Stock Market SPX Rally Nearing its End as DB Gets Slammed

Stock-Markets / Stock Markets 2016 Jun 30, 2016 - 02:55 PM GMT The SPX Premarket is up just a point. The rally may be over, or nearly so. There is a 50% probability of a last probe to the 50-day Moving Average at 2076.45 or slightly higher. Today has a minor pivot, but tomorrow’s pivot is very strong. My best analysis suggests a flat to mildly down day with the fireworks beginning tomorrow.

The SPX Premarket is up just a point. The rally may be over, or nearly so. There is a 50% probability of a last probe to the 50-day Moving Average at 2076.45 or slightly higher. Today has a minor pivot, but tomorrow’s pivot is very strong. My best analysis suggests a flat to mildly down day with the fireworks beginning tomorrow.

Perhaps a catalyst may come into play, motivating mutual funds and hedge funds to sell into the rally before the month-end. The anti-window dressing.

The VIX has likely reached its low and may be ready for a ramp higher.

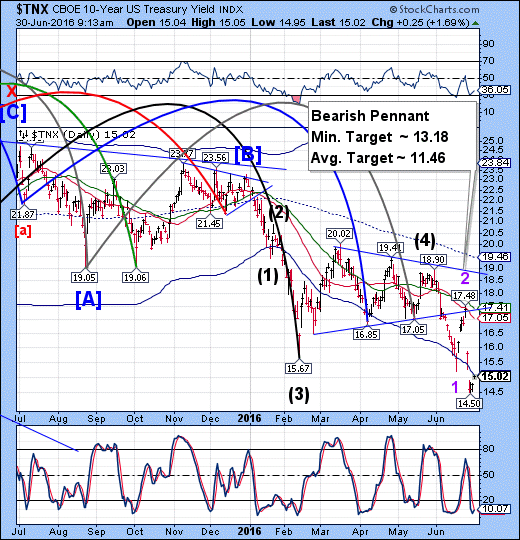

TNX is making the smallest of retracements and appears to be stopped at the Cycle Bottom. It need to relieve its oversold condition, but may not be able to as Wave 3 begins in earnest.

BKX may provide the catalyst for another leg down in equities. It has made a 43.7% retracement so far and may not have much more energy to expend on a lost cause.

ZeroHedge reports, “Despite all the exuberance over the Brexit bounce in US (and UK) equities, never minds bonds, FX, and credit being far less enthusiastic, Deutsche Bank is plunging once again this morning. Having failed The Fed's stress test for the second year running and been diagnosed by The IMF as the world's most systemically dangerous financial entity, the giant German bank is getting slammed down almost 4% today, back near record lows as its 'Lehman-esque' path to devastation continues.

This is far from over!!

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.