despite many “close calls” characterized by Lehman, the collapse of NASDAQ 5000, the Savings + Loan crisis in the early 90’s, and so on. Chart 1 proves the point for bonds. Since the inception of the Barclays Capital U.S. Aggregate or Lehman Bond index in 1976, investment grade bond markets have provided conservative investors with a 7.47% compound return with remarkably little volatility. An observer of the graph would be amazed, as was I, at the steady climb of wealth, even during significant bear markets when 30-year Treasury yields reached 15% in the early 80’s and were tagged with the designation of “certificates of confiscation”. The graph proves otherwise, because as bond prices were going down, the higher and higher annual yields smoothed the damage and even led to positive returns during “headline” bear market periods such as 1979-84, or more recently the “taper tantrum” of 2013. Quite remarkable, isn’t it? A Sherlock Holmes sleuth interested in disproving this thesis would find few 12-month periods of time where the investment grade bond market produced negative returns.

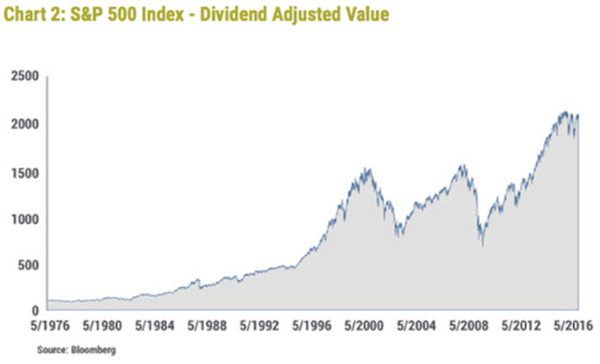

The path of stocks has not been so smooth but the annual returns (with dividends) have been over 3% higher than investment grade bonds as Chart 2 shows. That is how it should be: stocks displaying higher historical volatility but more return.

But my take from these observations is that this 40-year period of time has been quite remarkable – a grey if not black swan event that cannot be repeated. With interest rates near zero and now negative in many developed economies, near double digit annual returns for stocks and 7%+ for bonds approach a 5 or 6 Sigma event, as nerdish market technocrats might describe it. You have a better chance of observing another era like the previous 40-year one on the planet Mars than you do here on good old Earth. The “top dollar rooms in the financial market’s grand hotel” may still be occupied by attractive relative asset classes, but the room rate is extremely high and the view from the penthouse is shrouded in fog, which is my meteorological metaphor for high risk.

Let me borrow some excellent work from another investment firm that has occupied the upper floors of the market’s grand hotel for many years now. GMO’s Ben Inker in his first quarter 2016 client letter makes the point that while it is obvious that a 10-year Treasury at 1.85% held for 10 years will return pretty close to 1.85%, it is not widely observed that the rate of return of a dynamic “constant maturity strategy” maintaining a fixed duration on a Barclays Capital U.S. Aggregate portfolio now yielding 2.17%, will almost assuredly return between 1.5% and 2.9% over the next 10 years, even if yields double or drop to 0% at period’s end. The bond market’s 7.5% 40-year historical return is just that – history. In order to duplicate that number, yields would have to drop to -17%! Tickets to Mars, anyone?

The case for stocks is more complicated of course with different possibilities for growth, P/E ratios and potential government support in the form of “Hail Mary” QE’s now employed in Japan, China, and elsewhere. Equities though, reside on the same planet Earth and are correlated significantly to the return on bonds. Add a historical 3% “equity premium” to GMO’s hypothesis on bonds if you dare, and you get to a range of 4.5% to 5.9% over the next 10 years, and believe me, those forecasts require a foghorn warning given current market and economic distortions. Capitalism has entered a new era in this post-Lehman period due to unimaginable monetary policies and negative structural transitions that pose risk to growth forecasts and the historical linear upward slope of productivity.

Here’s my thesis in more compact form: For over 40 years, asset returns and alpha generation from penthouse investment managers have been materially aided by declines in interest rates, trade globalization, and an enormous expansion of credit – that is debt. Those trends are coming to an end if only because in some cases they can go no further. Those historic returns have been a function of leverage and the capture of “carry”, producing attractive income and capital gains. A repeat performance is not only unlikely, it is impossible unless you are a friend of Elon Musk and you’ve got the gumption to blast off for Mars. Planet Earth does not offer such opportunities.

“Carry” in almost all forms is compressed and offers more risk than potential return. I will be specific:

• Duration is unquestionably a risk in negative yielding markets. A minus 25 basis point yield on a 5-year German Bund produces nothing but losses five years from now. A 45 basis point yield on a 30-year JGB offers a current “carry” of only 40 basis points per year for a near 30-year durational risk. That’s a Sharpe ratio of .015 at best, and if interest rates move up by just 2 basis points, an investor loses her entire annual income. Even 10-year U.S. Treasuries with a 125 basis point “carry” relative to current money market rates represent similar durational headwinds. Maturity extension in order to capture “carry” is hardly worth the risk.

