Gold Falls Despite “Panic” Due To “Supply Issues” In Inter Bank Gold Market

Commodities / Gold and Silver 2016 Jun 22, 2016 - 03:00 PM GMTBy: GoldCore

Gold fell again today to its lowest in a week despite continuing uncertainty about the outcome of the Brexit referendum. This is contributing to very significant high net worth and institutional demand in recent days, particularly in the UK, which is leading to “panic” and “supply issues” in the interbank gold market.

Gold fell again today to its lowest in a week despite continuing uncertainty about the outcome of the Brexit referendum. This is contributing to very significant high net worth and institutional demand in recent days, particularly in the UK, which is leading to “panic” and “supply issues” in the interbank gold market.

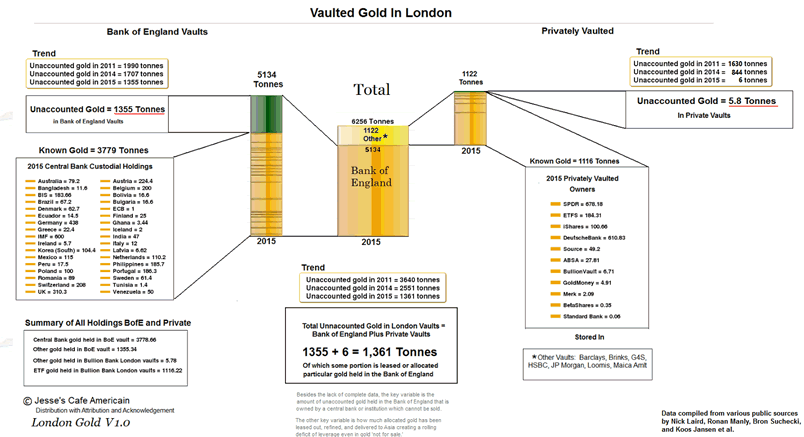

Supply issues which respected gold analysts and ourselves have warned in recent years were taking place, would deepen and would ultimately lead to a reset of gold prices to much higher levels.

Click chart to see

Increasing speculation that Britain may vote to stay in the European Union and hedge fund liquidations are being blamed for the recent price falls. However, bullion dealers such as GoldCore, mints and refineries that cater to the UK market have seen minimal selling this week and in fact there has been a surge in demand again this week.

We believe the price falls are due to hedge funds and banks liquidating positions and shorting the market. As ever, there is the risk that algo and high frequency trading (HFT) may be manipulating prices lower despite very robust physical demand and increasing liquidity issues in the interbank gold market.

Informed, senior sources at the highest level of the gold bullion industry have told us that there is “panic” in the inter bank or institutional gold market. According to the sources one of whom is from a leading Swiss gold refinery, we are in a “unique trading climate” that they have never seen before. This is not just due to Brexit but to “a number of factors” and so is likely to continue even after the Brexit referendum.

The market is subject to absolutely “unprecedented conditions” and a degree of illiquidity and “supply issues” not seen even in the immediate aftermath of September 11th, Lehman Brothers and the height of the Eurozone crisis.

Refineries and mints are being advised that bullion banks may take the unprecedented step of “suspending the trading of physical gold.” Premiums have risen on larger orders creating the situation where spreads are higher on larger orders. An example of this is that a 1,000 ounce order worth $12.66 million at current prices is trading at a premium of $0.33 per ounce over a smaller order of 500 ounces.

There is also warnings that stop loss orders above 5,000 ounces may not be filled at agreed prices and could be filled at much lower prices. A number of large liquidity providers in the gold market, such as Intl FC Stone, have increased margins.

Thus counter intuitively, larger high net worth and institutional orders are costing more than somewhat smaller relative orders. This has the effect of discouraging larger buy orders for physical – whether by accident or by design. “Officialdom” does not want surging gold prices in advance of the referendum due to the risks that this poses to the financial and monetary system and therefore prices may be being “capped” prior to the vote tomorrow.

This bodes well for prices in the aftermath of the vote – whether the UK votes to remain or leave in the EU.

Bullion banks “have been panicking” and advising that soon, they may no longer be able to quote prices on large gold bar orders. This response is previously unheard of and indicates the increasing illiquidity in the large gold bar market due to a recent surge in HNW, UHNW and institutional (wealth managers, hedge funds, banks etc) demand across the world coupled with already robust central bank demand.

The increasingly illiquid physical gold market where supply cannot keep up with demand underlines the importance of owning physical bullion coins and bars – either in your possession or having direct legal title to your individual coins and bars. Bullion should be owned in your name or your company’s name and be stored directly in the safest vaults in the safest jurisdictions in the world – outside the financial, banking system.

Gold Prices (LBMA AM)

22 June: USD 1,265.00, EUR 1,122.31 and GBP 862.98 per ounce

21 June: USD 1,280.80, EUR 1,129.67 and GBP 866.72 per ounce

20 June: USD 1,283.25, EUR 1,132.08 and GBP 877.49 per ounce

17 June: USD 1,284.50, EUR 1,142.05 and GBP 899.41 per ounce

16 June: USD 1,307.00, EUR 1,161.14 and GBP 922.01 per ounce

15 June: USD 1,282.00, EUR 1,141.49 and GBP 903.04 per ounce

Silver Prices (LBMA)

22 June: USD 17.20, EUR 15.23 and GBP 11.72 per ounce

21 June: USD 17.36, EUR 15.34 and GBP 11.78 per ounce

20 June: USD 17.34, EUR 15.30 and GBP 11.85 per ounce

17 June: USD 17.37, EUR 15.43 and GBP 12.19 per ounce

16 June: USD 17.71, EUR 15.79 and GBP 12.54 per ounce

15 June: USD 17.41, EUR 15.51 and GBP 12.26 per ounce

14 June: USD 17.25, EUR 15.37 and GBP 12.17 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.