Gold Price Continues to Move Higher : Stunning GLD Demand

Commodities / Gold and Silver 2016 Jul 06, 2016 - 07:20 AM GMTBy: Dan_Norcini

Safe haven gold continues its strong showing as plummeting interest rates and shaky global equity markets are creating a strong bid in this market.

Safe haven gold continues its strong showing as plummeting interest rates and shaky global equity markets are creating a strong bid in this market.

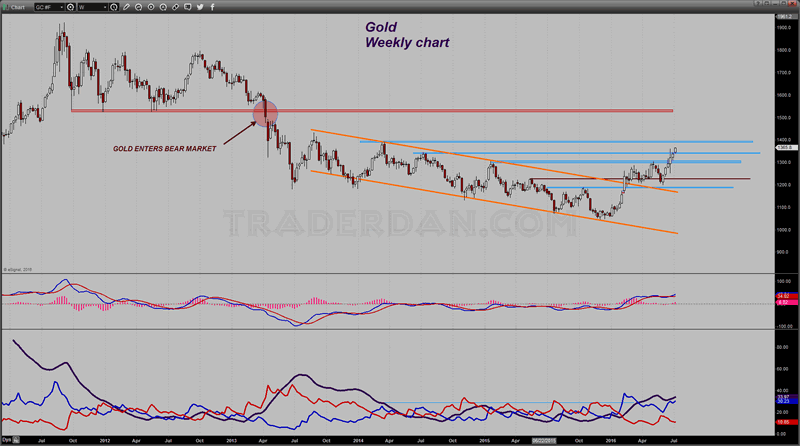

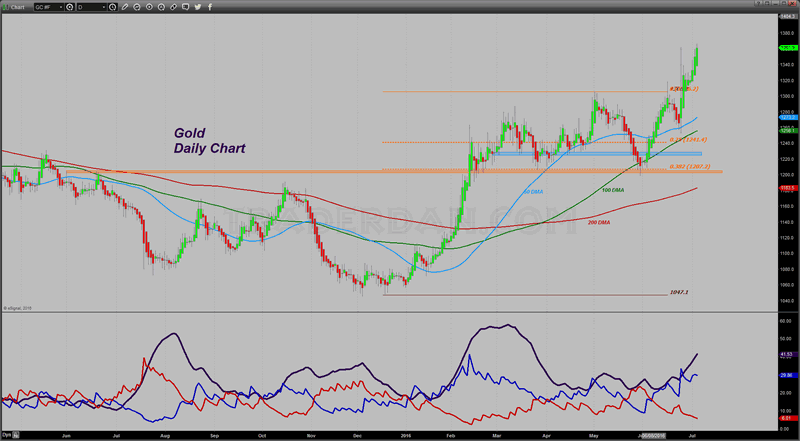

Gold pushed up towards last week’s high and in the process pushed through yet another overhead resistance level in the $1345-$1350 level.

Based on what I can see from this chart, there appears to be little resistance in its path until closer to the $1385 level. Above that lies psychologically significant $1400.

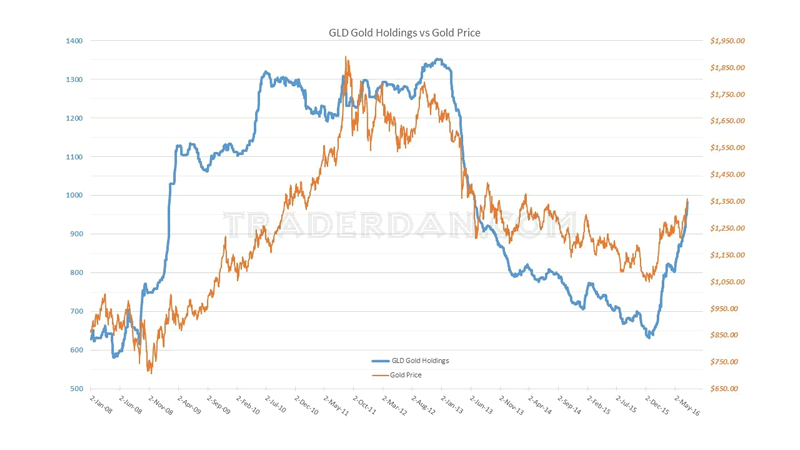

The real kicker for today however was the massive surge in reported GLD holdings. A whopping 28.8 tons of gold were reportedly added to GLD. I have not gone back to check my database but I suspect this might be very close to a record one day total or if not, a new record in itself. Gold holdings are now at 982.7 tons, the highest level since June 2013.

This is absolutely phenomenal demand.

