SPX testing the Cycle Top Resistance

Stock-Markets / Stock Markets 2016 Jul 11, 2016 - 05:21 PM GMT The SPX Premarket is challenging the 2-hour Cycle Top at 2136.81 this morning. Indications are, we may see a probe higher at the open. Although it did not go above the 2134.72 high of May 20, 2015 on Friday, it may do so this morning.

The SPX Premarket is challenging the 2-hour Cycle Top at 2136.81 this morning. Indications are, we may see a probe higher at the open. Although it did not go above the 2134.72 high of May 20, 2015 on Friday, it may do so this morning.

Does that hurt the bearish case? Probably not. You will note that May 19 was exactly 8.6 years (3141.6 days) from the October 11, 2007 high. The time has arrived fro a change of trend. However, I believe that the central banks have been pushing against that change of trend. Thus we have the Orthodox Broadening Top. A move above the upper trendline, called a throw-over, does not invalidate the formation.

Furthermore, this weekend is exactly 13.5 months (divisible by 4.3 and Pi) from the May 20, 2015 high. This indicates the probable resolution of this high in the next 24 hours.

ZeroHedge observes, “Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe later confirmed that Japan would unveil a new JPY 10 trillion ($100 billion) stimulus and the government would consider issuing new Japanese government debt for the first time in 4 years in order to "make most of zero interest rate environment to utilize fiscal investments" in order to "support domestic demand."

ZeroHedge again comments, “When we first heard this past Thursday that private blogger and Citadel employee Ben Bernanke was going to "secretly" meet with both the BOJ's Haruhiko Kuroda and Japan PM Abe, we warned readers that "something big was coming."

As noted late last week, "Bernanke will be in Japan next week. It has been arranged for him to meet officials including Abe and Bank of Japan Governor Haruhiko Kuroda, according to a government official speaking on condition of anonymity. Bernanke is expected to discuss Brexit and the BOJ's negative interest rate policy with Abe and Kuroda, the official said."

As Reuters added, "Some market players speculate Kuroda might decide, in a surprise, to provide "helicopter money" - a term coined by American economist Milton Friedman and cited by Bernanke, before he became Fed chairman, when talking about how central banks might finance government budgets as a way to seek to fight deflation."

All of this is happening while Deutsche Bank's Chief Economist Calls For €150 Billion Bailout Of European Banks.

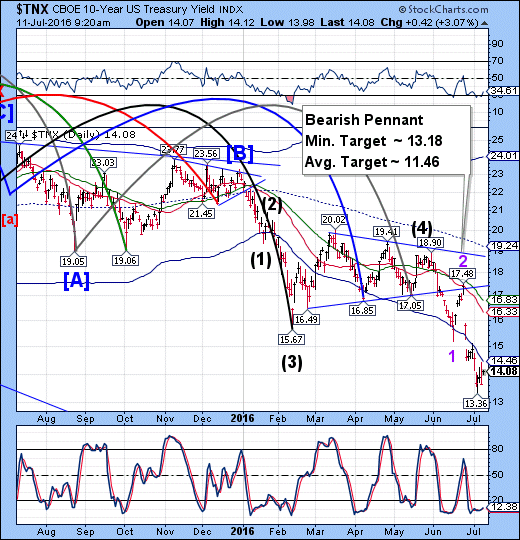

TNX bounced this morning at the news over the weekend. However, as strong as it may seem, there is no breakout. In fact, this is rather typical Wave (3) behavior. Note that it is testing the underside of the Cycle Bottom. Once the oversold condition is relieved, it is likely to resume its decline in a much stronger fashion.

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.