The Broad Stock Market, Helicopters and Gold

Stock-Markets / Stock Markets 2016 Jul 15, 2016 - 08:16 AM GMTBy: The_Gold_Report

There has been a stunning post Brexit turnaround in the markets, says technical analyst Clive Maund. Far from leading to chaos, the markets have taken it in their stride, and are now rising in anticipation of "helicopter money."

There has been a stunning post Brexit turnaround in the markets, says technical analyst Clive Maund. Far from leading to chaos, the markets have taken it in their stride, and are now rising in anticipation of "helicopter money."

Helicopter money is basically unlimited global liquidity intended to head off a liquidity crunch and keep the game going as long as possible—this is the next and ultimate stage in the fiat endgame. The starting point for this is Japan, but it will quickly become global, and legal constraints can simply be brushed aside—if laws prohibit it, they can be changed.

With the current global debt structure any serious liquidity problems could quickly lead to a catastrophic deflationary implosion, and that must be avoided at all costs. Helicopter money serves the best interests of the elites in various ways—they remain in power and in control for as long as possible, and can continue to use low interest rates and the carry trade, etc. to grow their fortunes even further, whilst the man in the street gets stuck with the bill as his standard of living and quality of life continue to deteriorate as inflation mounts and wages fail to keep up. There will be no prospect of interest rates being normalized, of course—there will be a hyperinflationary firestorm before that happens.

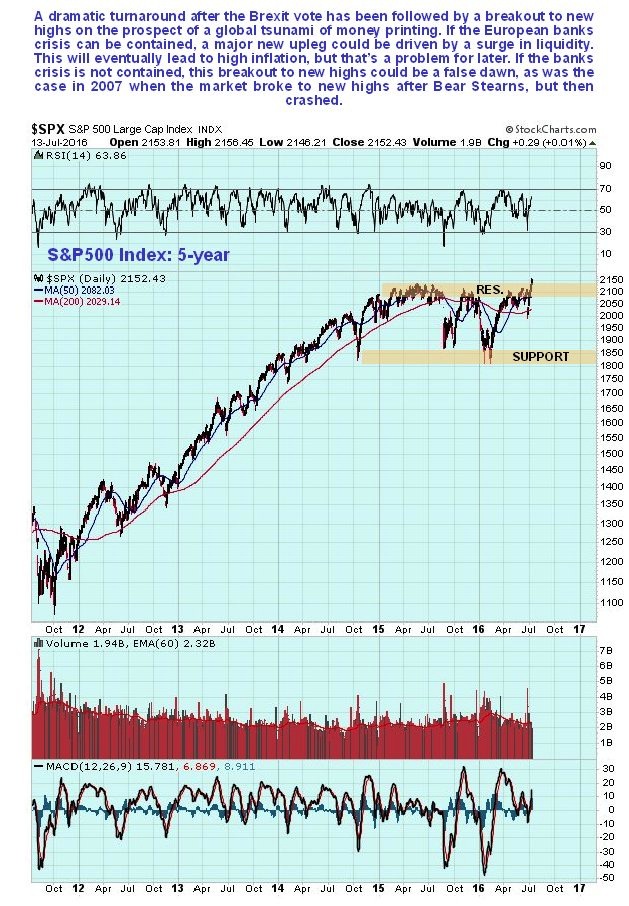

From an investment standpoint, helicopter money creates a "rising tide lifts all boats" situation, where most investments continue to rise in price, particularly those that provide a good yield. The prospect of this massive bonanza of newly printed money on a global scale is what has caused the reversal in stock markets of the past couple of weeks, that has seen both the Dow Jones industrials and the S&P 500 indexes break out to new highs. It has also been due to capital flight out of Europe, which is beset by severe problems, which why European markets have in contrast only rallied feebly.

The key point is that this rally looks like the start of a major up leg that will be fueled by a tsunami of money creation, but for it to continue the problems in the European banking sector in particular must be contained because if European banks collapse and there is contagion, we could quickly find ourselves back in a 2008 situation. The solution is to furnish European banks with whatever liquidity they require to head off crisis, but they might not succeed in achieving that.

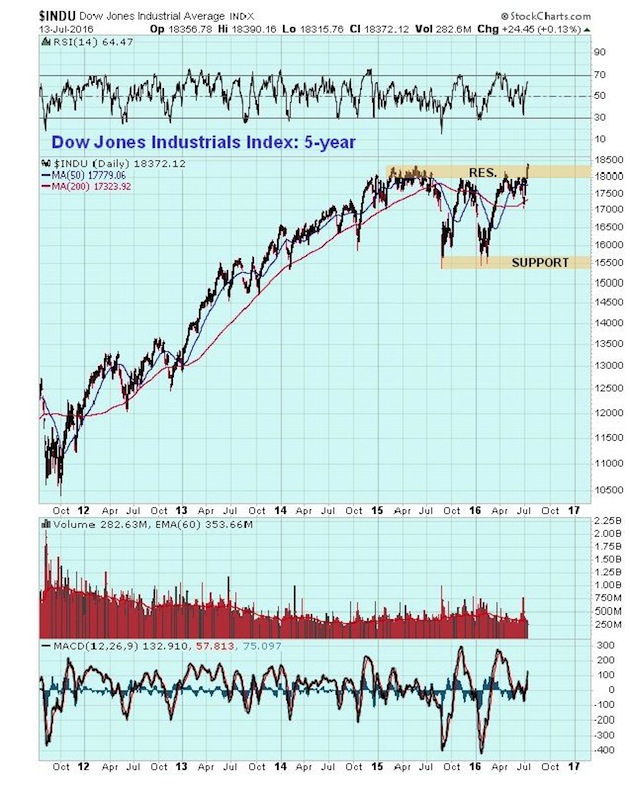

Turning now to the charts, we see the dramatic post Brexit turnaround and breakout to new highs by both the Dow Jones Industrials and the S&P 500 index on their respective 5-year charts. Here we should note that new highs don't necessarily mean that the markets are "in the clear," as there were new highs after the Bear Stearns debacle in 2007–2008, which ended up being followed by a crash.

