European Bank Stocks Plunge! It’s Not The Brexit Stupid

Stock-Markets / Financial Crisis 2016 Jul 06, 2016 - 07:12 AM GMTBy: James_Quinn

Just over a week ago the world was coming unglued, as enough British citizens grew a pair and spit in the face of the EU establishment and global elite by voting to exit the EU. The fear mongering by central bankers and their puppet political hacks failed to deter people who have become sick and tired of being abused and pillaged by bureaucrats working on behalf of bankers and billionaires.

Just over a week ago the world was coming unglued, as enough British citizens grew a pair and spit in the face of the EU establishment and global elite by voting to exit the EU. The fear mongering by central bankers and their puppet political hacks failed to deter people who have become sick and tired of being abused and pillaged by bureaucrats working on behalf of bankers and billionaires.

Stock markets around the world plummeted on Thursday and Friday. The world braced for another Black Monday. The phone lines were buzzing between central bankers around the world over the weekend as their banker constituents demanded relief. If one thing has been proven over the last seven years, its a coordinated effort between central bankers and Wall Street banks to rig the stock market higher can work over a short time period.

The titans of finance were able to once again confound short-sellers and the prophets of doom with a 5% surge from the Friday lows over the next week. It was surely a coincidence the Fed declared all Wall Street banks, safe, sound, and capable of buying back their stocks to the tune of billions early in the week.

These insolvent zombies were now free to borrow billions to buy back their overvalued stocks, destroying shareholder value, while boosting executive compensation. Poor Jamie Dimon is struggling to get by on his $27 million per year. The Wall Street banks obliged by immediately announcing multi-billion dollar buyback schemes to capitalize on the short-term trading mentality of the 30 year old MBA trading geniuses who bought the news without worrying about the actual value of the stocks they were buying.

The stock prices of the biggest banks in the world rose in unison, as the lemming traders use the same HFT programs and the same illogical thought process. By the end of the week Brexit meant nothing as far as the markets were concerned. And they are probably right. Brexit was just the latest distraction to keep the masses focused on the wrong things, as the scoundrels continue to pillage the wealth of the people.

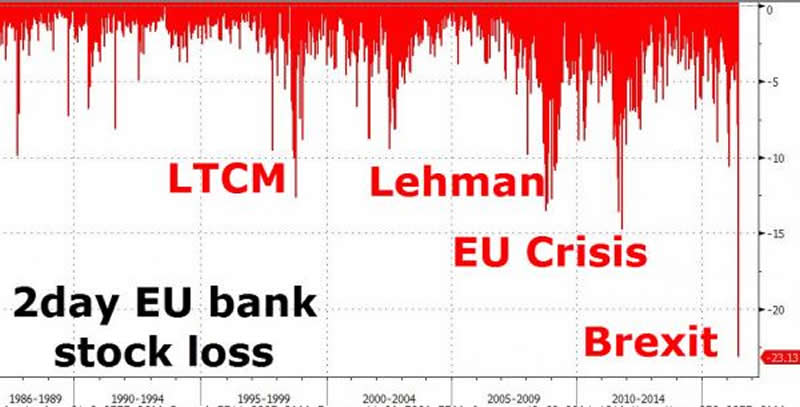

The largest banks in the world have experienced large declines over the last year, before Brexit ever entered the lexicon. Even after the central banker induced bounce last week, the price action of the largest banks in the world over the last year reflect an impending financial crisis. The truth is the Fed’s report on the health of banks is nothing but propaganda to keep the masses sedated. Without the suspension of mark to market rules in March 2009, every major bank in the world would have been liquidated in bankruptcy. Anyone who thinks these banks are healthy is either brain dead or dependent upon the establishment for their sustenance.

| % Change since 7/15 | |

| JP Morgan | -13.1% |

| Bank of America | -28.7% |

| Wells Fargo | -20.1% |

| Citigroup | -30.2% |

| Barclays | -59.9% |

| Deutsche Bank | -57.9% |

| HSBC | -32.8% |

| BNP | -34.0% |

| Mitsubishi Bank | -50.0% |

The EU economic situation still reflects depression conditions across most of the continent. Europe is drowning in bad debt as their largest banks (Deutsche Bank, Barclays, BNP, all Italian banks) are effectively insolvent and are propped up by the EU central bank. Greece was never fixed. Nothing has been fixed. The little people continue to suffer, while the Brussels bureaucrats fiddle and delay the inevitable implosion by replacing old bad debt with new bad debt. The idiocy of allowing millions of refugees to flood the continent when their socialist paradise is already bankrupt, is beyond comprehension for rational thinking people.