• Similarly, credit risk or credit “carry” offers little reward relative to potential losses. Without getting too detailed, the advantage offered by holding a 5-year investment grade corporate bond over the next 12 months is a mere 25 basis points. The IG CDX credit curve offers a spread of 75 basis points for a 5-year commitment but its expected return over the next 12 months is only 25 basis points. An investor can only earn more if the forward credit curve – much like the yield curve – is not realized.

• Volatility. Carry can be earned by selling volatility in many areas. Any investment longer or less creditworthy than a 90-day Treasury Bill sells volatility whether a portfolio manager realizes it or not. Much like the “VIX®”, the Treasury “Move Index” is at a near historic low, meaning there is little to be gained by selling outright volatility or other forms in duration and credit space.

• Liquidity. Spreads for illiquid investments have tightened to historical lows. Liquidity can be measured in the Treasury market by spreads between “off the run” and “on the run” issues – a spread that is nearly nonexistent, meaning there is no “carry” associated with less liquid Treasury bonds. Similar evidence exists with corporate CDS compared to their less liquid cash counterparts. You can observe it as well in the “discounts” to NAV or Net Asset Value in closed-end funds. They are historically tight, indicating very little “carry” for assuming a relatively illiquid position.

The “fact of the matter” – to use a politician’s phrase – is that “carry” in any form appears to be very low relative to risk. The same thing goes with stocks and real estate or any asset that has a P/E, cap rate, or is tied to present value by the discounting of future cash flows. To occupy the investment market’s future “penthouse”, today’s portfolio managers – as well as their clients, must begin to look in another direction. Returns will be low, risk will be high and at some point the “Intelligent Investor” must decide that we are in a new era with conditions that demand a different approach. Negative durations? Voiding or shorting corporate credit? Buying instead of selling volatility? Staying liquid with large amounts of cash? These are all potential “negative” carry positions that at some point may capture capital gains or at a minimum preserve principal. But because an investor must eat something as the appropriate reversal approaches, the current penthouse room service menu of positive carry alternatives must still be carefully scrutinized to avoid starvation. That means accepting some positive carry assets with the least amount of risk. Sometime soon though, as inappropriate monetary policies and structural headwinds take their toll, those delicious “carry rich and greasy” French fries will turn cold and rather quickly get tossed into the garbage can. Bon Appetit!

******

Just a Game

(Originally published on the Janus Capital website, July 6, 2016)

If only Fed Governors and Presidents understood a little bit more about Monopoly, and a tad less about outdated historical models such as the Taylor Rule and the Phillips Curve, then our economy and its future prospects might be a little better off. That is not to say that Monopoly can illuminate all of the problems of our current economic stagnation. Brexit and a growing Populist movement clearly point out that the possibility of de-globalization (less trade, immigration and economic growth) is playing a part. And too, structural elements long ago advanced in my New Normal thesis in 2009 have a significant role as well: aging demographics, too much debt, and technological advances including job-threatening robotization are significantly responsible for 2% peak U.S. real GDP as opposed to 4-5% only a decade ago. But all of these elements are but properties on a larger economic landscape best typified by a Monopoly board. In that game, capitalists travel around the board, buying up properties, paying rent, and importantly passing “Go” and collecting $200 each and every time. And it’s the $200 of cash (which in the economic scheme of things represents new “credit”) that is responsible for the ongoing health of our finance-based economy. Without new credit, economic growth moves in reverse and individual player “bankruptcies” become more probable.

But let’s start back at the beginning when the bank hands out cash, and each player begins to roll the dice. The bank – which critically is not the central bank but the private banking system– hands out $1,500 to each player. The object is to buy good real estate at a cheap price and to develop properties with houses and hotels. But the player must have a cash reserve in case she lands on other properties and pays rent. So at some point, the process of economic development represented by the building of houses and hotels slows down. You can’t just keep buying houses if you expect to pay other players rent. You’ll need cash or “credit”, and you’ve spent much of your $1,500 buying properties.

To some extent, growth for all the players in general can continue but at a slower pace – the economy slows down due to a more levered position for each player but still grows because of the $200 that each receives as he passes Go. But here’s the rub. In Monopoly, the $200 of credit creation never changes. It’s always $200. If the rules or the system allowed for an increase to $400 or say $1,000, then players could keep on building and the economy keep growing without the possibility of a cash or credit squeeze. But it doesn’t. The rules which fix the passing “Go” amount at $200 ensure at some point the breakdown of a player who hasn’t purchased “well” or reserved enough cash. Bankruptcies begin. The Monopoly game, which at the start was so exciting as $1,500 and $200 a pass made for asset accumulation and economic growth, now turns sullen and competitive: Dog eat dog with the survival of many of the players on the board at risk.