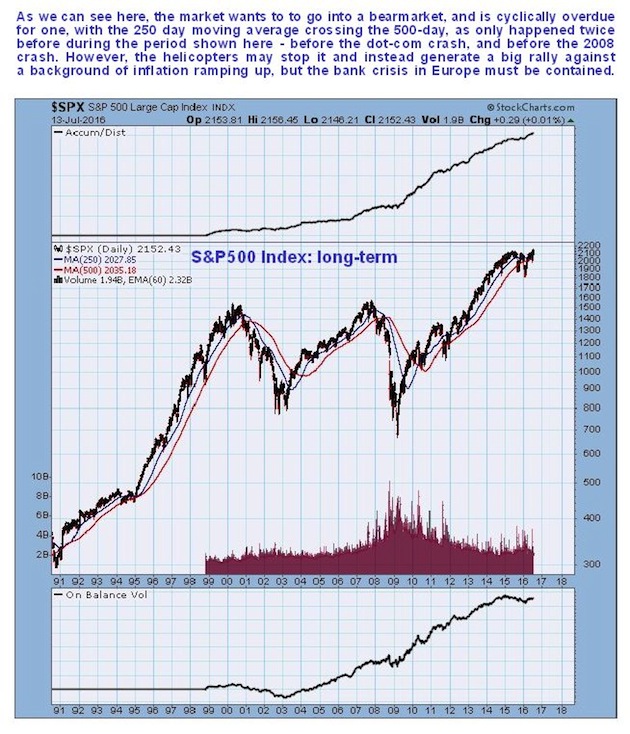

Basically, the markets want to correct, want to have a bear market, but those in power are pulling out all the stops to prevent this happening with their reckless and ultimately suicidal money printing orgy—if markets quadruple over the next three years, what does it mean if money only buys 20% of what it does now?

We can see how, from a purely cyclical standpoint, the stock market is ready for a severe bear market now on the following long-term chart. It could yet happen if the problems in the European banking sector are not contained, but the intention of the elites is keep the game going to the bitter end with their resorting to helicopter money.

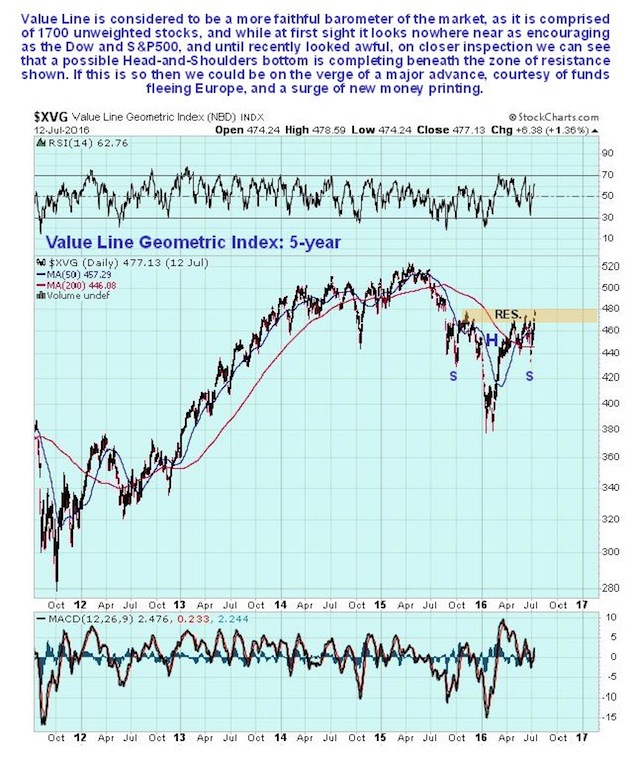

The charts for the Value Line, which is more representative of the U.S. market as it is composed of 1,700 unweighted stocks, at first sight look weak, in comparison to the Dow and the S&P 500, but on closer inspection we can see that it may be completing a Head-and-Shoulders bottom, which is easier to see on its 2-year chart. If so, a big market rally is in prospect.

We have been caught flat footed by this rally, and the best course of action is thought to be to unload any broad market short positions.

Here is perhaps the most important point of all. It has already been pointed out in the latest Gold and Silver Market updates that the latest gold and silver COT charts are at frightening extremes. If the helicopters take off and shower the world with cash, as is looking more and more likely, then the investment world will quickly switch back to "risk on" and gold and silver will become a sideshow again for a while, until the inflation really kicks in—this will be the time that the $10,000 an ounce gold crowd really have their day, and it won't be as far off as many think.

Here is a good article I found this morning in Zerohedge on the helicopters now warming their engines, entitled Soon and really really crazy. The latest Gold Market update highlighting the extreme danger signaled by the COTs was greeted with scorn, an example being this mail from the "This time it's different school"…

"COTS are not bearish they are desperate...what worked before is not working any longer....why would they continue to add to shorts when they must be so deep under water...you can't hold your breath forever....they cannot control the Chinese Gold exchange that is the point...when we break 1400 if they are still short....it's game over....and they deserve it making all that easy money at the expense of the tax payer..."

We will have to see, but my contention is that if we go back to "risk on" again in a big way, thanks to the work of the helicopter fleet, then gold could get smashed back down again, at least until the inflation starts to build in preparation for the now inevitable hyperinflation.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts provided by Clive Maund

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.