Is the Stock Market Rally Over?

Stock-Markets / Stock Markets 2016 Jul 08, 2016 - 09:47 AM GMT It appears that SPX may be waiting for the Jobs Report tomorrow morning at 8:30 am to reveal its intent. This is my primary Wave structure for SPX. It follows an irregular Wave pattern that fits within the Orthodox Broadening Top. Although the Broadening Top allows for a probe to or beyond 2120.55, but does not require it. As it stands, Wave [v] of 5 is very nearly equal to Wave [i] of 5, satisfying a wave relationship and indicating a probable completion.

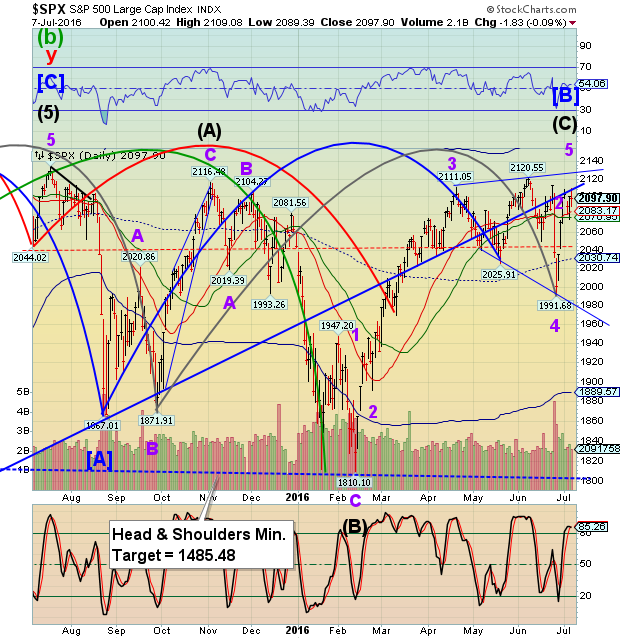

It appears that SPX may be waiting for the Jobs Report tomorrow morning at 8:30 am to reveal its intent. This is my primary Wave structure for SPX. It follows an irregular Wave pattern that fits within the Orthodox Broadening Top. Although the Broadening Top allows for a probe to or beyond 2120.55, but does not require it. As it stands, Wave [v] of 5 is very nearly equal to Wave [i] of 5, satisfying a wave relationship and indicating a probable completion.

Should today’s high be the top, we may see an 8.6 day decline to July 19, which appears to be a Trading cycle low. The initial target appears to be near 1931.00, but it could go much lower. A suggested low may be near the Cycle bottom support at 1889.57.

A market top must have agreement across multiple currencies in order to effect a true trend change. In this case, the SPX/XEU gives a good example of a probable trend change about to take place. Should the USD continue its decline to 90.50, this would be a double whammy on Europeans fleeing into the SPX as a safe haven. The SPX peaked out in Yen by mid-April, so ther two major currencies support the decline in SPX.

The only currency in which the SPX is appreciating rapidly is the British Pound Sterling. Even that trend may take a breather while SPX declines.

There you have it. The rally may be over, or nearly so. Let’s see if tomorrow morning’s news is enough of a catalyst to put some distance in this decline.

I may not be able to report to you all day tomorrow, since Iam involved in a day trip to Indiana. The Weekend Update is my next scheduled project.

Regards,Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.