Another Stocks Bear Market?

Stock-Markets / Stock Markets 2016 Jun 27, 2016 - 10:36 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: A lengthy correction is most likely underway!

SPX Intermediate trend: Brexit has most likely initiated a decline of intermediate nature.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

"ANOTHER" BEAR MARKET?

Market Overview

Last week, the British people voted to leave the EU. Rarely have so many experts and professionals been so wrong about the outcome of this referendum, and its immediate impact - an estimated loss of 2+ trillion dollars in value by stock markets around the world by Friday's close - was undoubtedly far greater than it would have been if even a neutral stance had been taken ahead of the voting. But the bookies, the polls and expert opinions could only see "remain" as the logical outcome. In the US, the Dow shed 611 points, and the SPX 76!

Janet Yellen, among many, thought that Brexit could have a negative economic impact on the world's economies, including that of the USA, so don't expect the bearish mood to change anytime soon since no one has a clear idea of what the full consequences of this move will be. Furthermore, it may take months, if not years, for some clarity to emerge. You know how much the stock market loves uncertainty! It is probably fair to say that those who have been predicting the onset of a bear market have their best opportunity yet, of being correct. If the selling continues for any length of time, this will also be the third attempt that prices have tried to break out of their broad 1800-2135 trading range since the April 2015 high, and you know what they say about the third time ... it usually succeeds! But we'll let the market itself make that decision as we observe, analyze, and comment. For the moment, we can probably say that the weekly, daily, and hourly trends of the SPX are all down, and this will be reinforced if we break below the 2026 level decisively.

SPX Chart Analysis

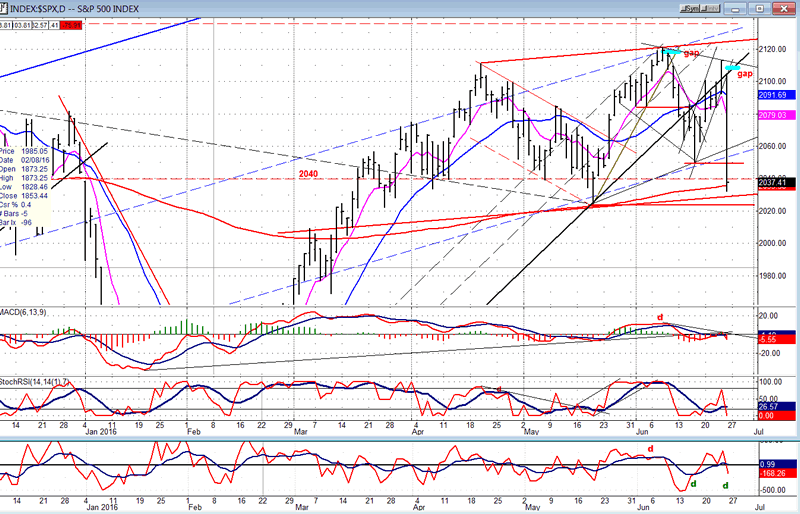

Daily chart

After nearly five months of rallying from 1810, SPX broke its trend line and started to correct. Deceleration had been evident for the past month and there was every reason to believe that a significant reversal was taking place. However, the initial decline found support above its recent low, and gave every indication of extending its uptrend -- probably to a new all-time high -- if Britain voted to stay in the EU. Even last Thursday, on the day that the voting took place, the index opened with a gap and closed twenty points higher, on its high of the day! Well, you know the rest. After the results started to go for "leave" the futures, which had risen to 2127 during the early session, started to drop and continued all the way down to 2007 before bargain hunters appeared and rallied it back to 2046. Selling resumed shortly afterwards, and a drop of 76 points was recorded at the close -- about the same amount as the 8/24/15 (net) decline.

SPX found support on its 233-DMA, just above the lower channel line created by a (red) parallel drawn across the two short-term tops. Since that level corresponds to a minor count across the distribution which took place over the past three days of trading, we could hold that area for a little while before dropping lower to satisfy the full short-term count. With the weekly oscillators extending their declines, and the daily and hourly oscillators rolling over, it is unlikely that the selling is over. This practically ensures that the 2026 level will be penetrated...with all the negative consequences that it implies.

If the entire three months of trading above 2026 is considered distribution, a significant downtrend lies ahead of us when that level is finally broken.

This chart and others below, are courtesy of QCharts.com.

