Deflation Is Blowing In On An Eastern Trade Wind

Economics / Deflation Jul 03, 2016 - 06:59 AM GMTBy: Raul_I_Meijer

Brexit is nowhere near the biggest challenge to western economies. And not just because it has devolved into a two-bit theater piece. Though we should not forget the value of that development: it lays bare the real Albion and the power hunger of its supposed leaders. From xenophobia and racism on the streets, to back-stabbing in dimly lit smoky backrooms, there’s not a states(wo)man in sight, and none will be forthcoming. Only sell-outs need apply.

Brexit is nowhere near the biggest challenge to western economies. And not just because it has devolved into a two-bit theater piece. Though we should not forget the value of that development: it lays bare the real Albion and the power hunger of its supposed leaders. From xenophobia and racism on the streets, to back-stabbing in dimly lit smoky backrooms, there’s not a states(wo)man in sight, and none will be forthcoming. Only sell-outs need apply.

The only person with an ounce of integrity left is Jeremy Corbyn, but his Labour party is dead, which is why he must fight off an entire horde of zombies. Unless Corbyn leaves labour and starts Podemos UK, he’s gone too. The current infighting on both the left and right means there is a unique window for something new, but Brits love what they think are their traditions, plus Corbyn has been Labour all his life, and he just won’t see it.

The main threat inside the EU isn’t Brexit either. It’s Italy. Whose banks sit on over 30% of all eurozone non-performing loans, while its GDP is about 10% of EU GDP. How they would defend it I don’t know, they’re probably counting on not having to, but Juncker and Tusk’s European Commission has apparently approved a scheme worth €150 billion that will allow these banks to issue quasi-sovereign bonds when they come under attack. An attack that is now even more guaranteed to occcur than before.

Still, none of Europe’s internal affairs have anything on what’s coming in from the east. Reading between the lines of Japan’s Tankan survey numbers there is only one possible conclusion: the ongoing and ever more costly utter failure of Abenomics continues unabated.

It’s developing in pretty much the exact way I said it would when Shinzo Abe first announced the policies in late 2012. Not that it was such a brilliant insight, all you had to know is that Abe and his central bank head Kuroda don’t understand what their mastodont problem, deflation, actually is, and that means they are powerless to solve it.

That Abe said somewhere along the way that all that was needed was his people’s confidence to make Abenomics work, says more than enough. The multiple flip-flops over a sales-tax increase say the rest. People don’t become more confident just because someone tells them to; that has the opposite effect. Deflation results from reduced spending, which in turn comes from not only decreasing confidence as well as a decrease in money people have available to spend.

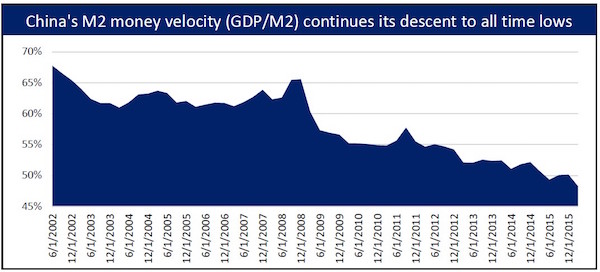

That modern economics sees everything not spent as ‘savings’ adds significantly to the failure -on the part of Abe, Kuroda and just about everyone else- to understand what happened in Japan over the past 2-3 decades. To repeat once again, inflation/deflation is the velocity of money multiplied by money- and credit supply. The latter factor has in general gone through the roof, but that means zilch if the former -velocity- tanks.

That this velocity is -still- tanking, in Japan as well as in the western world, is due to, more than anything else, an unparalleled surge in debt. At some point, that will catch up with any economy and society. Even if they are growing, which our economies are not. Growth has been replaced with credit, and credit is debt. It’s safe to say that money velocity cannot possibly ‘recover’ until large swaths of debt have been cancelled, one way or another.

For Japan we saw this week that “..household spending fell for the third straight month in May and core consumer prices suffered their biggest annual drop since 2013..” (Reuters) while “..The Topix index dropped about 9% in June, plunging on June 24 with the Brexit vote, the most since the aftermath of the 2011 earthquake. The yen strengthened about 8% against the dollar in June..“ (Bloomberg).

