Banking Crisis Alert -How Safe is Your Bank

Stock-Markets / Credit Crisis 2008 Jul 23, 2008 - 02:54 PM GMTBy: Marty_Chenard

Sunday's headline coming out of Washington was :"Paulson braces public for months of tough times"

Sunday's headline coming out of Washington was :"Paulson braces public for months of tough times"

Paulson had these comments:"I think it's going to be months that we're working our way through this period -- clearly months,"

"The number of troubled banks will increase as they struggle to cope with big losses on bad mortgages."

In one breath, he was telling Americans to "brace themselves for tough times ahead". In the next breath, he was essentially saying, don't worry, the US Banking system is sound.

Big trouble coming ... but don't worry?

The conditions are potentially serious enough for everyone to be considering "safety measures".

On today's update, we are going to discuss the following:

1. The new problem banks are facing,

2. The safety of your deposits and savings accounts,

3. How to check on the safety level of your bank, and ...

4. An action list of recommendations.

______________________________________

First, let's discuss “What is happening to the Mortgage business and how does it effect bank profits?”

Here are two recent headlines that help paint the current picture:

A. This Morning's Bank Related Headlines:

"Wachovia has $8.9B loss, cuts 6,350 jobs."

"Wachovia slashes dividend, jobs, to shut mortgage unit after $8.86B loss in second quarter."

“Late Monday, Wachovia announced plans to leave the wholesale mortgage lending business.”

* This means that fewer mortgages choices will be available for home owners, and the competition for mortgages will increase, resulting in higher mortgage rates. Wachovia is not the last bank with sub-prime or “in-trouble” loan exposures that will be facing financial problems.

B. “Freddie Mac, the second-largest U.S. mortgage-finance company, may cut purchases of home loans from banks and bonds backed by housing debt to shore up its capital amid record delinquencies.”

* This means that fewer mortgages will be available for home owners. Bottom line: Higher costs for mortgagors, and fewer income producing loans for banks. So, the question is: "Is the Banking Crisis over, or in an early stage where everyone should be on a Cautious Alert and implementing protective safety measures?

How do the above problems effect Banks and their profits?

I talked with my local bank Mortgage Officer last Friday. This Asheville financial institution is typical of many U.S. banks. Basically, their policy has been to sell (re-market) all 30 year mortgages. They keep select high quality 10 and 15 year mortgages. That has been an excellent policy that has kept this bank in sound financial condition, not withstanding that they also had a policy to never get into the sub-prime, high risk mortgages.

1. The new problem banks are facing:

Banks need to the ability to re-market their mortgages. However, is Fannie Mae and Freddie Mac cut the number of mortgages they buy from banks, then there will be fewer mortgages available. Banks make a profit on each mortgage placed … it is part of their monthly revenue stream . If the mortgage placement market were to shrink 20%, then that would represent a 20% drop in new mortgage placement revenues for banks. This is a terrible time for banks to start seeing decreasing mortgage revenues.

This morning's headline about Wachovia exiting the mortgage market after declaring an 8.9 billion loss shows you how bad lending policies are putting some banks in dire straights. When IndyMac's bank closure had depositors in line trying to get their money, it send shock waves to consumer confidence.

If your bank is a high-risk institution, why expose yourself to such risks?

Being a stock market analysis and perceiving early potential problems, I moved our Corporate and Personal accounts from Wachovia to Home Trust Bank over a year ago. Owning a business means that you definitely do not want the possibility of any disruption of banking services. On the personal side, you do not want any funds at risk, or any possibility of delay in retrieving those funds. Such is not the case with Wachovia at this time, but their risk rating has obviously risen. At Wachovia, I had become just a number dealing with an expansive cadre of personnel and rules making everything difficult … at Home Trust Bank, I am known and remembered by their staff and greeted by my last name. (Old fashion banking relationships haven‘t disappeared at Home Trust.)

To me, it is more than just the question of whether or not a bank might end up on the in-trouble 300 lists. It is about which banks are so healthy and sound, that they face little or no possibility of ever joining the 300 lists in the future if things continue to get worse.

2. The safety of your deposits and savings accounts: Are risk levels unacceptable at your current bank, S&L, or Credit Union?

First, let me say that Paulson is correct about safety of the majority of our banks. As I understand it, there are approximately 90 banks on their “trouble list” at this time, with a probable 300 banks that will join the list.

As a stock market investor, you aggressively avoid any company's stock that has financial problems and increasing future risk. Why investors do this while not applying the same criteria to their financial institution puzzles me … especially because their money and life savings are often kept there.

3. The safety of your deposits and savings accounts …

For security, and peace of mind, I am only interested in the safest banks with the highest quality of financials with the lowest risk. For that, I use Veribanc's rating service. They have been analyzing financial institutions for decades and do a wonderful job.

The safest banks in the U.S. are their “Blue Ribbon Banks”. They are the safest, and most financially sound banks in the country. (On Savings and Loans (S&Ls), and Credit Unions, their top ratings are 3 Star institutions.) And yes, their reports take a hard look and investigation into what banks have “problem loans” and how serious the problem is.

I am at Home Trust Bank because they have one of the highest Veribanc ratings. I sleep at night knowing that our business and personal accounts are in good hands and that I won't be surprised by any “bad loan” news about them.

4. An action list of recommendations: How to check on the safety level of your bank:

A.) Check on the safety level of your Bank, S&L, or Credit Union that you are banking with.

