The Soaring Risk of Flying in Bernanke's Helicopter

Stock-Markets / Stock Markets 2016 Jul 15, 2016 - 08:28 AM GMTBy: Doug_Wakefield

"Although the term 'helicopter money' is very frequently used in economics, it is doubtful whether such a policy will bring the results people really want. The following example shows why.

Let us assume that the Bank of Japan one day mailed 1 million yen in new bank notes to every Japanese citizen. The person who finds 1 million in his mailbox will probably feel very happy at that moment, because he things he is richer by that amount. Thproblem is what happens next.

When the person finds out that every Japanese person has also received 1 million, he would turn pale. Because at that instant he would realize that what he can buy with that amount has just shrunk dramatically." - Balance Sheet Recession: Japan's Struggle with Uncharted Economics and its Global Implications (2003) Dr. Richard Koo, page 55

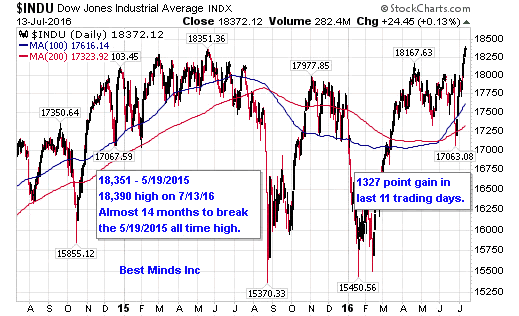

This week, the helicopters descended on global markets, helping push the Dow and S&P 500 to another all time high as July monthly options come to a close this Friday. No need to deleverage just yet...right? Pile into risk on trades; central bankers have your backs.

"Something Big" Indeed Came - Bernanke's Japan Visit Unveils "Helicopter Money", Sparks Monster Rally ~ Zero Hedge, July 11, 2016

Helicopter Money 'The Next Step' in Monetary Policy Says Fed Official Loretta Mester ~ ABC News Australia, July 12, 2016

So let's compare comments made this week in the press regarding Bernanke's actual visit with members of the Bank of Japan and Prime Minister Shinzo Abe, comments that stem from ideas Bernanke discussed on his blog at the Brookings Institute 3 months ago.

Here is What Ben Bernanke Told the Bank of Japan ~ ZH, July 12 '16

"Mr. Bernanke visited Tokyo at a time of intense speculation that Mr. Abe may resort to so-called 'helicopter money', a radical form of monetary easing advocated by the former Fed chief. The strategy involves a central bank directly financing government spending or tax cuts. Japan once implemented the measure in the 1930s-40s and ended up stoking sky-high inflation."

What Tools Does the Fed Have Left? Part 3: Helicopter Money ~ Bernanke Blog at the Brookings Institutes, posted on April 11, 2016

"Some have suggested an alternative approach in which the central bank prints money and gives it away -- so-called "people's QE." From a purely economic perspective, people's QE would indeed be equivalent to a money-financed tax cut (Friedman's original helicopter drop, although perhaps more targeted). The problem with this policy, which would certainly be illegal in most or all jurisdictions, is not its economic logic but its political legitimacy: The distribution of what are effectively tax rebates should be subject to legislative approval, not determined unilaterally by the central bank."

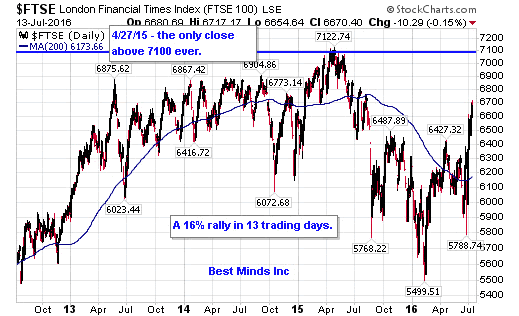

Since the bell was rung on June 24th , the day after the Brexit vote was counted the night before, the FTSE 100 dropped 592 points or 9.2% in under a day, but then over the last 13 days racked up 929 points for a 16% gain. A sign that all is well, or a big rally before the next wave of selling?

Clearly, the "helicopter money" headlines that started this week were after a 2-week rally in US and European stocks.

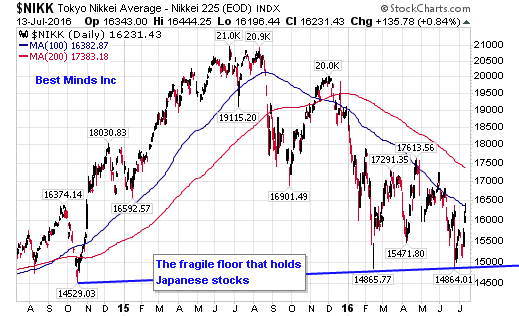

The reason was clear. Japanese stocks were close to a critical line, and needed a rally to help hold up equity markets as we came through July monthly options week. So in three days, we have a 1338-point rally, producing a gain of 8.8%.