Brexit was nothing more than a reaction to the political corruption of the establishment and the economic policies (bank bailouts, ZIRP, QE, NIRP) jammed down the people’s throats by the rich to benefit the rich. The middle and lower classes around the world have been screwed over by the bankers and their captured politicians. The anti-establishment sentiment is spreading like wildfire and is likely to set off a firestorm which will eventually burn down the palaces of the ruling elite. But, in the meantime, these greedy myopic sociopathic bastards will use every means necessary to retain their power, control of the system and their immense riches.

The stock market is their sole gauge of success or failure. The Federal Reserve and their central banker brethren in Japan, China and Europe know they are running nothing but a confidence game based upon their ability to keep their debt based ponzi scheme running for a little while longer. Their fear is palpable. They’ve tried every monetary trick in their briefcases. They have failed to revive the real economy, but that was a secondary goal. Their job was to revive the wealth of their banker owners and the billionaire class who run the show. Keeping the stock market elevated has become their one and only goal.

Confidence in clueless academics like Yellen is dwindling. Anger is building among the hoi polloi. They are sick of getting pissed on, while the politicians and bankers tell them its just rain. Brexit was another crack in the ice. I was not surprised by the stock market recovery. When Bear Stearns collapsed in March 2008 the market sold off, but quickly recovered all its losses. Six months later the world blew sky high. Jim Cramer and his slimy ilk were bullish the whole way down.

Brexit is just a symptom of the disease eating away at the fabric of our global economy. Lehman’s collapse was not the cause of the 2008 worldwide financial crisis. It was just the excuse for something that was going to happen no matter what. Bad debt, bad bankers, bad regulators, bad politicians, media cheer leading, and a willfully ignorant populace were a toxic combination – and it’s worse today.

The always thoughtful and honest John Hussman points out the coming stock market crash will have nothing to do with Brexit or any other excuse used by the mainstream media to obscure the truth. It’s the extreme valuations that will result in the stock market falling.

First things first. While the full attention of financial market participants is focused on “Brexit” – last week’s British referendum to exit the European Union – the singular factor to recognize here is that the vulnerability of the financial markets to steep losses has very little to do with Brexit per se. Rather, years of yield-seeking speculation, encouraged by central banks, had already brought the financial markets to a precipice prior to last week’s vote. It’s not entirely clear whether Brexit is a sufficient catalyst to burst the bubble, as we recall that the failure of Bear Stearns in early-2008 was followed by a period of calm before the crisis was sealed by Lehman’s failure, and numerous dot-com stocks had already been obliterated by September 2000, when the tech bubble began its collapse in earnest. We’ll take the evidence as it comes, but we’re certainly defensive at present, for reasons that have little to do with Brexit at all.

The Brexit “recovery” was touted by the CNBC apparatchiks as proof all is well. They dare not point out a 10 year investment in Treasuries will net you a 1.35% yield (the lowest in history) and almost guaranteed capital losses. They certainly won’t pontificate on stocks being priced to deliver negative real returns over the next 10 years. You won’t hear any warnings about home prices now exceeding the 2005 peaks in most major markets, just prior to a 30% collapse. Commercial real estate is also at bubble levels. Every asset class is overvalued. There is no place to hide and the average Joe is unwittingly unaware of the danger looming just over the horizon. Hussman explains the peril awaiting the unprepared.

The high-level churning in global financial markets since late-2014 represents what we view as the top formation of the third speculative bubble in 16 years. For the U.S. market, valuation measures most reliably correlated with actual subsequent market returns pushed to the third most offensive extreme in history at the May 2015 market high, eclipsed only by the 2000 and 1929 peaks (see Choose Your Weapon for a ranking of various measures, and the chart series in Imagine for a current perspective). Because this speculative episode has infected nearly every asset class, rather than favoring tech stocks or mortgage securities as in previous bubbles, the median price/revenue ratio across individual U.S. stocks actually pushed to the most extreme level on record in recent weeks, before promptly retreating on Friday.

