Financial Markets Roiled as Britain Votes Itself Out of EU

Stock-Markets / Stock Markets 2016 Jun 25, 2016 - 06:34 PM GMTBy: The_Gold_Report

Britain has voted to exit the European Union and its prime minister has resigned in the wake of the Brexit vote. The markets have, so far, reflected the world's uneasy reaction to the event. But it is early days, says newsletter writer and technical analyst Clive Maund, who offers his views on the day after Brexit.

Britain has voted to exit the European Union and its prime minister has resigned in the wake of the Brexit vote. The markets have, so far, reflected the world's uneasy reaction to the event. But it is early days, says newsletter writer and technical analyst Clive Maund, who offers his views on the day after Brexit.

Woke up to the stunning news this morning that Britain has voted by a narrow but clear majority to leave the European Union (EU). I had feared that the British electorate would be cowed into submission by the barrage of pro-Europe propaganda and scaremongering, like the Scots were at the time of the Scottish independence referendum, but they weren't—or at least sufficient of them weren't to assure a positive result.

Nevertheless, 48% still voted to stay in, which shows you how many gullible idiots there are out there—they are either that or in some way they are benefitting from the EU, by getting handouts etc.

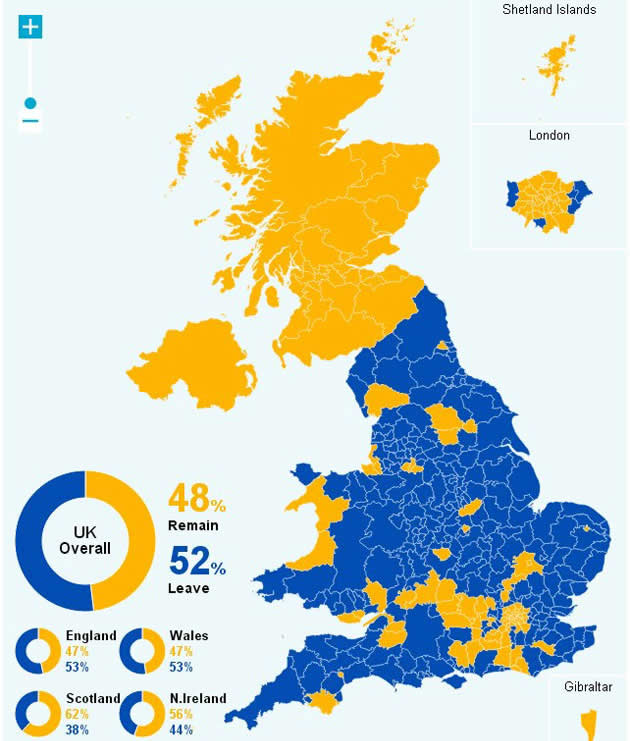

The election result map above is interesting, as it reveals that the whole of Scotland and Northern Ireland voted to stay in Europe; this shows that they are probably benefitting from EU handouts. Actually, in both the Scottish referendum a couple of years ago, and in the EU vote last night, the Scots showed about as much force as Longshanks' son, and none of the valor of William Wallace, as those of you familiar with the film "Braveheart" will understand.

It was amusing to watch upper-class buffoon David Cameron, the British prime minister, both admitting defeat over the EU vote and announcing that he was going to quit on the TV this morning—and not surprising considering that he has misread the mood of the population and made a fool of himself by standing up resolutely for the interests of the elites over the EU vote. Also weighing in was former European Central Bank president Jean Claude Trichet, who has made the claim that voters in EU countries are fed up with their national leaders, and not the EU itself, when the reverse is nearer to the truth.

The losers were engaged in a damage limitation exercise and trying to put on a brave face, but the plain fact of the matter is that the EU has just had a stake driven through its heart, and this corrupt, rotten and unaccountable coterie of crooks and parasites—and we are talking here about the EU administration and bureacracy, NOT European member states or European citizens—are now living on borrowed time. It is to be hoped that the populations of other EU states follow suit and drive them out as fast as possible.

If you want to see just how rotten the EU is, here is the link to that video I posted a couple of days ago, Brexit: The Movie, that you may not have seen. It's about an hour long, but worth watching.

Thus, we should not be upset that markets are plunging because of the UK Brexit, as the ruling classes throw a tantrum. So what if markets crash now? That was slated to happen at some point anyway, after years of fiscal abuse, so why not get it over with?

Most of the predictions made before the Brexit vote in The Brexit Vote and the Markets have turned out to be correct, with the dollar and dollar bull ETFs soaring and commodities like oil dropping hard and stock markets plunging. The major exceptions are gold and silver, which is surprising given the huge rise in the dollar and gold's extreme COT structure. However, it's early days yet, and if we now see a full-blown market crash, the dollar could end up as "the only man left standing."

We’ll end with a link to an article about Nigel Farage, entitled Farage's Life's Work Comes to Fruition. Farage has campaigned for years for this day against tremendous resistance, and has endured an enormous amount of mockery and ridicule. Now he is successful: The establishment has no choice but to take him more seriously.

Many think that Trump has more chance of becoming the next U.S. president because of this result—see Brexit is proof that Trump will be the next President.

The big question now is whether the sharp drop in the markets can be contained and reversed, or whether this drop marks the start of something much more serious.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Map courtesy of Clive Maund

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.