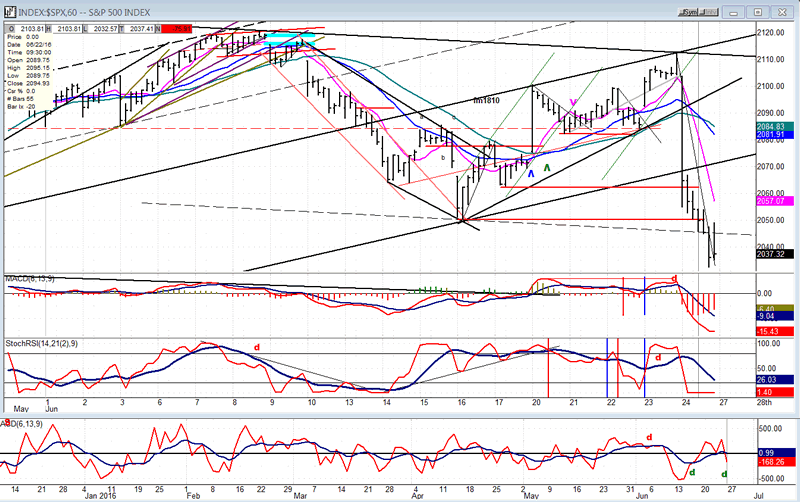

Hourly chart

As we reached our first minor projection target of about 2031, the SPX bounced 13 points in the last hour, but it lost most of it in the last five minutes of trading, and the rest of it (and more) after the close. That should almost ensure a negative opening on Monday, especially since only a minor phase of distribution has, thus far, been satisfied. With the futures remaining near the target price, it's possible that this will be only a partial minor corrective pattern, followed by its completion in the form of a brief rally on Monday morning. But with the fierce downside momentum, I would not bet on it unless some positive comments are made over the weekend. (I just read that petitions to the Parliament for a second referendum is now 2.7 million???)

With the brief bounce, the steep hourly downtrend finally gave us the opportunity to draw a trend line which was broken in the last hour. However, it is very steep and the normal trend usually involves at least two trend line breaks, and more often three before a reversal takes place. With the market so oversold on a near-term basis, a brief bounce is possible. Also, note that the hourly oscillator does show some positive divergence.

We need to see Monday's opening before engaging in further short-term analysis.

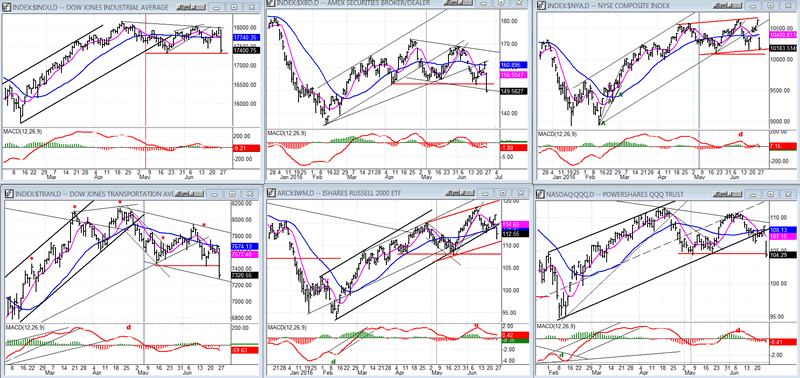

SPX et al... (daily

Of the six leading/confirming indexes shown below, three have already broken the comparable 2026 SPX level. However, this is not sufficient to declare a permanent break. It normally takes 3 daily closes below (or above) a trend line for the penetration to be considered valid. And, if we are starting something serious, all these indices will have to participate.

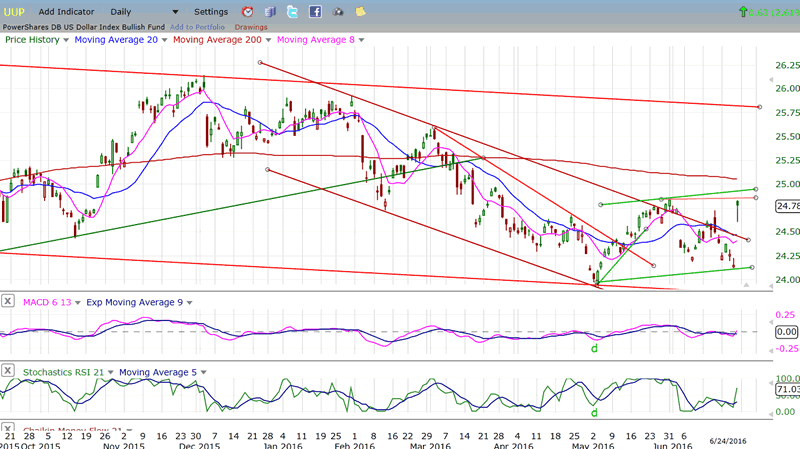

UUP (dollar ETF)