All right. So how is this relevant to today’s finance-based economy? Hasn’t the Fed printed $4 trillion of new money and the same with the BOJ and ECB? Haven’t they effectively increased the $200 “pass go” amount by more than enough to keep the game going? Not really. Because in today’s modern day economy, central banks are really the “community chest”, not the banker. They have lots and lots of money available but only if the private system – the economy’s real bankers – decide to use it and expand “credit”. If banks don’t lend, either because of risk to them or an unwillingness of corporations and individuals to borrow money, then credit growth doesn’t increase. The system still generates $200 per player per round trip roll of the dice, but it’s not enough to keep real GDP at the same pace and to prevent some companies/households from going bankrupt.

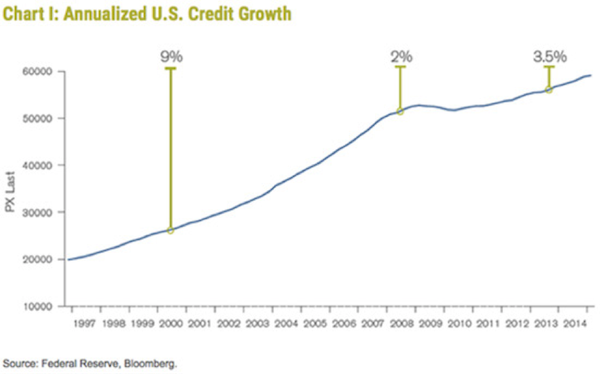

That is what’s happening today and has been happening for the past few years. As shown in Chart I, credit growth which has averaged 9% a year since the beginning of this century barely reaches 4% annualized in most quarters now. And why isn’t that enough? Well the proof’s in the pudding or the annualized GDP numbers both here and abroad. A highly levered economic system is dependent on credit creation for its stability and longevity, and now it is growing sub-optimally. Yes, those structural elements mentioned previously are part of the explanation. But credit is the oil that lubes the system, the straw that stirs the drink, and when the private system (not the central bank) fails to generate sufficient credit growth, then real economic growth stalls and even goes in reverse.

(To elaborate just slightly, total credit, unlike standard “money supply” definitions include all credit or debt from households, businesses, government, and finance-based sources. It now totals a staggering $62 trillion in contrast to M1/M2 totals which approximate $13 trillion at best.)

Now many readers may be familiar with the axiomatic formula of (“M V = PT”), which in plain English means money supply X the velocity of money = PT or Gross Domestic Product (permit me the simplicity for sake of brevity). In other words, money supply or “credit” growth is not the only determinant of GDP but the velocity of that money or credit is important too. It’s like the grocery store business. Turnover of inventory is critical to profits and in this case, turnover of credit is critical to GDP and GDP growth. Without elaboration, because this may be getting a little drawn out, velocity of credit is enhanced by lower and lower interest rates. Thus, over the past 5-6 years post-Lehman, as the private system has created insufficient credit growth, the lower and lower interest rates have increased velocity and therefore increased GDP, although weakly. Now, however with yields at near zero and negative on $10 trillion of global government credit, the contribution of velocity to GDP growth is coming to an end and may even be creating negative growth as I’ve argued for the last several years. Our credit-based financial system is sputtering, and risk assets are reflecting that reality even if most players (including central banks) have little clue as to how the game is played. Ask Janet Yellen for instance what affects the velocity of credit or even how much credit there is in the system and her hesitant answer may not satisfy you. They don’t believe in Monopoly as the functional model for the modern day financial system. They believe in Taylor and Phillips and warn of future inflation as we approach “full employment”. They worship false idols.

To be fair, the fiscal side of our current system has been nonexistent. We’re not all dead, but Keynes certainly is. Until governments can spend money and replace the animal spirits lacking in the private sector, then the Monopoly board and meager credit growth shrinks as a future deflationary weapon. But investors should not hope unrealistically for deficit spending any time soon. To me, that means at best, a ceiling on risk asset prices (stocks, high yield bonds, private equity, real estate) and at worst, minus signs at year’s end that force investors to abandon hope for future returns compared to historic examples. Worry for now about the return “of” your money, not the return “on” it. Our Monopoly-based economy requires credit creation and if it stays low, the future losers will grow in number.

Subscribe to John Mauldin’s Free Weekly Publication

Each week in Outside the Box, John Mauldin highlights a thoughtful, provocative essay from a fellow analyst or economic expert. Some will inspire you. Some will make you uncomfortable. All will challenge you to think outside the box. Subscribe now!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.