Japan has an upper-house election in a little over a week, and it seems like Abe can still feel comfortable about his position. A remarkable thing. The country needs to stop digging, it’s in a more than 400% debt-to-GDP hole, but Abe won’t listen. The rising yen is suffocating what is left of the economy, as are the negative interest rates, but all the talk is about ‘further easing’.

Still, Japan is outta here, and this has been obvious for a long time to the more observant observer. In the case of China, it is a more recent phenomenon, and it will even be disputed for a while to come. It’s also one that will have a much more devastating effect on the west. We’ve seen problems in various markets in Singapore, Macau and Hong Kong, but the real issues on the mainland are still to be sprung on us.

Mainland stock exchanges are as good a place as any to begin with. The combined tally for Shanghai and Shenzhen looks like this -data till June 23-; yes, that’s a loss of over 40% in the past year.

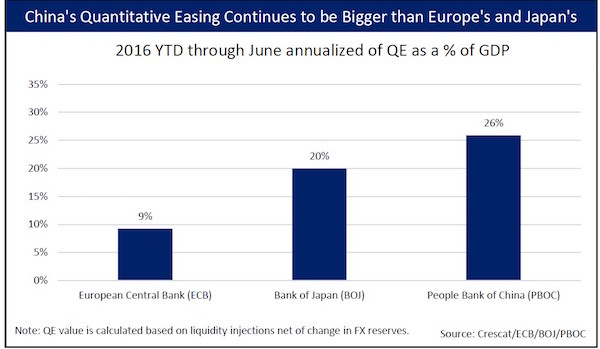

Beijing has been trying very hard to paper over these numbers, even quit supporting it all for a while through 2014, only to do a 180º when they didn’t like what they saw (foreign reserves drawdown), and now PBoC injections have gone bonkers: $316 billion in one month would mean $4 trillion on a yearly basis in what is really nothing but monopoly money.

Meanwhile, corporate bonds are, perhaps partly because of volatility, becoming an endangered species. Maybe the PBoC can do something there as well, the way Draghi does in Europe (must be high on the agenda), but there’s already so much bad debt we hardly dare watch.

China must and will try to keep boosting exports by devaluing the yuan. It’s just waiting for an opportunity to do it without being accused of currency manipulation. Perhaps it can create that opportunity?! Create a crisis and then use it?! Regardless, this Reuters headline yesterday sounded very tongue in cheek:

China To ‘Tolerate’ Weaker Yuan

Note: remember Japan above? The yen rose 8% against the USD just in June, as the yuan fell by just 4.5% in all of 2015 (6.8% over the past 2 years). Now you go figure what’s happening to Japan-China trade. And the yuan is still hugely overvalued. But the desire to be part of the IMF basket of currencies comes with obligations. Trump doesn’t help either.

I said in the beginning of this year that a 30% devaluation was something of a minimum, and that certainly continues to stand. So yeah, creating a crisis may be the only way out. An accident in the South China Sea perhaps. Combined with a ‘tolerance’ for a 50% weaker yuan….

All of the above leads us to the title of this essay: deflation is coming in from the east. China’s economy’s already in deflation, even though it will take some time yet to be acknowledged. A very ‘nice’ report from Crescat Capital provides a bunch of clues.

In July of 2014, we wrote about the huge imbalance with respect to China’s M2 money supply and nominal GDP relative to the US. At the time, China’s M2 money supply was 71% higher than the US but its economy was 56% smaller, which we said was an indication of the overvaluation of the Chinese currency. Since that time, the yuan has fallen by only 6.8% relative to the dollar. We haven’t seen anything yet.

Today, the circumstances have significantly worsened. Money supply has continued to grow faster than GDP. With over $30 trillion of assets in its banking system and an underappreciated non-performing loan problem, we are convinced that China is headed for a twin banking and currency crisis. Money velocity has reached historically low levels which reflects China’s extreme credit imbalance and its crimping impact on its ability to generate future real GDP growth.