The dollar got a boost from Brexit which propelled it beyond the borders of the corrective channel. Was this a flash-in-the-pan, or a genuine attempt at resuming its uptrend? With the markets in a state of chaos, it is best to wait for the dust to settle before making solid predictions.

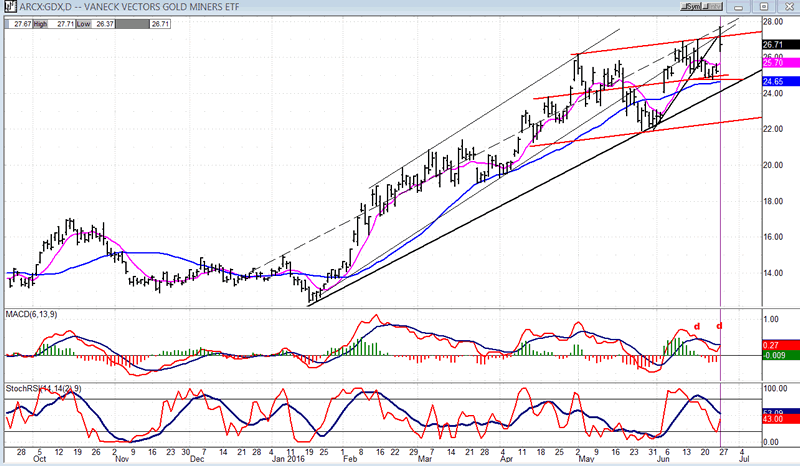

GDX (Gold Miners ETF)

I am going to start posting a chart of GDX instead of GLD. It does not follow gold tick for tick but, for those who are adventurous, it has trading ramifications which are far more interesting. Friday's surge encountered resistance at the top of what looks like a topping formation. If this is the start of a new uptrend, it will have to clear that resistance completely and start trading outside of it. The odds are against it at the moment.

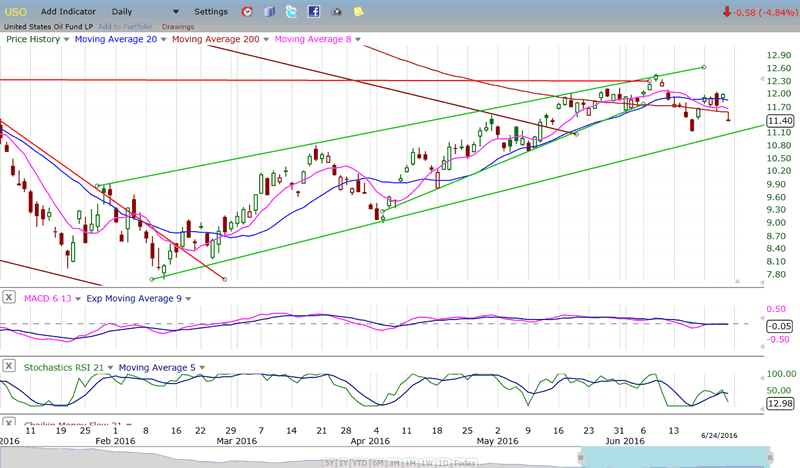

USO (US Oil Trust)

USO went the other way on Brexit. It makes sense fundamentally as well as technically. USO should now challenge its main uptrend line and, if penetrated, this would herald the beginning of a prolonged consolidation process.

Summary

"The British referendum should have a significant influence on the markets this coming week. It is best to keep from making specific predictions, especially about the intermediate trend, until after the results have been announced."

In the light of what happened Friday, last week's summary turned out to be words of wisdom. The prospects for the stock market bulls have dulled considerably as a result. The only thing that would change the situation would be that a second referendum would supersede the first. At this time, the possibility of this happening are bleak to none.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.