B.) To do this, go to this link : http://www.veribanc.com/

C.) When you get to their web page, click on the link I circled in red as seen below:

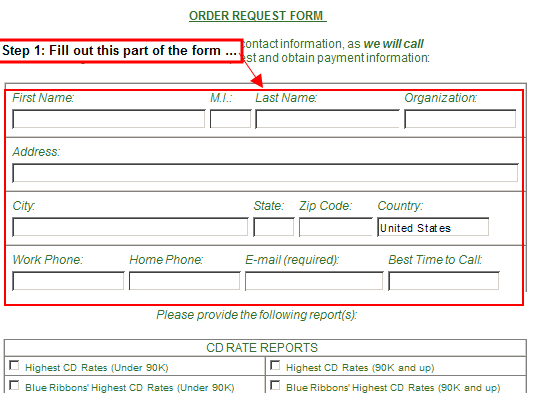

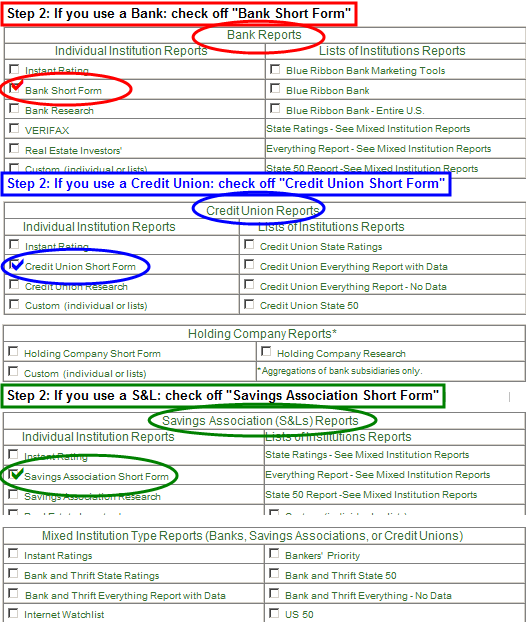

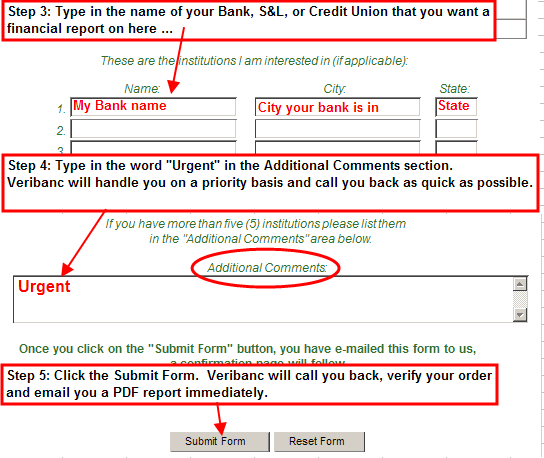

D.) By clicking on the above link, it will take you to the Order Form page I posted below. Don't get intimidated by all the options you see below … I will make it simple and easy for you and circle the exact things you need to do.

NOTE: There are 30 different reports that Veribanc offers. I have made it simple … order the "Short Form Report" which I show below. It is only $25 and it tells you if your financial institution is a Blue Ribbon Bank, their total assets, equity, net quarterly income, previous quarter's rating, and the estimated Regulatory Classification (My bank's classification was “Well Capitalized” which is what I wanted to see.)

There is an “Instant Rating Report” for $10. Don't get that one … you just get a verbal report if the bank is a Blue Ribbon or 3 Star (or other rating) and none of the other important details.

What to do: Obviously, if you get a report where your bank has serious problems, then "find a new bank ASAP". With excellent Veribanc information, there is no reason for anyone to be in a risky banking institution in this day and age.

We hope you enjoyed this special update and found it helpful. We know this information is not about the stock market, but it is about the safety of your money and future retirement funds which is one of the missions of StockTiming.com. (Feel free to use the link at the bottom of this page to forward this page to your colleagues, family, or friends.)

_______________________________________________________________

______ Tuesday, July 22nd. at 1:57 PM - Important Update _____

_______________________________________________________________

This just came in from one of our Hedge Fund manager subscribers.

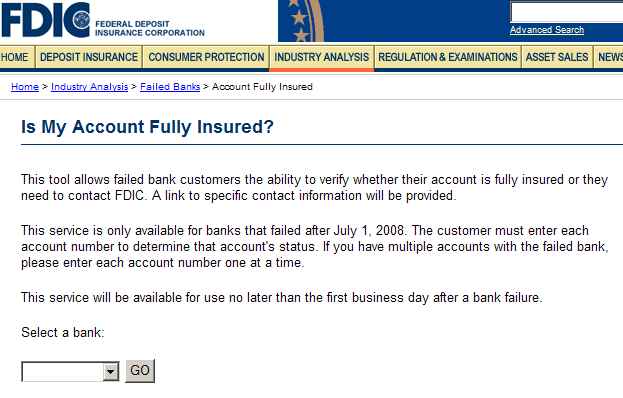

His question was, "Why would the FDIC need to post such a website page?

The FDIC page is below and the link to the FDIC page is: http://www4.fdic.gov/dip/index.asp

If so, simply click on the link below to quickly and easily forward an email link . It is completely private, so we won't even know if you send one. Send This Page To a Friend

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.