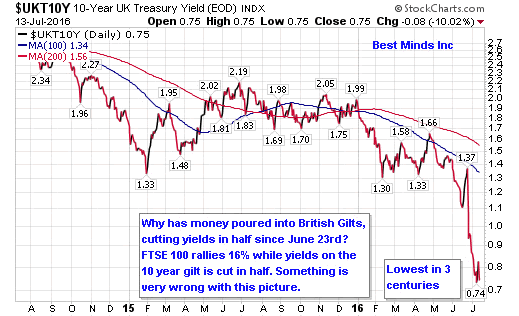

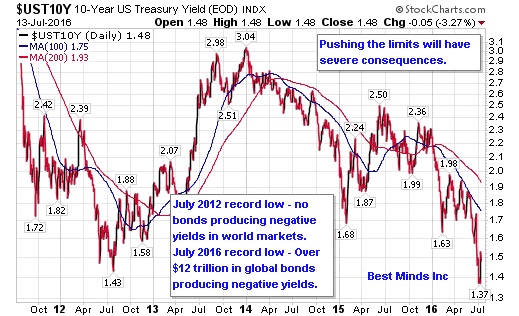

If we then include the fact that the S&P 500 broke its May 2015 all time high on Monday the 11th, and the Dow did the same on Tuesday, May 12th, while the last 3 weeks have produced the lowest yields in centuries in the US and Britain, then it is clear that something is very wrong with the view of "helicopter money is part of our unlimited tool chest" being espoused by Bernanke, Mester, and other socialist central planners.

Only a fool would believe that given enough intervention by central banks stock prices need never deflate again. The 6,000-point drop between June 2015 high and June 2016 low in the Nikkei make that painfully clear.

Only a delusional nut would believe that interest rates could be suppressed indefinitely merely by bringing out more central planning schemes.

¥ 10 Trillion Versus ¥ 135 Trillion

Let's focus on Japan, and run through a recent article, an article released in April 2013, and a chart of how well "conquering deflation" with massive intervention and debt has worked since 2013 when Japanese leaders launched the largest "stimulus" measures in the nation's history.

First, the "helicopter" rally that shot the Nikkei up almost 9% in the last 3 trading days is based on a ¥10 trillion stimulus package announced by newly reelected Prime Minister Shinzo Abe.

Abe Orders Drafting of New Stimulus Package to Breathe Life into Japan's Economy ~ The Japan Times, July 12 '16

"Prime Minister Shinzo Abe ordered economic revitalization minister Nobuteru Ishihara on Tuesday to draft a range of economic measures to bust deflation and raise Japan's growth potential, including with a supplementary budget for fiscal 2016.

On Tuesday, the Nikkei financial newspaper reported the projects are likely to be worth about ¥10 trillion ($100 billion), including the supplementary budget and government-backed loans to businesses."

Now journey with me back to April 2013 when the financial world was hit with THE largest QE plan to "defeat deflation" on record. Since January 1990 was the last time the Nikkei produced an all time high, the Japanese culture that deflation is a very real term.

Bank of Japan Unleashes World's Biggest Burst Of Stimulus in $1.4 trillion (¥ 130 trillion) Shock Therapy ~ Financial Post, April 4, 2013

"New Governor Haruhiko Kuroda committed the BOJ to open-ended asset buying and said the monetary base would nearly double to 270 trillion yen ($2.9 trillion) by the end of 2014 in a shock therapy to end two decades of stagnation.

'We took all available steps we can think of. I'm confident that all necessary measures to achieve 2% inflation in two years were taken today,' he said...."

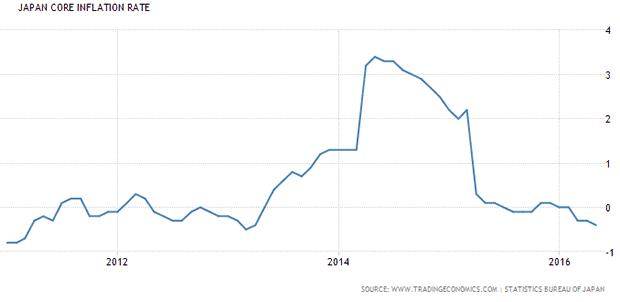

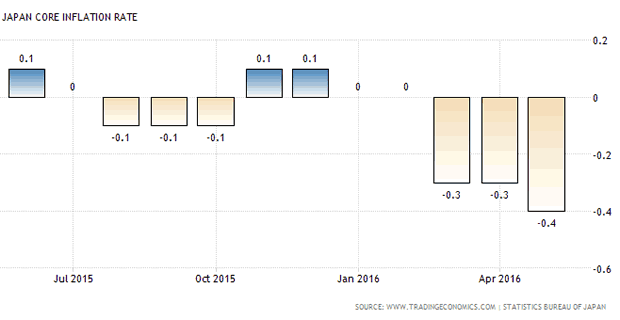

Now we leap forward to July 2016, and look at what impact the mega stimulus from 2013 has had on core inflation in Japan.

