Stock Market Risk off

Stock-Markets / Stock Markets 2016 Jun 10, 2016 - 02:58 PM GMT Good Morning!

Good Morning!

SPX Premarket now appears to be beneathits round number support at 2100.00. Should the sell-off continue, it opens the door to test the trendlines at 2085.00 later today.

ZeroHedge writes, “The overnight market action has so far been a repeat of yesterday's, when global bond yields relentlessly slid to fresh record lows around the globe following the launch of the ECB's corporate bond monetization program, and which unlike in recent days has been seen increasingly as a "risk off" signal, pressuring worldwide equities sharply lower. Indeed, Asia was down 1% and various European bourses flirting with a 2% drop, with US equity futures down about 0.6%, but the biggest story once again remains the collapse in yields, as 10Y government notes in Japan, Germany and the U.K. all posted record-low yields over last 24 hours, with US Treasury set to follow soon. For now, all eyes are fixed on the 10Y German Bund and what time today it goes into negative territory.”

VIX is higher, possibly breaking out above its prior high of 15.25.

ZeroHedge reports $2.6 Billion in equity outflows, “Note VIX futures open interest hit new all-time highs on 6/7/16 (501k contracts)…lots of volatility buyers ahead of “summer of shocks”

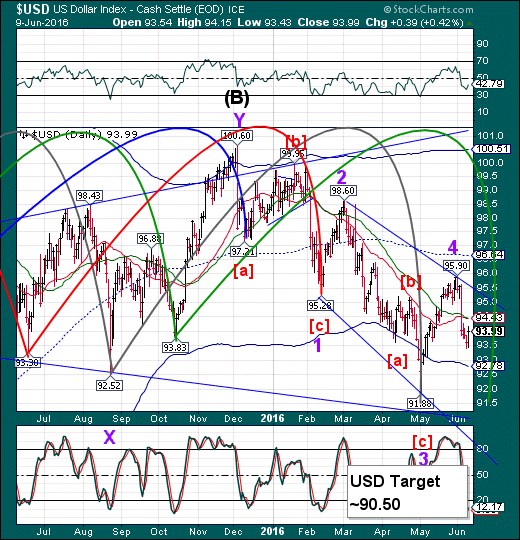

USD attempted a rally overnight and appears to have been beaten back beneath overhead resistance at 94.43. USD/JPY appears to be hovering just above its lows at 105.51. This isn’t far from its October 11, 2014 low at 105.15. It is entirely possible to see parity or lower in USD/JPY by the end of the month.

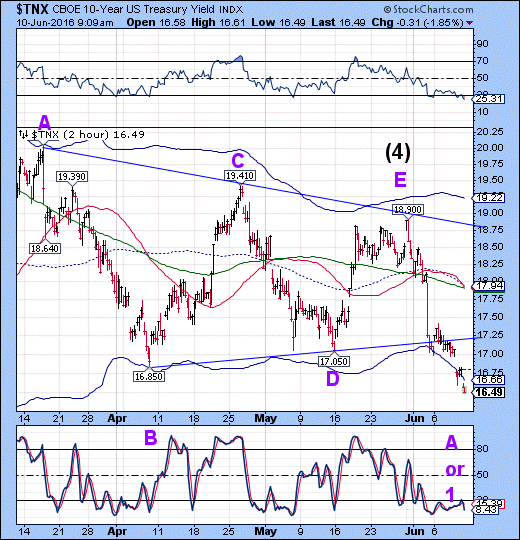

TNX declined beneath its April 7 low at 16.85 and may now challenge its February 11 low at 15.67. There is a Head & shoulders formation not seen on this chart suggesting a target of 13.21 for TNX.

ZeroHedge writes, “At 2.0bps, 10Y Bunds are inching ever closer to the Maginot Line of NIRP which JGBs have already crossed, and all of this global compression is dragging US Treasury yields to their lowest levels since February's flash-crash... and it appears stocks are catching down to that reality.”

EuroStoxx 50 Index appears to have broken its Bearish Flag trendline at 2945.00. A Wave 3 of (3) appears to be underway.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.