Brexit doesn’t matter. Japan’s deflationary depression doesn’t matter. The fraudulent US jobs recovery and falsified inflation figures don’t matter. The Chinese real estate collapse doesn’t matter. Low oil prices destroying the economies of Middle East countries, Russia, Venezuela, and Brazil don’t matter. Double digit unemployment and civil chaos across Europe don’t matter. Speeches by Yellen, Draghi, and Kuroda attempting to prop up markets don’t matter. Mainstream corporate media propaganda about economic growth doesn’t matter.

The latent risk is already in place. Total global debt is now $70 trillion higher than it was in 2007, a 50% increase. Real median household income is lower than it was in 2007, while rent, food, healthcare, and taxes have risen dramatically. QE, ZIRP, and a myriad of other Keynesian “solutions” have failed miserably, while piling unpayable debt on top of unpayable debt. With corporate profits plunging, all economic indicators flashing red, consumers tapped out, confidence in leaders waning, and stock valuations at extreme levels, the plunge through thin ice is inevitable. The trigger is inconsequential, as Hussman points out.

“Imagine the error of skating on thin ice and plunging through. While we might examine the hole in the ice in hindsight, and find some particular fracture that contributed to the collapse, this is much like looking for the particular pebble of sand that triggers an avalanche, or the specific vibration that triggers an earthquake. In each case, the collapse actually reflects the expression of sub-surface conditions that were already in place long before the collapse – the realization of previously latent risks.

Finding the specific trigger that causes the skaters to plunge through the ice isn’t particularly informative. The fact is that catastrophe is inevitable the moment the skaters ignore the latent risk, or rely on faulty evidence to conclude that the ice is stable. The fracture in some particular span of ice is just one of numerous other spots that might have otherwise given way if the skaters had chosen a different course. Hitting that spot creates the specific occasion for the underlying risk to be expressed, but an unfortunate outcome was already inevitable much earlier.”

The dead EU bounce produced by central bank coordination, Wall Street buyback announcements, and hedge fund HFT machines buying the most shorted stocks, appears to have run its course. These rigged markets do not reflect fundamentals or valuations. They are controlled by traders and central bankers. Their movements are based on technical criteria programmed into Wall Street supercomputers by Ivy League MBAs. Their lemming like behavior works well on the way up, but not so good on the way down.

Deteriorating fundamentals, a two year topping distribution, and declining liquidity has set the stage for a market plunge. As Hussman points out, in a technical market where all players are following the exact same playbook, when certain levels are breached the bottom will fall out of this market and no one will step in to buy. It’s a long way down to fair value – at least 50%.

But for investors, the main objects of focus should be the condition of valuations and market action, particularly the status of market internals, and the position of the major indices relative to various trigger points that might result in concerted selling attempts by trend-followers. That’s particularly important since value-conscious investors will likely have little interest in absorbing shares at nearby prices.

The general public always underestimates the danger at market tops. Things have been going swimmingly well for those with substantial assets to gamble in the markets. As we entered 2008 the “experts” on Wall Street, in academia, and in the financial media predicted smooth sailing and 10% annual returns in perpetuity.

They called Bear Stearns a hiccup on the road to riches. The enormous mortgage control fraud being perpetrated by the largest banks in the world went unnoticed by Bernanke and his band of merry bankers. Paulson acted clueless. Bush muddled along in his moronic trance. Until the ice gave way and hundreds of millions went under and have never come back up. Brexit is a large crack in the ice. Italian banks are the next crack. Muslim refugees are a crack. Declining oil prices are a crack. There are dozens of potential triggers for the inevitable clearly foreseeable catastrophe.

As we saw with the Bernie Madoff ponzi scheme, it can go on for years with the willful disregard of regulators and co-conspirators (JP Morgan), the denial of reality by investors, and the illusion of stability provided by the ponzi masters. Once stress is applied and too many investors ask for their money at the same time, the collapse is sudden and catastrophic.

Hussman knows the EU is a ponzi scheme, their banks are insolvent, and collapse is inevitable. The EU leadership is attempting ever greater distortions to avoid the catastrophic collapse. Britain just asked for their money back. Referendums loom in other countries. They will not be the cause of the collapse. The fundamentally unsound and increasingly bankrupt system is the cause.

Think of the EU, in its current ill-structured form, as a kind of Ponzi scheme, and Britain as the guy who just asked for his money back. There are undoubtedly greater prospects for near-term disruption after last week’s vote, but the hallmark of a Ponzi scheme is the attempt to use progressively greater distortions in order to preserve a structure that is fundamentally unsound and increasingly bankrupt.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2016 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.