Stock Market Bounce May be Over

Stock-Markets / Stock Markets 2016 Jun 15, 2016 - 06:34 PM GMT SPX may have met its match with the Broadening trendline at a 35% retracement. The peak came at 10:13 am, just 7 minutes over the 30.1 hours required to complete the Cycle.

SPX may have met its match with the Broadening trendline at a 35% retracement. The peak came at 10:13 am, just 7 minutes over the 30.1 hours required to complete the Cycle.

VIX appears to have completed its retracement, or nearly so. It may be possible that it will resume its ascent. It has already nearly accomplished its Broadening Bottom target. The retracement appears to be a Pennant formation, giving VIX a new target of 31.00, near the January-February highs.

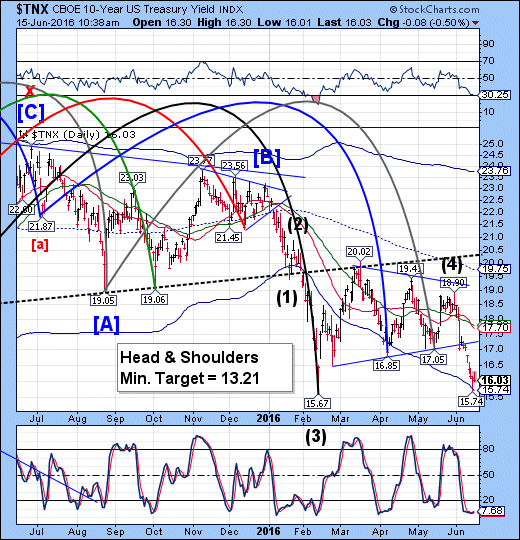

TNX appears to have complete its retracement and is on its way lower. The first target is the February 12 low. However, if this is Wave 3 of (5), the ultimate target may be as low as 12.58. This appears to be lower than the Head & Shoulders formation target. Let’s see which it is.

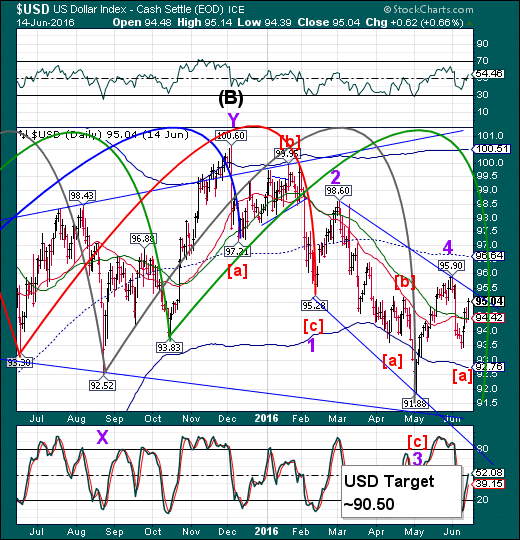

USD may challenge its 50-day Moving Average today at 94.45 today, especially after the announcement this afternoon. Today may be the start of something interesting in the currency market. A decline beneath that level confirms the decline will continue.

CNBC reports that the overwhelming mood is bullish on the dollar. It comments, “With a possible Brexit on the horizon, the dollar has strengthened as the referendum creeps closer. One trader sees the greenback going even higher, making an ETF tracking the U.S. currency worth an options play.

Looking at a daily chart of the U.S. dollar ETF UUP, Todd Gordon of TradingAnalysis.com starts off by pointing out that options on the UUP have grown more expensive, giving traders an attractive opportunity to sell them.

"We would like to sell this expensive implied volatility," Gordon said Tuesday on CNBC's "Trading Nation."

When it comes to direction, he projects the UUP will rise further.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.