Are Copper and China Stocks Set to Rally?

Commodities / Copper Jun 22, 2016 - 10:16 AM GMTBy: The_Gold_Report

Technical analyst and newsletter writer Clive Maund explores the link between an anticipated copper rally and an upswing in Chinese markets.

Technical analyst and newsletter writer Clive Maund explores the link between an anticipated copper rally and an upswing in Chinese markets.

In marked contrast to gold, copper looks to be set up for a sizable rally here. On its one-year chart we can see that after its significant drop during May and early June, it is down on an important support level that is certainly capable of generating a rally, despite its still bearishly aligned moving averages…

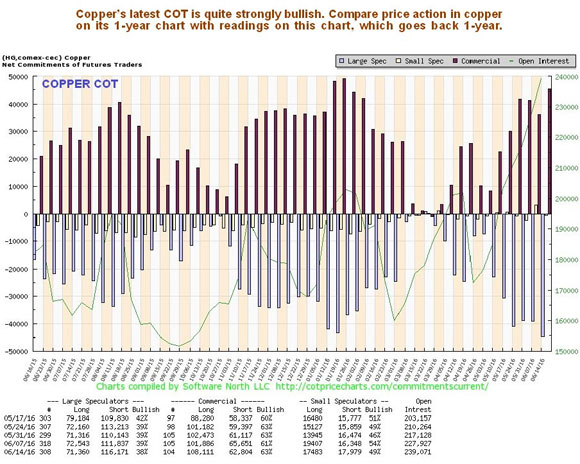

The chances of copper rallying soon are greatly magnified by its latest COTs, which show that the Commercials are now heavily long, while the normally wrong Large Specs are heavily short—this is the setup for a rally, and one reason for selecting a one-year time frame for the copper chart above is so that you can compare past peaks and troughs with the readings on the COT chart, which also goes back a year.

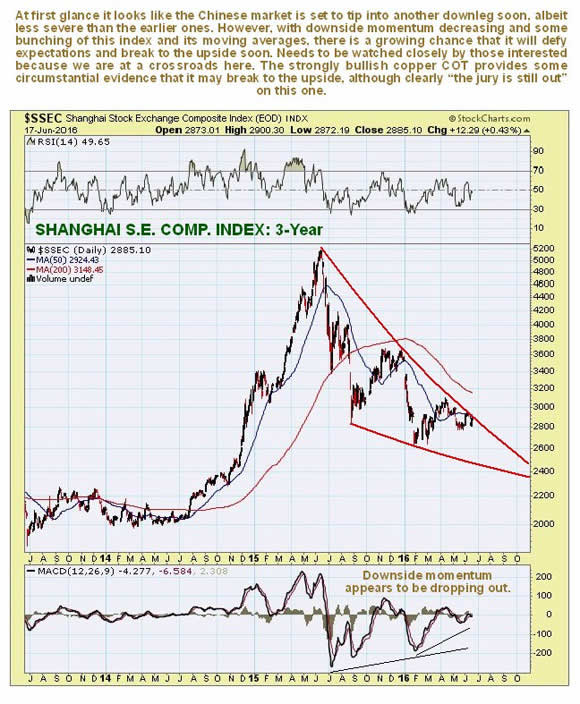

Since the price of copper is to a large extent determined by what goes on in China, which is by far its biggest market, this bullish copper setup prompts thoughts about the outlook for the Chinese market. The Chinese stock markets have had a really rough time over the past year, with an army of "get rich quick merchants" being put through the meat grinder after they generated a bubble rally.

But if you have ever watched Chinese gamblers in a casino, you know that "they'll be back," as Arnie would say—they just love to gamble. While this fact in itself won't necessarily generate a rally, the Chinese stock market is showing increasing signs that it could defy current expectations and break to the upside.

On the three-year chart for the Shanghai Composite, it looks at first glance like the market is set up for another downleg, after trundling sideways for most of this year. And it may yet, but with downside momentum easing after its earlier severe losses, and some bunching of price and moving averages, the chances of an upside breakout, although still not great, are starting to improve, and the now positive medium-term outlook for copper provides some circumstantial evidence that this might occur.

Your attention is drawn to a couple of articles that I found interesting but you may not have seen. One is an article in ZeroHedge on The American Dream, and the other is an interesting article by David Stockman entitled Bubble News from the Nosebleed Section. I don't necessarily agree with Stockman, but this article is certainly a highly amusing read, as many of his articles are.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Clive Maund

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.