Not Too Late For Real Money In A World, Distracted

Stock-Markets / Global Financial System Jul 13, 2016 - 03:56 PM GMTBy: Dr_Jeff_Lewis

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. - Henry Ford

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. - Henry Ford

A recent IMF study estimated that the profits of the big banks in the United States are almost entirely due to the government sponsored backstops. It’s not just bailouts, but also cheap credit, and judicial negligence.

So when the JP Morgan and Chase pay a $13 billion fine for criminal behavior it's nothing compared to what they're getting simply by having a government insurance policy.

Meanwhile crisis perceived begins a new cycle.

For the renewed European debt crisis, and the Germans on begging, while they blame the Italians. So much for the political/monetary union.

So the Germans have now forgotten.

But, hey... If all of this sounds absurd, reflect on the source. When money is untethered, the license to print extends beyond binary debt script

Don't look now, Japan creeps back into the limelight, soon to be the testing grounds with QE from Helicopters.

If it were only that simple.

We are about to see that complexity unwind. As the huge counter-parties (derivative holders) unravel in a panic, the entire system of circular causality will be revealed.

In Europe, it’s the troika policies. The population should pay for the risky, careless behavior of the bankers.

Put it to the people for the vote. Brexit is a distant memory, contained by the self-granted legal powers given to the Treasuries, the stabilization funds, and the great liquidity providers.

Remember the what the Swiss did with their EU vote?

The citizens can decide their own fate and then beg for more of it.

Remember, visions of 'Helicopters' will soon morph into QE - in the name of 'fiscal' policy - for what's good (and food) for the unwashed masses.

The creditors are laughing.

Turn off the machines and people don’t eat. Sure, let them vote, they imagine.

Give them hope and the illusion of freedom in a flag, while tapping the deep wells of perpetual welfare for the debt slaves.

Let them try and rise up against the economic and social policies deriving from the bureaucracy and the banks.

Historians will be sorting this out for decades. The 'winners' will repaint it all in terms of the little guy -- as if they little guy was more than a pawn in the wealth transfer.

We are merely in the early stages, where the last variable is the unmeasurable velocity of money - a concept as close to all or none when it appears.

Sadly, the narratives passed down through the annals of history will eventually enable yet more forgetting.

For now we are fed from the media’s carefully crafted script. One side or the other. While the rot is systemic.

The great irony is that it is all right in front of us. Like a slow motion train wreck - broadcast through a maze of information channels.

We are at the crossroads, where information is wide open and accessible. But how long will this last? As each crisis comes with another layer of liberty lost forever.

And the principles are all the same. For the con artist, the pickpocket.

They distract us by using the basic rules of sensation, whilst simultaneously and gently slipping past your guard. They are good at it.

We are told what to believe - neatly organized into one side or the other.

As little “black swans” are periodically released, tagged, and tracked in the wild.

They have the power and the guns. The long arm of the law, demonstrating more than a willingness to use force.

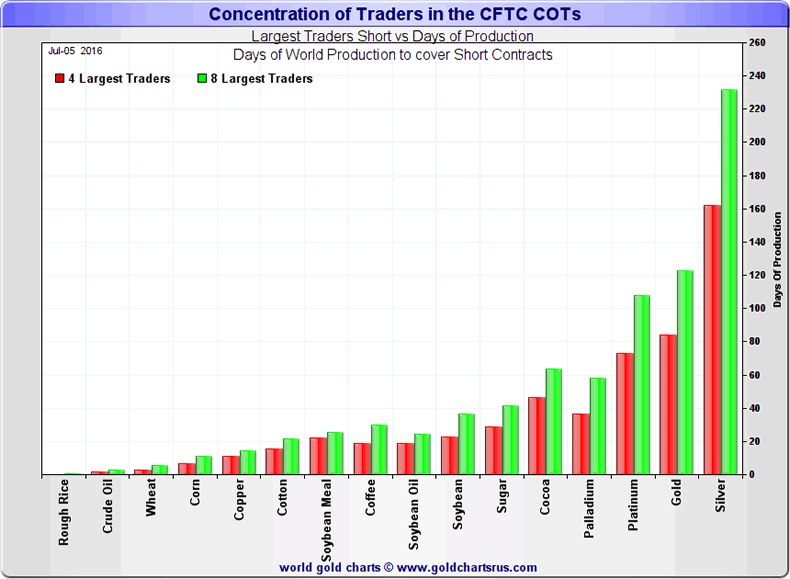

The banks, enabled by the bureaucracy create devastating economic and social policies abroad and at home. Hope calls for an uprising... as the banks maintain a desperate margined grip on the perception of real money...for now held captive by the greatest risk to the current fiat experiment. Get real before it's gone.

To receive early notification for new articles, click here.

Or to view our products, services, and private community discussion. click here.

By Dr. Jeff Lewis

Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com

Copyright © 2015 Dr. Jeff Lewis- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dr. Jeff Lewis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.