Just as worrying as the immense amount of credit built up, China has been reporting major downward revisions in its balance of payments (BoP) accounts. For more than a decade, China had been reporting an impossible twin surplus in its BoP accounts. When we wrote about this issue in 2014, we emphasized the likelihood of massive illicit capital outflows that not been accounted for. At that time, according to the State Administration of Foreign Exchange of China (SAFE), China had accumulated a BoP imbalance that was close to $9.4 trillion surplus since 2000 which we believed represented capital outflows that should have been recorded in the capital account.

The same accumulated BoP number today, revised by SAFE several times since, is now a deficit of about $2.8 trillion. Essentially, with its revisions, the SAFE has acknowledged even more capital outflows over the last 16 years than we had initially identified. On the capital account side, there was a downward revision of $10.1 trillion – from a $4.2 trillion surplus to a $5.9 trillion deficit. On the current account side, the revisions show that Chinese exports have not been as strong as initially reported over the last decade and a half. China’s current account surplus has been reduced by $2.1 trillion– going from $5.1 trillion to $2.9 trillion over the last 16 years. What we initially considered to be a $9.4 trillion imbalance has been more than proven by a $12.2 trillion revision.

Those are some pretty damning numbers, if you sit on them for a bit. There was another graph that came with that report that takes us head first into deflationary territory. China’s velocity of money:

That is utterly devastating. It’s what we see in the US, EU and Japan too, but ‘we’ have thus far been able to export our deflation -to an extent- to … China. No more. China has started exporting its own deflation to the west. Beijing MUST devalue its currency anywhere in the range of 30-50% or its export sector will collapse. It is not difficult.

That it will have to achieve this despite the objections of Donald Trump and the IMF is just a minor pain; Xi Jinping has more pressing matters on his mind. Like pitchforks.

The ‘normal’ response in economics would be: in order to fight deflation, increase consumer spending (aka raise money velocity)! But as we’ve seen with Japan, that’s much easier said than done. Because there are reasons people are not spending. And the only way to overcome that is to guarantee them a good income for a solid time into the future, in an economy that induces confidence.

That is not happening in Japan, or the US or EU, and it’s now gone in China too. Beijing has another additional issue that (formerly) rich countries don’t have. This is from a recent Marketwatch article on Andy Xie:

China Is Headed For A 1929-Style Depression

[..] Xie said China’s trajectory instead resembles the one that led to the Great Depression, when the expansion of credit, loose monetary policy and a widespread belief that asset prices would never fall contributed to rampant speculation that ended with a crippling market crash. China in 2016 looks much the same, according to Xie, with half of the country’s debt propping up real-estate prices and heavy leverage in the stock market – indicating that conditions are ripe for a correction. “The government is allowing speculation by providing cheap financing .. China “is riding a tiger and is terrified of a crash. So it keeps pumping cash into the economy. It is difficult to see how China can avoid a crisis.”

Yeah, China is supposed to be going from an export driven- to a consumer driven economy. Problem with that seems to be that those consumers would need money to spend, and to earn that money they would need to work in export industries (since there is not nearly enough domestic demand). Bit of a Catch 22. And definitely not one you would want to find yourself in when the global economy is tanking.

The more monopoly money Beijing prints, the more pressure there will be on the yuan. And if they themselves don’t devalue the yuan, the markets will do it for them.

Kyle Bass says China’s $3 trillion corporate bond market is “freezing up” (see the third graph above), which threatens to undermine the $3.5 trillion market for the wealth management products Chinese mom and pops invest in. He expects a whopping $3 trillion in bank losses, an amount equal to the entire corporate bond market (!) “to trigger a bailout, with the central bank slashing reserve requirements, cutting the deposit rate to zero and expanding its balance sheet – all of which will weigh on the yuan.”

With the yuan down by as much as it would seem to be on course for, wages and prices in the west will plummet. This wave of deflation is set to hit western economies already in deflation and already drowning in private debt, and therefore equipped with severely weakened defenses.

Leonard Cohen once wrote a song called “Democracy Is Coming To The USA”. Maybe someone can do a version that says deflation is coming too. Not sure that’s good for democracy, though.

Have a great Holiday Weekend.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2016 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.