While You Were Watching 4th July Fireworks, Silver Surged Above $21

Commodities / Gold and Silver 2016 Jul 05, 2016 - 12:53 PM GMTBy: Jason_Hamlin

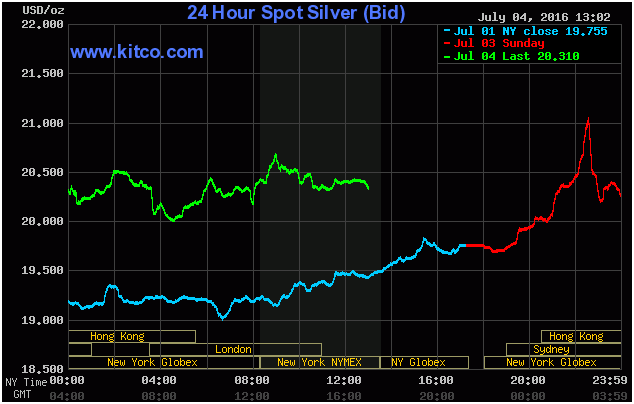

While most Americans were busy watching fireworks explode across the night sky, the real fireworks were taking place with the silver price. During Asian and London hours it surged over 7%, taking out psychological resistance at $20 and briefly surging above $21 for the first time since 2013!

Short squeeze anyone?

Silver confirmed its uptrend this past week by breaking through resistance at $18, at which point we added to our silver positions in expectation of the current move above $20 per ounce.

Technical stops were triggered overnight when silver rocketed through $20, forcing short sellers to cover their positions. Fresh buying also poured into the market as a close above $20 is a very bullish sign and suggests more upside ahead.

Another bullish factor for silver is the Chinese Yuan dropping to a record low. Some analysts believe a breakdown in Chinese foreign reserves is bullish for precious metals. The liquid portion of the reserves may be much smaller than widely believed and that situation is bearish for RMB and bullish for gold and silver.

We believe the silver price will make a new all-time high above $50/ounce within the next 12 months and climb above $100/ounce within the next few years. This is a conservative silver price forecast based on the duration and percentage increase of past silver bull market cycles, plus the historic gold/silver ratio. Many respected analysts believe that silver will ultimately climb above $500 per ounce by 2020. Nobody knows for sure exactly where the price will go, but I remain convinced that the upside potential is enormous compared to the downside risk.

Profit from the Leverage in Silver Mining Stocks

While the price has since slipped back a bit, silver is still holding steady above $20 on Monday morning. Silver mining stocks are likely to have a huge open tomorrow morning on this news. Remember, profit margins for miners are strongly leveraged to the advance in the silver price.

If a company produces silver at $15 per ounce and silver is trading at $18, they have a $3 profit margin. If the silver price goes up from $18 to $21, that is a 17% advance in the silver price. But the profit margin of the miner DOUBLES from $3 to $6! So, a 17% advance in the silver price equates to a 100% increase in the profit margin of the miner in this particular example.

This example helps to explain why silver miners are up an average of 150% in 2016 on a 40% advance in the silver price. Of course, some of the best-in-breed junior silver stocks are up 500% or more in the past six months! Get all of our top silver, gold, energy and agriculture picks by signing up for the Gold Stock Bull Premium Membership.

We work hard at uncovering undervalued silver stocks with the potential to generate huge returns for investors. Below is a picture of me touring a silver mine in Mexico that I ended up recommending to subscribers after meeting with management. You can benefit from our hard work and research, simply by subscribing here for less than $1 per day.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2016 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.