As we can see, the 2% inflation target was reached as Japan entered 2014, but by 2015 core inflation was back at zero. As we can see below, the nation is back in price deflation this year, and this after the largest "print money, buy up stocks and government bonds" scheme in world history. If we look back to the start of this article, we can see that the Nikkei dropped over 6,000 points between its June 2015 high and its June 2016 low. Clearly, asset inflation has failed miserably over the last year.

Will printing up less than 10% of what was printed up as Japan came through 2013 and 2014 solve the problems that the mega stimulus announced in April 2013 failed to do, when looking at core inflation over the last 5 years, negative rates on government bonds that began this year, or the Nikkei's steep decline since its 18 year high last summer?

The Last Buyer At The Top

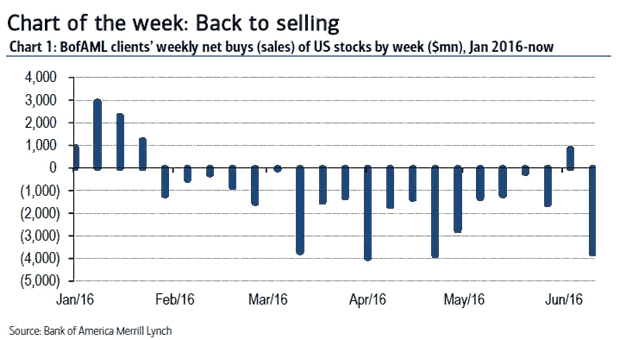

As of July 8th, we know from Lipper Fund Research that US stock based funds had seen 17 weeks of net outflows. This means the trend of net outflows by retail investors had taken place since March 11th.

We know as of June 14th, research by BofA Merrill Lynch reveals that institutional clients were sellers for 20 of the last 21 weeks. This trend would have started the week ending February 19th.

So who decided to DIVE IN since the collapse in global equity markets on June 24th and 27th, and buy, buy, buy! Anyone watching this drama for the last few years will not be surprised by the answer.

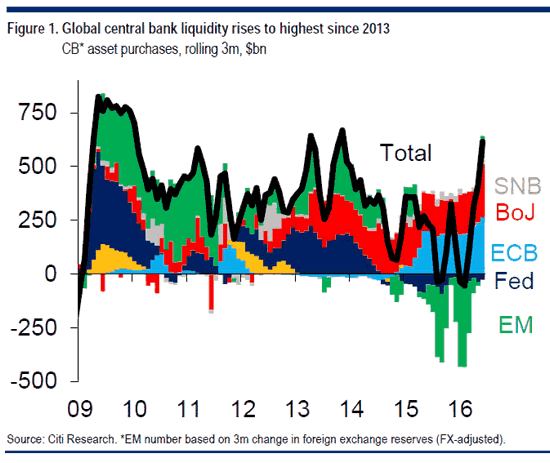

Matt King, Head of credit product strategy at Citigroup, made it clear this week that "a surge in net global central bank asset purchases to their highest since 2013" was our "mystery buyer".

And while this may sound bullish, we need to remember the following stats. The largest QE programs to create debt to artificially inflate Japanese equity prices hit a brick wall last summer. AFTER the last 3 days power rally, the Nikkei is still down 22% from its 2015 high.

The largest QE programs in Europe began March 2015. After its rally 12 day rally since June 27th, it is still down 20% from its all time high in April 2015.

US stocks (SPX, INDU) and junk bonds (HYG) created new all time highs over the last three days. Is this a gift from the central banking "helicopters", or a desperate attempt to keep from having US equities and junk bonds join the deflationary trend underway for more than a year in major European and Asian equity markets?

Be a Contrarian, Remember Your History

Bulls become bears, and bears become bulls. Trends always end; always begin.

If you have never downloaded my research paper, Riders on the Storm: Short Selling in Contrary Winds (Jan '06), do it now while the Dow is still claiming a new "all time high". Patterns are only getting tighter and shorter. The "infinite arsenal" of schemes is facing gravity, and gravity is a fierce opponent, as all good contrarians know.

To gain access to the most up to date research, click here to start a six month subscription to The Investor's Mind. Critical thinking, technical analysis, and history are crucial for everyone seeking patterns to help navigate these waters.

On a Personal Note

Check out the posts at my personal blog, Living2024. The latest post is The “Experience” Market Bubble.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.