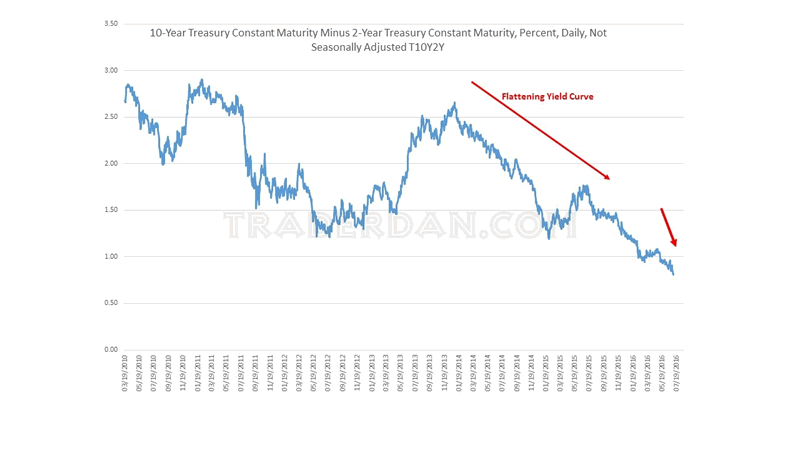

In my view, this is all traceable to the collapse in interest rates. The yield curve is growing flatter and has broken into yet another new low.

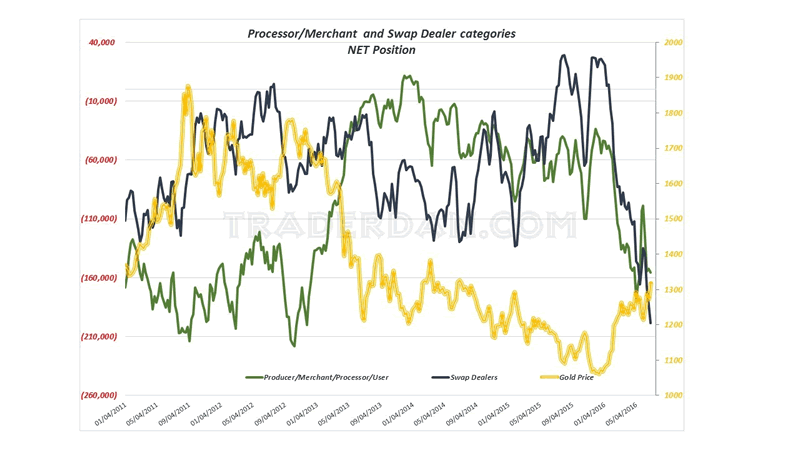

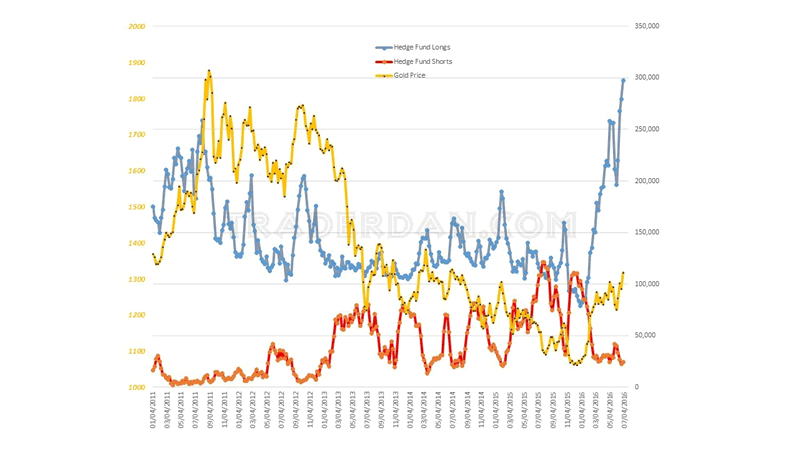

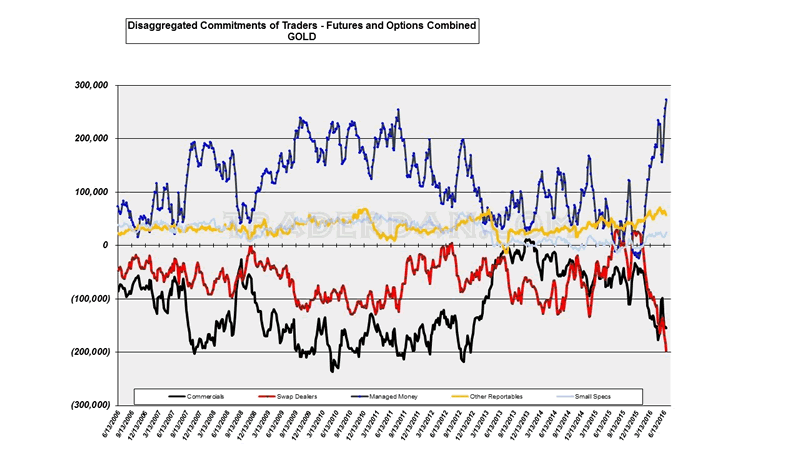

Simply put – there is no opportunity cost in owning gold at this time nor is there any particular reason to be aggressively selling the metal. This is in spite of the record high fund long exposure.

These numbers are already outdated as it has been a full week now since the COT data graphed above was reported. There is no doubt in my mind that the hedge funds have piled on even more longs. And why should they not given the environment?

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.