Stock Market SPX Below Mid-Cycle Support

Stock-Markets / Stock Markets 2016 Jun 27, 2016 - 03:26 PM GMT The SPX Premarket fell beneath mid-Cycle support/resistance this morning at 2026.59. As I write, it has bounced to retest the resistance. It appears likely that it may hold.

The SPX Premarket fell beneath mid-Cycle support/resistance this morning at 2026.59. As I write, it has bounced to retest the resistance. It appears likely that it may hold.

ZeroHedge reports, “US equity futures are tumbling at the open following Cable and USDJPY's dive. Dow futures dropped 100 points (down 900 points from pre-Brexit highs) and broke below Friday's early crash lows...”

You may recall that I had been expecting a major cycle bottom on or around October 19, 2015. Instead, we had the bottom on September 29, about 22 days early, due to a concerted effort of multiple central banks to reverse the decline. I have also stated that the average Master cycle length is 258 days. In other words, shorter cycles are followed by longer Cycles, as the revert back to the mean.

The current Master Cycle low was due during the week of June 13. One is tempted to mark the June 16 low (Wave 1) as the Master Cycle low. However, the Pi Cycle also interacts with the Master Cycle, often “guiding” the Master Cycle low as it did on January 20. The next Pi Cycle low is due on July 3, three weeks later than June 13. Three weeks from the June 16 low is July 7, so we have a range of days between July 5 and July 7 in which we may expect to see the next Master Cycle low. In doing so, the Cycles are reverting to the mean.

VIX futures are modestly down, perhaps testing the Cycle Top support at 25.09. The Pennant formation suggests that VIS is going much higher this week.

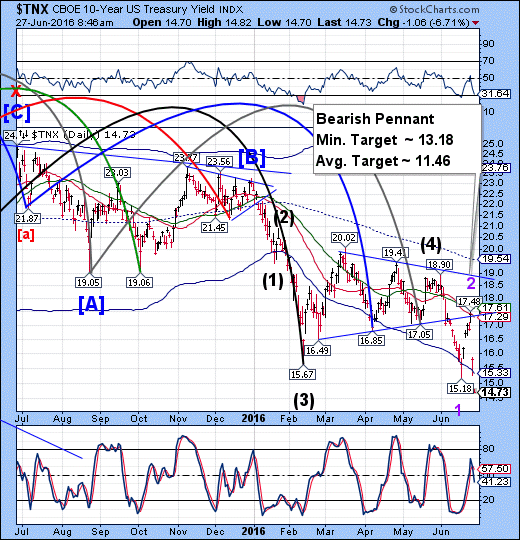

TNX has a similar Wave/Cycle pattern as the SPX and may also have its Master cycle low shortly after July 3, also tis Pi date. It’s Master Cycle low last Fall should have fallen on October 15. This suggests that we may see the TNX low a little earlier than in the SPX.

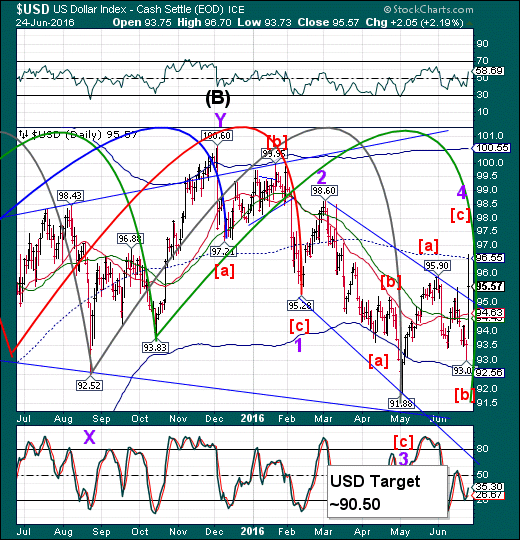

USD appears to be retesting its mid-Cycle resistance at 96.56 this morning by reaching a high of 96.52. It may have only completed Wave 4 of sn ending Diagonal. Wave 5 may take two months or more, suggesting a low in August. My Cycles Model suggests that low may occur on the week of August 23.

Having a declining Dollar may reduce the attractiveness of dollar-denominated assets.

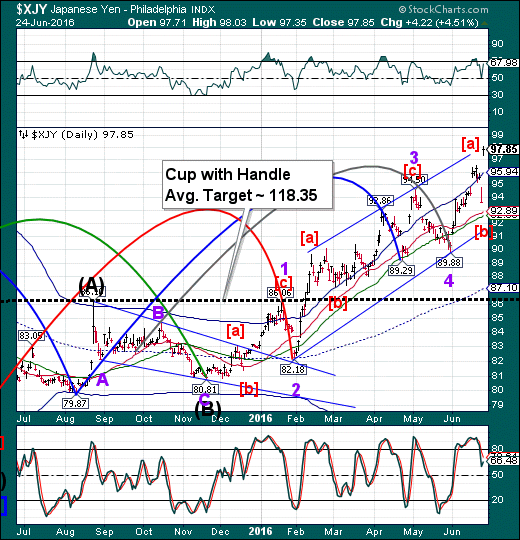

There’s not much discussion, yet, but the Yen has an interesting Cup with Handle formation that might answer our questions about safe havens. So far, the outlook on the Yen appears to be the correct one. There is a period of strength in the Yen that expires on August 25.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.