SPX Rally Nearing Completion. USB Maybe Finished

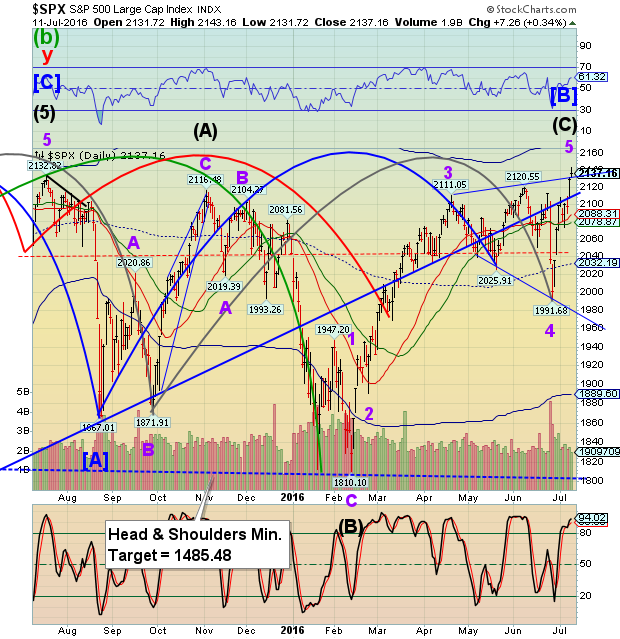

Stock-Markets / Stock Markets 2016 Jul 12, 2016 - 02:45 PM GMT I have been reviewing the Cycle Model and have a few observations to pass on. There is little doubt why Ben Bernanke went to visit Abe and Kuroda last weekend. The June 27 Master Cycle low is the last of its kind until October 4, 2016. It appears that this is the last chance they have of igniting a rally in order to preserve the uptrend.

I have been reviewing the Cycle Model and have a few observations to pass on. There is little doubt why Ben Bernanke went to visit Abe and Kuroda last weekend. The June 27 Master Cycle low is the last of its kind until October 4, 2016. It appears that this is the last chance they have of igniting a rally in order to preserve the uptrend.

I have observed that market manipulation can only be successful when it follows the trend. Theoretically, the trend may have ended on June 8, only 3 weeks from the 8.6 year anniversary of the October 11, 2007 high. However, the Brexit decline wasn’t enough to break the uptrend, hence the rally to “save it” ensued.

This has sent David Stockman into a paroxysm.

Today is day 258 in the current Master Cycle in VIX. You will notice again, a very long space between its origin and the next Master Cycle low. This projects to the next VIX Master Cycle low being sometime in November. There is a probability of a VIX low in early September, but it currently appears to be a Trading Cycle, a lesser low.

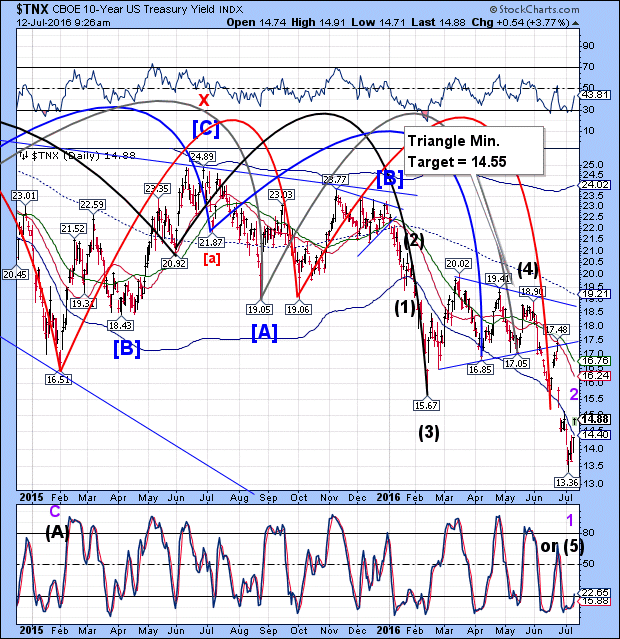

TNX surged higher this morning, but did not break out above it 15.12 high. USB is expecting a Master cycle low next week, so this could be the end of the line for the TNX decline.

The Long bond is arguably finished with its rally. The February 11 low may be considered the 34.4-year Cycle date, but the decline wasn’t structurally complete. It was the Fed and other central banks buying US Treasuries that kept the yields on a lower path for another 5 months.

A look at the monthly USB chart says it all. It is currently in throw-over, but not for very long. The time is come to exit or be short bonds.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.