Stock Market Sell Off Coming!

Stock-Markets / Stock Markets 2016 Jun 14, 2016 - 09:33 PM GMTBy: Chris_Vermeulen

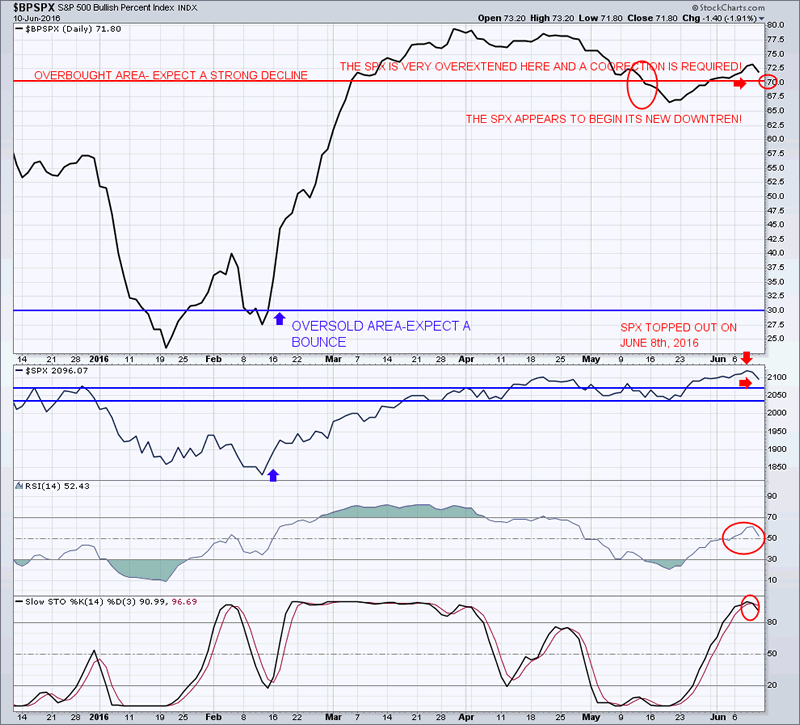

This “distortion” between “risk” and “return” has created a “bubble” effect in all global equity classes. I informed my subscribers to exit the SPX on November 25th, 2014 and to enter cash. Their equity risk exposure was reduced to zero. Momentum oscillators are now extremely overbought and are very clearly trending bearish. I wait for confirmation before entering any new long SDS and long VXX positions.

This “distortion” between “risk” and “return” has created a “bubble” effect in all global equity classes. I informed my subscribers to exit the SPX on November 25th, 2014 and to enter cash. Their equity risk exposure was reduced to zero. Momentum oscillators are now extremely overbought and are very clearly trending bearish. I wait for confirmation before entering any new long SDS and long VXX positions.

This week (Tuesday) there is another FOMC meeting. The news of this monetary policy will be released on Wednesday, June 16th, 2016. Expect choppier price going into the meeting and shortly thereafter.

