Here’s a Trillion-Dollar Investment Opportunity for Those Few with No Debt

Companies / Credit Cards & Scoring Jun 22, 2016 - 02:42 PM GMTBy: John_Mauldin

BY TONY SAGAMI

BY TONY SAGAMI

Politicians and central bankers throw the word “trillion” around as if it were chump change, but a trillion dollars is a huge mountain of money.

A trillion is equal to a thousand billions (1,000 x 1,000,000,000).

1,000 = one thousand

1,000,000 = one million

1,000,000,000 = one billion

1,000,000,000,000 = one trillion

Here’s another way to look at a trillion dollars. If you earned $40,000 a year, it would take:

25 years to earn $1 million

25,000 years to earn $1 billion

25 million years to earn $1 trillion

Clearly, a trillion of anything is a lot. That’s why the headline below caught my attention.

Credit card debt will hit $1 trillion in 2016

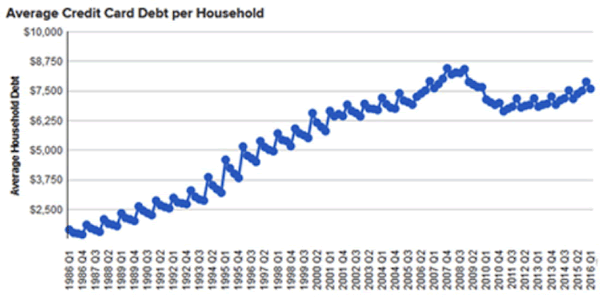

Credit card watchdog CardHub estimates that American credit card balances will hit $1 trillion in 2016, a debt burden that has never been reached before, not even during the go-go days of the dot-com boom.

Not only are Americans borrowing more, they are paying it back at a snail’s pace. Americans added an astounding $71 billion in credit card debt in 2015 and repaid just $26.8 billion during the first quarter of 2016: the smallest first-quarter paydown since 2008.

Relative to Q1 2015: -23%

Relative to Q1 2014: -17%

Relative to Q1 2013: -18%

Relative to Q1 2012: -22%

Relative to Q1 2011: -18%

Relative to Q1 2010: -30%

Relative to Q1 2009: -160%

Disturbingly and surprisingly, middle-aged Americans hold the highest credit card debt. The average 45- to 54-year-old American owes $9,000 on credit cards—50% more than the average Millennial!

Student and automotive loans are already past the $1 trillion mark

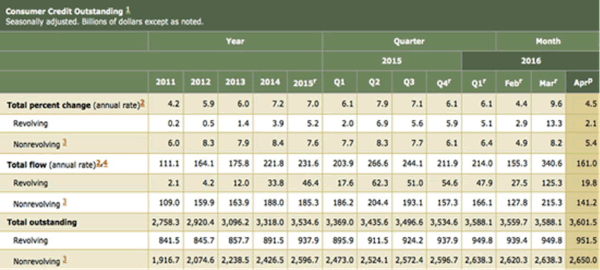

But credit cards are just one part of the American debt binge. Total outstanding consumer credit (a measure of non-mortgage debt) increased by $13.4 billion to $3.6 trillion in April.

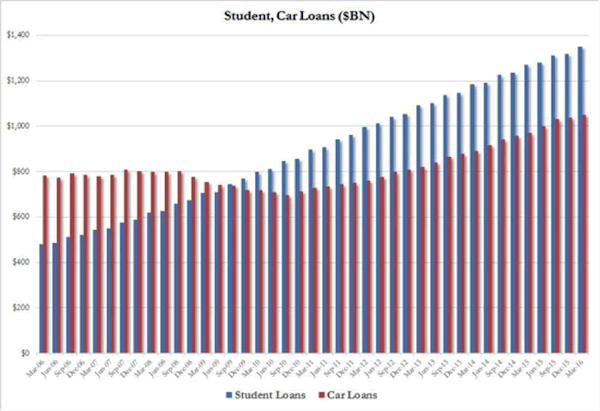

The biggest chunk is student loans, which make up 37% of outstanding consumer credit. Student-loan lending climbed to $989.6 billion in April and now stands at $1.26 trillion.

There’s that trillion-dollar number again!

Experian Automotive reports that open automotive-loan balances rose 11.1% in Q1 2016 and exceeded $1 trillion for the first time ever. Oops! Another trillion dollars!

Actionable investing ideas

Because you are reading this article, odds are that you’re not the typical American saddled with student and auto loans and/or credit card debt. You probably have little to no debt and lots of cash.

If that’s the case, let me brief you on some investing opportunities that lie on the lending side of those trillion dollars of debt.

Quick fact: the average interest rate on credit cards today is a whopping 15.19%.

Given that the national average for 1-year deposits is a measly 1.09%, it is clear that credit card companies are making lots of money.

The purest ways to invest in the credit card business are Capital One Financial Corp. (COF), Synchrony Financial (SYF), and American Express Company (AXP).

As a dividend lover, I would point out that Capital One Financial (2.2%) and American Express (1.7%) pay a decent dividend too.

If you think that I’m nuts and that the credit card business is a house of cards ready to tumble, you should take a look at PRA Group (PRAA). They purchase and collect defaulted consumer receivables in North America and Europe.

You see, even in these days of NIRP, ZIRP, and QE… there are still ways to turn lemons into lemonade. I share most of them in my free weekly newsletter at Mauldin Economics.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.