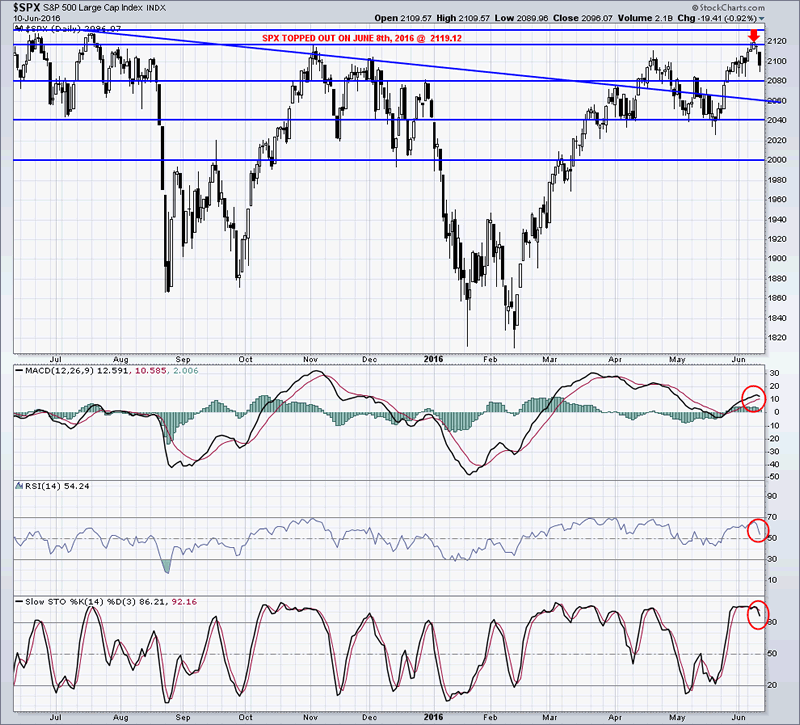

The Only Chart You Need to Read!

The U.S. markets failed to break out!

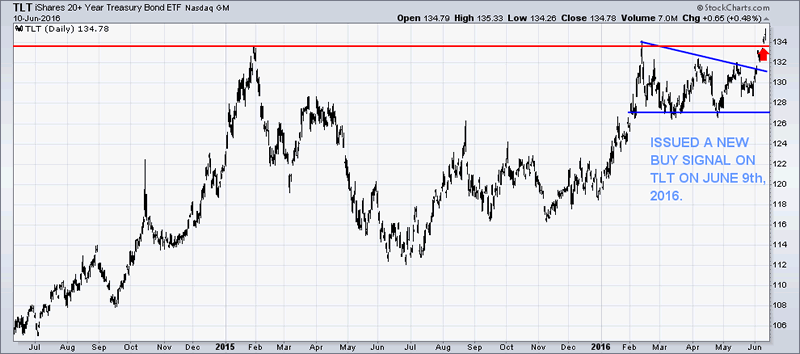

Daily Chart Of Bonds

The bond rally set a record high in the rush to a new “safe haven”. We are now experiencing a global rally in government bonds’ which broke out last Friday, June 10th, 2016, while equities declined. We entered this new long term trade on for bonds.

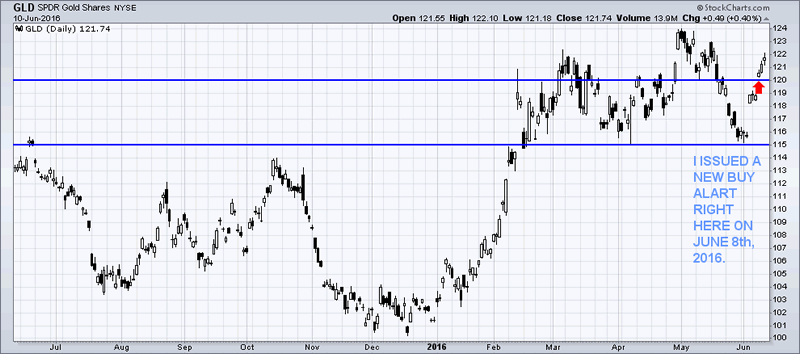

Daily Chart Of Gold

Nothing will stop this new bull market in gold and silver. We entered this new long term trade on June 8th, 2016. Now there is a stampede into this much talked about “asset class”. Just take a look as the chart of gold below.

In short, the major trends of all asset classes which have been in place for several years are coming to an end. The majority of investors have no idea what is starting to take place and will do what the masses do every time a new bear market takes place. They will hold their positions, watch the value of their nest egg get cut 30-60% in size, and then give up and exit equities near the bear market lows 6-18 months from now. It is unfortunate, but technically we need the masses to do what they always in order for things to unfold in a controlled fashion. In a recent post, I showed where the financial markets and sectors are within this major economic cycle.

There are some new trades I will be taking very soon with my money and subscribers. If you want to be in tune with the markets and profit during chaos, then you should think about joining my morning daily video newsletter and ETF trade alerts service: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.